NetCredit is an especially transparent provider of loans and lines of credit for borrowers with poor credit, making them a strong alternative to subprime lenders or payday loans.

This NetCredit review covers all the most important facts about the lender, including their loan products, how they work, who qualifies, and whether another lender may be a better choice for you. Read on to hear what real customers say and whether the pros outweigh the cons of a NetCredit loan.

Pros & Cons

Pros

- Offers loans up to $10,000 to borrowers with sub-par credit

- Stands out as a transparent lender, with features that make terms and costs clear for approved borrowers

- Borrowers typically receive their funds the next business day if not sooner

- Provides both personal loans and lines of credit

- More trustworthy than many subprime lenders due to being owned by a publicly traded company (Enova Financial)

- Excellent track records, ratings, and reviews: has a 4.8 out of 5 stars in Trustpilot

Cons

- Borrowing costs will be higher than options for well-qualified borrowers

- Maximum loan sizes of $10,000 may be less than some borrowers are looking for

- Only available in 37 states

NetCredit Overview

Although NetCredit could be categorized as a subprime lender, they stand out for their transparent approach to doing business and the fact that they are owned by a publicly traded company, Enova Financial.

It has been in business for over 10 years and specializes in personal loans and line of credit products that aim to provide borrowers with quick access to funds (offering next business day funding or sooner), flexible terms, and credit-building opportunities.

Their products are designed for individuals who might not meet the eligibility criteria for other loans, so while their cost of borrowing money is on the high end compared to more premium products, the accessibility, flexibility, and the credit building opportunities they offer might be worth the cost when other options are limited. APRs (34.99% to 99.99%) vary by state, and while higher than credit cards, they still tend to be lower than worst-case payday loan scenarios (often in the triple digits).

The loan amounts range from $1,000 to $10,000, with 6 to 60-month terms. While lower than the maximum amount from some online lenders, it's also larger than similar lenders.

What Products NetCredit Offers

NetCredit provides two core financial products designed to cater to different needs: unsecured personal loans, and personal lines of credit. These products can be used for various purposes, from covering emergency expenses to consolidating higher-cost debt.

Let’s look at how these products work and their specific features.

Personal Loans

NetCredit’s loans offer the following features:

- Loan amounts ranging from $1,000 to $10,000

- Fixed interest rates for predictable repayment terms (from 34% to 99.99%)

- Suitable for various financial scenarios, such as home improvements or unexpected expenses

- Various repayment schedules available to fit your budget (from 12 months to 60 months)

- Loan applications are typically funded the next business day

- Credit Builder, payment history made to NetCredit is reported to two of the three major credit bureaus, making it an opportunity to build credit for more options in the future

Personal Lines of Credit

NetCredit’s personal lines of credit offer similar value as their personal loans, while providing an extra level of financial flexibility.

Unlike a personal loan, which provides a lump sum of money upfront, a line of credit acts more like a credit card, allowing you to access only the amount of funds needed as you go. As you repay the amount you took out, the line of credit gets replenished and ready for you to borrow from again if you need to.

The line of credit may be best for borrowers whose needs may change over time and who don't need a full loan amount immediately.

Interest Rates and Fees

When it comes to cost, interest rates, and fees, it’s important to note that NetCredit’s personal loans and line of credit are not the cheapest forms of credit. However, traditional payday loans or cash advances can easily be more expensive (often exceeding triple-digit APRs), so NetCredit may be a more favorable option for some borrowers.

