SoLo Funds offers loans up to $575 through peer-to-peer lending. But shop around: you might be able to borrow more with top alternatives.

Are you trying to steer clear of expensive personal loans? If so, you might be one step closer. SoLo Funds and similar apps have made it their mission to create alternatives to very expensive forms of credit like payday loans and cash advances.

SoLo Funds is a top peer-to-peer lending app that helps borrowers get the cash they need by allowing individual investors to lend up to $575 on a fixed repayment period. While it can be a great option for some, not all loan requests are accepted, and many borrowers need more than the maximum $575 that SoLo Funds offers.

Fortunately, there are a number of popular alternatives to SoLo Funds that offer a wide range of loan sizes and approval criteria. This means that no matter your financial profile and needs, there may be a good option for you out there.

In this guide, we'll cover the pros and cons of SoLo Funds alternatives, and how to identify the best choice for you. Let's get started.

- Lenme, most similar to SoLo, for larger loans up to $5,000

- AmONE, loan marketplace for borrowing $2,000 - $100,000

- SuperMoney, for larger loans up to $100,000

- Prosper, for personal loans between $2,000 and $50,000

- Earnin, for early access to your direct deposit paychecks

- Dave, for mobile banking and small loans up to $500

- Upstart for installment loans from $1,000 to $50,000

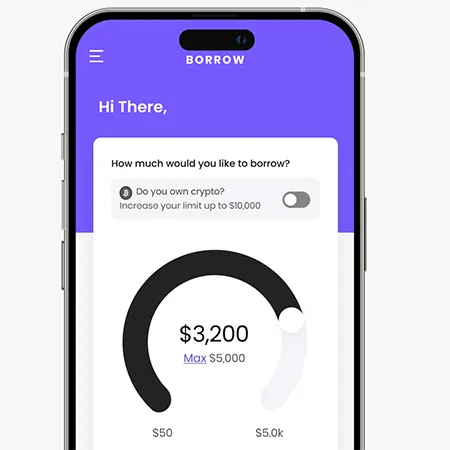

1) Lenme

Peer-to-peer loans like SoLo for amounts up to $5,000

Lenme Borrow is the most similar to SoLo Funds as it's also a peer-to-peer loan marketplace where users can set the terms for their request, and then investors share offers for the borrower to accept. Your loan request is offered to many investors at the same time, so there's an opportunity for higher approval odds. Unlike SoLo Funds, Lenme loan limits can get much larger with an established history.

Lenme is also similar in that most of the setup is just downloading the app, completing identity verification, and linking a bank account.

Fast Facts

- Loan Amount: $50-$5,000

- Interest Rate Type: Based on custom offers from investors

- Loan Term: 1-12 months with monthly payments

- Speed: Typically 1-2 days after accepting a loan offer

- Rating: 4.3 of 5 stars on 26,000 App Store reviews

Pros

- Higher loan amounts: Although it may take time to build a positive history, the $5,000 loan limit is much higher than most small cash advance apps.

- No hard credit check: Your borrowing limit is based on building history with Lenme.

- Possibility for competitive rates: Multiple lenders are able to compete for your loan request.

- Flexible payback: Payback is automatically deducted from your bank account, but there's an option to request a payback extension via the Lenme app if you need it.

Cons

- Speed: Although Lenme claims you can receive loan offers in minutes, in reality it can sometimes take a day or two to fully fund.

- Limited features: If you're looking for features beyond solely borrowing, like budgeting or saving, other apps on the list may be worth considering.

Read more in our full Lenme review

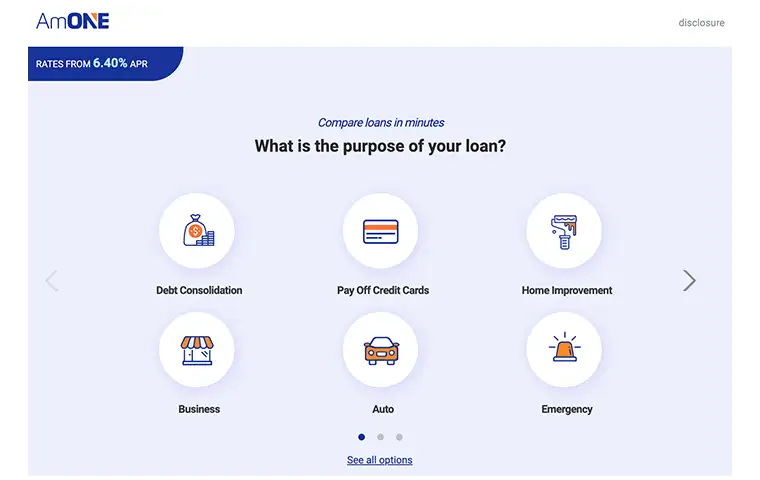

2) AmONE

For all types of credit profiles borrowing $2,000 and up

AmONE, owned by Quinstreet, a publicly traded company, is an online lending platform that connects borrowers with all types of credit—including less-than-perfect credit—to lenders best suited to their needs (it has helped 13 million people find loans). They are a marketplace, meaning that a network of different lenders, including top lenders such as Achieve and Upstart, may provide offers you can review and choose from. The service is fast, zero–obligation, and a simple online process means that you can review loan offers in minutes.

Fast Facts

- Loan Amount: $2,000-$100,000

- Interest Rate: From 6.40%

- Loan Term: Varies by lender

- Speed: About 1 business day after accepting a loan offer

- Rating: 4.4 of 5 stars (Excellent) on Trustpilot

Pros

- Multiple loan offers at once: One simple form can result in multiple offers, making comparison shopping easier

- Speed: The application and funding process for loan requests is fast and straightforward

- Additional resources: If a borrower doesn't qualify for a loan, the website can provide other resources, such as debt consolidation

Cons

- Costs: Interest rates and terms vary by lender. Review all offers and terms carefully before accepting any offer (loan consultants are available to help you understand offers)

Read more in our full AmONE review

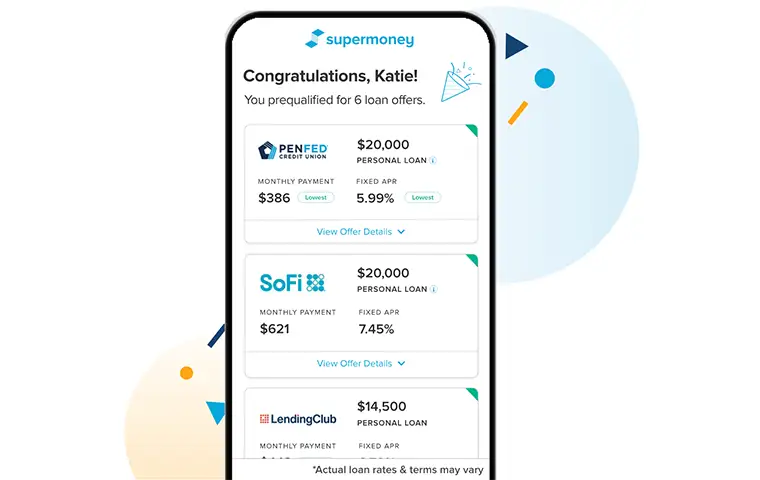

3) SuperMoney

For larger, personal loans up to $100,000

SuperMoney taps into their lender network to match your financial profile and borrowing needs to the lenders best suited to you. By filling out one simple form, the website automatically selects their top lender picks for you based on your profile – and you get to pick and choose from the list based on the offers provided.

Because SuperMoney works with a big network of lenders, they offer one of largest range of loan sizes as well as credit score criteria -- meaning that more borrowers are likelier to get approved for larger loan sizes.

Fast Facts

- Loan Amount: $500-$100,000

- Interest Rate: From 6.74% APR, depending on creditworthiness

- Loan Term: 3 months to 7 years

- Speed: 1-2 business days after accepting a loan offer

- Rating: 4.9 of 5 stars on Trustpilot

Pros

- Easy to compare loan offers: Filling out one form results in multiple loan offers, making it easy to compare/contrast rates and terms

- Large lender network: With dozens of lenders available, borrowers are likelier to get approved for the loan amount they need up to $100,000

- Excellent user reviews: SuperMoney is one of the best-reviewed lending networks out there, proving that they are high quality and trustworthy

Cons

- Rates vary: Because SuperMoney doesn't provide loans themselves (lenders in their network do), they do not control interest rates or fee terms. Make sure to carefully review offers before accepting one.

4) Earnin

Early access to paychecks with amounts up to $750

Earnin speeds up your access to every paycheck. The cash advance app lets users receive up to $100/day from their pay right away instead of waiting multiple business days to receive the funds. Earnin users have obtained over $15 billion through the app's cash advances, making it a solid possible finance option for people with steady income.