That said, unlike many lenders catering to low or poor credit borrowers, NetCredit takes significant steps to make its lending process transparent and honest with its Rates & Terms page. They are clear in listing out key facts, including:

- Annual percentage rates range from 34.00% to 99.99%

- Loan offers are influenced by the borrower’s state of residence, which means your location significantly impacts your loan's potential size, cost, and terms

- Personal loan repayment has a fixed interest rate and repayment schedule

- Since it's not a lump sum payout like a personal loan, the Line of credit product has a variable repayment structure

Other fees also depend on your state, making it very important to thoroughly read any loan offer before accepting. NetCredit doesn't charge any application, prepayment, or non-sufficient funds fees, but depending on the state, you may pay a one-time origination fee if your loan is approved and funded on personal loans. On the line of credit, you may need to pay Cash Advance Fees (charged each time you draw cash from the line) and Statement Balance fees (calculated based on the outstanding balance owed). And, of course, regardless of your state, you will have to pay interest on both products.

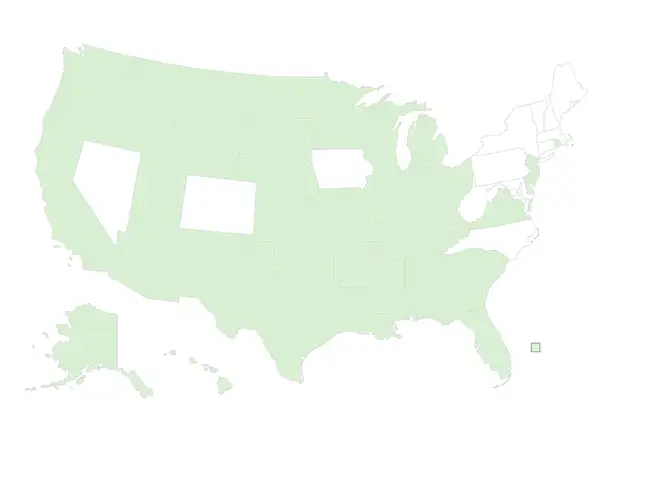

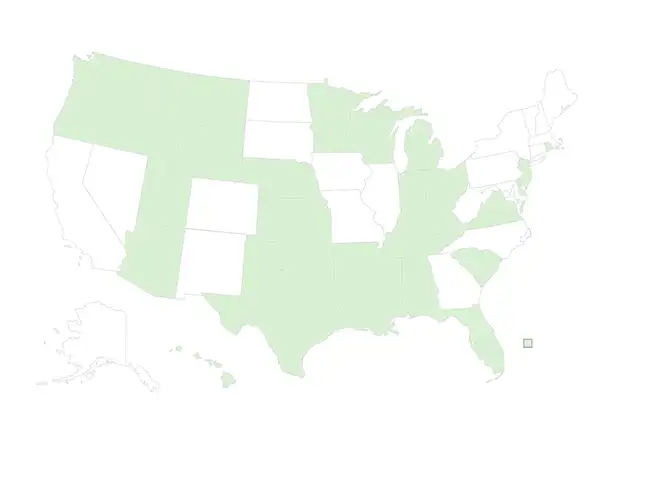

Where NetCredit Is Available

Personal loans are available in: Alabama, Alaska, Arkansas, Arizona, California, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, New Mexico, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin and Wyoming.

Lines of credit are available in: Alabama, Arkansas, Arizona, Delaware, Florida, Hawaii, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Montana, Nebraska, New Jersey, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin and Wyoming.

If you don't see your state listed in either map, consider checking out NetCredit's partner brand, CashNetUSA (also owned by Enova Financial).

What Makes NetCredit Standout

With its unique dedication to transparency and honesty, NetCredit stands out among other lending options for borrowers with lower credit scores. But how exactly does NetCredit make it easy for borrowers to understand total costs and make the most of their loan? They offer 5 features that help:

- My Choice Guarantee: Provides a 1-2 day time window for borrowers to change their minds about accepting a loan offer, with no penalty or cost for returning the funds by a certain date

- ClearCost For Me: A promise to be transparent and honestly answer any questions a borrower has, in addition to clearly posting rates and terms on the NetCredit website (something many lenders do not do)

- My RightFit: Makes it easy to compare/contrast the loan products a borrower qualifies for, whether it's a personal loan or a line of credit, and to customize the loan size, terms, and repayment schedule

- My ScoreSaver: Allows borrowers to check what loan amount and interest rate they will qualify for – without requiring a hard credit pull that lowers credit scores

- My CreditBuilder: Reports to all three credit bureaus, ensuring that borrowers who make responsible payments get the credit they deserve and continue to build up their credit scores

How To Apply

Applying is a straightforward process designed with the borrower’s convenience and confidence in mind. The application process can be boiled down to three stages: a soft credit inquiry to get pre-approved for a loan amount and rate, submitting personal and financial information, and selecting and getting your loan.

Application Process

- Pre-approval. The application process gets started by providing basic personal information and a soft credit inquiry, which does not affect your credit. This ensures that checking your eligibility will not cause any harm to your score.

- Application. At this stage, borrowers enter required documents to prove their identity and income. Once you’ve completed the application, if you qualify, you can review offer details for their line of credit, personal loan option, or both. From there, you can compare options and see which option fits you best.

- Funding. Once you've selected your loan, funds are deposited into the bank account you provided during the application process. NetCredit is fast: borrowers usually have their cash the next business day, but in some cases, it can even be the same day.

Eligibility

To qualify for NetCredit products, applicants must meet the following criteria:

- Live in one of the states where NetCredit operates

- Be 18 years or older

- Have a valid personal checking account

- Have an email address

- Proof of employment and verifiable income

- Identification number (Social Security number)

Note: No minimum credit score is required to qualify for NetCredit products, making them accessible to individuals with limited or not-so-good credit.

Impact on Credit Score

It’s worth mentioning that NetCredit reports your payment history to major consumer credit bureaus. This means that making on-time payments can help improve your credit score over time, and conversely, missing or paying late can hurt.

Maintaining a low balance relative to your overall credit limit and receiving credit limit increases when your account is in good standing can also positively influence your credit utilization ratio, thereby making a difference in improving your credit.

Financial Health Check: Is NetCredit Right for You?

Deciding whether NetCredit is right for you might involve double-checking:

- Your financial needs

- Your repayment ability

- Your income stability

- Whether the loan fits your budget

Comparing Rates and Services

Comparison of interest rates is a key step in evaluating whether NetCredit’s offerings are competitive: lower interest means less to repay each month and over the loan's lifetime. It’s also important to verify the lender's credibility, which includes checking third-party review sites for customer experiences. While NetCredit does offer potentially fast funding, no prepayment penalties, and a pre-qualification tool, it’s also clearly positioned as a more expensive form of credit.

Calculating and Understanding Repayment

Having your loan payments calculated accurately is crucial to ensure they are manageable within your budget. To calculate your total monthly loan costs, consider the sum of the principal repayment, interest charges, and any applicable fees. Net Credit has built a promise around making sure you understand the costs, so read the terms thoroughly while checking your own finances to make sure they fit your budget.

Loan affordability can be assessed by comparing these costs with your budget to determine if the payments are sustainable over the term of the loan.

Reviews: What Other People Are Saying

Reviews provide valuable insights into a lender's quality, integrity, and experience. The good news is that the vast majority of NetCredit customers have expressed satisfaction with the company. For example, the company has a rating of Excellent (4.8/5 stars) on Trustpilot with over 21,000 reviews Trustpilot and a solid B rating from the Better Business Bureau.

According to these customers, NetCredit stands out for:

- Rapid funding and loan approvals

- Higher approval rates than other lenders

- Clear and easy application process

- Ease of understanding rates and total costs

Of course, like any company, NetCredit also has its detractors. Most customers who reported frustration did so because of a loan application denial, even after submitting income verification documents. It's an important reminder that pre-approval is not the same thing as full approval, and not all customers will be approved.

Always ensure that you clearly understand all loan terms and conditions before proceeding with your application.

Tips for Borrowing Responsibly

Before you sign on the dotted line, it’s important to consider some tips for borrowing responsibly. Understanding your loan terms, being aware of repayment obligations, and knowing your rights as a borrower can help you manage your loan effectively.