Fast Facts

- Loan Amount: Up to $750

- Interest Rate: 0% APR

- Loan Term: Until next payday

- Speed: 1-3 business days or faster with Lightning Speed feature

- Rating: 4.7 of 5 stars on 242,866 Apple App Store reviews

Pros

- Overdraft protection: Earnin sends notifications when your balance is getting close to zero to help keep you away from overdraft fees.

- 0% APR instant cash advances: Credit card cash advances can get expensive, but with Earnin, you don't have to worry about interest.

- No credit check: You won't have to worry about a hard pull damaging your credit if you get a cash advance from Earnin.

Cons

- Requires access to your bank account: The app can use your bank account to recoup the cash advance.

5) Dave

Great for mobile banking and small loans up to $500

Dave is one of the most established cash advance apps that also provides financial tools and resources. The fintech company allows users to create bank accounts and capitalize on a debit card with up to 15% cash back on qualifying purchases. Dave's network of 37,000 ATMs makes it easier for debit cardholders to withdraw cash without paying fees. The app even has an automatic budgeting feature that lets you know how much you can spend.

Fast Facts

- Loan Amount: Up to $500

- Interest Rate: 0% APR

- Loan Term: Until next payday

- Speed: Instant or up to 3 days

- Rating: 4.8 of 5 stars on 627,269 Apple App Store reviews

Pros

- Access to side hustles & local job opportunities: If you need help finding work or want an extra side hustle to help with the bills, Dave's database can help the search.

- Get a full banking experience: Aside from ExtraCash, Dave offers an immersive banking experience that can help you save money and receive cash back on purchases.

Cons

- Limited repayment options: Dave will be automatically repaid on your next payday or the nearest Friday.

6) Prosper

Best for P2P loans over $2,000

Prosper is one of the most popular peer-to-peer lending platforms. The company has connected investors with borrowers since 2005. Over 1.4 million people have borrowed money through the Prosper peer-to-peer lending marketplace. The marketplace has over 20,000 investors who average a 5.7% historical return on Prosper's P2P loans.

Fast Facts

- Loan Amount: $2,000-$50,000

- Interest Rate: 6.99% to 35.99%

- Loan Term: 2-5 years

- Speed: 1-5 business days

- Rating: 4.7 of 5 stars on 11,502 TrustPilot reviews

Pros

- Higher loan amounts: You can borrow up to $50,000 through Prosper. Other P2P lending apps don't offer that much, and you will only get a few hundred dollars with a cash advance app.

- You only need a 600 credit score: Many other lenders request higher credit scores, making it more difficult to get financing.

- You can get a co-signer: A co-signer with a good credit history can help you get approved and secure a lower interest rate for your loan.

- Flexible repayment terms: Borrowers can repay the loan through fixed monthly payments over 2-5 years.

Cons

- Fees: The origination fee can be as high as 5% of the loan's value.

Read our full Prosper review

7) Upstart

Upstart uses AI to make loans more accessible to borrowers with fair credit and decrease the likelihood of defaults. An Upstart study revealed that only 48% of Americans have access to prime credit, even though 80% of Americans have never defaulted on a credit product. This study demonstrates there's more to creditworthiness than a FICO score, and Upstart makes loans more accessible to people with lower scores. The approach has generated plenty of demand, as the fintech company has originated over $32 billion in loans.

Fast Facts

- Loan Amount: $1,000 - $50,000

- Interest Rate: 5.99% to 35.99%

- Loan Term: 3 or 5 years

- Speed: As fast as 1 business day

- Rating: 4.9 out of 5 stars on 41,260 TrustPilot reviews

Pros

- No prepayment penalty: If you want to get out of the loan sooner and avoid interest payments, you won't have to worry about a penalty fee.

- Lower interest rates: Upstart looks at your credit score and other factors.

- Pro 1

- Pro 2

Cons

- The minimum loan term is 3 years: A lengthier loan term may not be the best choice for borrowers who need less funds and can quickly repay the loan.

- No co-signers allowed: Some peer-to-peer lending platforms let borrowers get a loan with a co-signer. Upstart borrowers have to rely on their own credit and financials to secure a loan.

- No mobile app: You will have to view your Upstart dashboard from your smartphone's browser or on a computer.

Read our full Upstart review

How SoLo Funds Compares

SoLo Funds connects borrowers with investors. You don't need a great credit score to get a small loan; you can still get favorable terms. Borrowers can decide the interest rate, repayment period, and other factors when using SoLo Funds.