Let’s explore these aspects in more detail.

Thinking Ahead About Repayment

Managing your loan effectively is crucial to maintaining good financial health. This involves staying on top of your repayment schedule and communicating with NetCredit if you encounter any issues. It’s also important to consider the impact of your repayment history on your credit score, as NetCredit reports this information to major credit bureaus.

Consistent, on-time payments can help improve your credit score over time.

Reading Carefully

Understanding your loan terms is crucial. NetCredit loans can span from six to 60 months, with the term impacting the size of your monthly payments and the total interest you’ll accumulate. It’s important to verify that the loan amount meets your needs and to understand the timeline for receiving the funds.

Knowing Your Rights and Obligations

As a borrower, you should fully understand your repayment obligations, such as the repayment schedule and any options for early payoff without penalties. NetCredit provides the My Choice Guarantee, allowing customers to return the loaned funds by 6 p.m. ET the next business day if they’re not satisfied.

Alternatives to NetCredit

While it may be a viable option for many borrowers, exploring alternatives is always a good idea. Loans like NetCredit to consider include CreditFresh, Upstart, and Prosper.

Take a look at some Fast Facts to see if they may be a good option for you to consider alongside NetCredit:

CreditFresh: Best for small, fast loans

Like NetCredit, CreditFresh caters to borrowers with fair to poor credit. Although they only offer lines of credit (no personal loans), their loan sizes range from $500 to $5,000 and fund very quickly. CreditFresh is another lender with positive reviews known for being reputable and honest in how they conduct business. This could be a solid option for people looking for smaller loans struggling to get approved by other lenders.

Read our full CreditFresh review here.

Upstart: Best for larger loans

Upstart is a unique lender that uses AI-driven technology to assess hundreds of data points about a borrower—not just their credit score—to make approval decisions. Because this lender offers loan sizes up to $50,000, its unique approach to approvals could make it a solid choice for people with subpar credit in need of higher loan limits.

Read our full Upstart review here.

Prosper: Best for comparing multiple loan offers

As a "lending marketplace," Prosper allows borrowers to receive multiple loan offers from different lenders simply by filling out one form. Accessing multiple lenders at once can help increase a borrower's approval odds while also making comparison shopping between offers easier. Because these loans can go as high as $50,000 and borrowers can take out up to two loans at once, Prosper stands out as one of the more flexible lending options for people with less-than-perfect credit.

Read our full Prosper review here.

The Bottom Line

NetCredit is dedicated to providing a simple, transparent borrowing process for people with fair to poor credit. With personal loans and lines of credit up to $10,000, they could be a good option if you're looking for a fast loan with flexible terms. However, they will have higher interest rates than prime lenders so, as with any lender, it is important to compare your options and make sure NetCredit is the best choice for you.

Frequently Asked Questions

What type of loan is NetCredit?

NetCredit caters to borrowers with lower credit scores offering unsecured personal loans and lines of credit of up to $10,000. Both loan products are relatively flexible, with up to 60 months terms, and can be approved and funded on the same day.

What are the eligibility criteria for NetCredit loans?

To be eligible for NetCredit loans, you must live in one of the 37 states where it operates, be 18 or older, have a valid personal checking account and an email address, and demonstrate a verifiable income. Unlike with many other lenders, there is no minimum credit score requirement.

How does a personal line of credit from NetCredit work?

A personal line of credit from NetCredit allows you to access funds as needed, which is helpful for managing unpredictable expenses or consolidating higher-interest debt.

What is the interest rate range for NetCredit loans?

The interest rates for NetCredit loans range from 34.00% to 99.99%, influenced by the borrower's state of residence and creditworthiness.

How quickly can I receive funds from NetCredit?

You can receive funds from NetCredit as quickly as the next business day after loan approval, with same-day funding possible if you apply early.