The loan amount goes up to $575 if you build up your SoLo Score and repay loans on time, but the minimum loan amount is $50, and each loan is due within 35 days. SoLo Funds uses an optional tipping system instead of interest; the tip is the amount an investor receives for providing the loan to a borrower. You might get a loan without providing a tip, but investors can filter results by the tip. A higher tip (0% to 15% of the loan's value) might get more attention.

Solo Funds Highlights

- Loan Amount: $20-$575

- Interest Rate Type: Optional tipping system, no compound interest

- Loan Term: Up to 35 days

- Speed: Depends on tip, repayment history, can be as fast as 20 minutes

- Rating: 4.4 of 5 stars on 23k Apple App Store reviews

Pros

- No hard credit check: Your borrowing limit is based on your banking and SoLo Funds history, not your credit score.

- Borrow from SoLo members: You can determine the conditions and borrow according to what suits you best.

- No interest rate: Most lenders set interest rates for their loans, but you can get interest and fee-free loans with SoLo Funds. With SoLo Funds, you decide by choosing the tip you'd like to pay. Setting a higher tip might help you get cash sooner, but you can put a loan on the P2P marketplace without a tip.

Cons

- You can only borrow up to $575: It's not enough for every situation, and borrowers just getting started can only borrow up to $100. Personal loans and other peer-to-peer platforms offer higher loan amounts than SoLo Funds.

- Short repayment: Borrowers have to repay the loan within 35 days. If the borrower does not pay on time, the borrower must also pay a late fee to the lender.

SoLo Funds recently passed 1 million registered users, many of whom have left great reviews about the P2P loan app. While SoLo Funds has much to offer, the fintech company isn't a solution for large loan amounts. Knowing some of the top peer-to-peer lending apps can help you find the right match to access more funds.

How to Choose a Lender Like SoLo Funds

While many choices mean there's likely a solid option for your specific needs, it can feel overwhelming to comb through the options. Here are five things to look for when finding a personal loan and comparing peer-to-peer lending and cash advance apps.

- Interest and fees: Loans and apps can get expensive if you aren't careful. Check the origination fees, membership fees, interest rates, and other costs associated with borrowing money.

- Loan amount: Most cash advance apps only let you borrow a few hundred dollars. Consumers who need thousands of dollars to cover their costs should look at other lending options.

- Credit requirements: Most cash advance apps do not require good credit to borrow money. Some peer-to-peer lending apps let you get financing even with a 600 credit score, but some have higher requirements. Be sure to compare options and their loan process.

- Reviews: Every cash advance and P2P app makes itself look like the best. Customer reviews can help you determine whether these apps are good or bad.

- Loan terms: Most cash advances are due at the next paycheck, but there is more variety with peer-to-peer lending apps. Some apps let you take out 7-year terms, while others won't let you borrow a loan with more than two years on it.

The Bottom Line

While there are many instant loan app options for loan amounts under $575 to explore, the app that stands out as the most similar to SoloFunds due to its peer-to-peer nature, core features, and up to $5,000 loan limit is Lenme. Lenme offers a lending model similar to SoLo Funds and has received similar favorable reviews. So, if you're looking for a loan of up to $5,000, consider checking out this top contender.

Frequently Asked Questions

What is Peer-to-Peer Lending?

Not everyone can get a loan from a bank. Some banks have high credit score requirements, and consumers may have to find alternatives. Payday lenders and title loans can provide relief, but these financial products typically have excessive interest rates and fees.

Peer-to-peer lending can be a middle ground and another personal finance option that makes loans more accessible than traditional banks.

What's the difference between cash advance apps and SoLo Funds?

Cash advance apps give users an early payday against future income, while SoLo Funds gives users small loans. Most cash advance apps connect to your bank account and automatically use the next payday for repayment.

Why are loan apps like SoLo Funds better than payday loans?

Apps like SoLo Funds have lower costs than most payday loans. You will likely save a lot of money if you avoid payday loans and go with a loan app like SoLo Funds instead.

Will cash advance apps like SoLo Funds help me build credit?

Cash advance apps usually do not aid in building credit since they do not perform a hard credit check or report payment history to major credit bureaus. However, some apps have built add-on solutions that will help you establish credit history as you use their platform.

I have bad credit. Will a cash advance app still loan me money?

Cash advance apps often make loan decisions based on your deposit and payment history, without conducting a hard credit check.