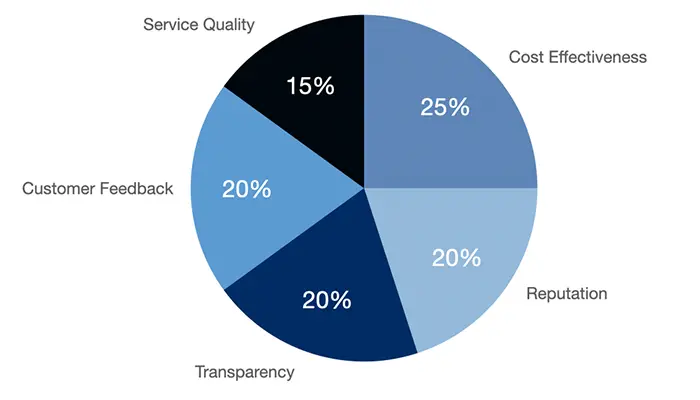

As part of our review process, Loanfolk may provide an independent rating based on five key Assessment Categories:

Breakdown of Assessment Categories

Cost-effectiveness / Value Exchange

Weight: 25%

Different customers will assess value (i.e., whether a product/service is worth the money) differently based on their own specific needs, circumstances, and credit profiles. For that reason, our assessments consider the value exchange a given company offers for the money, as opposed to affordability as defined by specific dollar amount costs or APRs. We focus on areas including loan amounts and types of products made available to different borrower profiles, flexibility in terms of uses and repayment, and potential for positive impacts on a customer's financial health (such as reporting to all three credit bureaus). We compare these offerings overall against their fees to validate that a company is providing enough value to their customers to justify their cost.

Reputation

Weight: 20%

The world of financial services is filled with scams, misrepresentations, and predatory practices. A foundational component of our assessments is whether or not a company is fully legitimate in the first place. We conduct complete background research to confirm whether a company has had a judgement or regulatory action rendered against them, and whether they have been the subject of negative news/PR stories. We distinguish whether a company has had slip-ups in the past or is currently under scrutiny, and note these findings as part of both our written review and our overall company rating.

Transparency

Weight: 20%

We look for critical elements of a financial product – including fees, APRs, and terms – to be prominently disclosed and presented. The most transparent companies will also include tools such as calculators or sample tables to help potential customers understand the total costs of a product/service. As part of our assessment, we look for these elements and prioritize the companies that exemplify candor and clarity.

Customer Feedback

Weight: 20%

The experiences that current and past customers have had can speak volumes about critical aspects of a company, including the customer service experience, transparency/honesty, and overall value of the products or services offered. That's why we scrutinize major review sites, including Trustpilot, Better Business Bureau, and Trustindex. Additionally, we review message boards such as Quora and Reddit to understand what customers are saying – the good, the bad, and the ugly. We dig deep to separate legitimate concerns or drawbacks from frustrations that can arise from misunderstandings or unrealistic expectations, leaving us with a clear view of the pros and cons of a specific company.

Service Quality

Weight: 15%

The experience a company provides – from enabling potential customers do their research on their website, to the application process, to providing the product, to ongoing customer service – helps separate good companies from great ones. That's why we consider platform reliability, the digital experience, and the different ways customers can reach customer service as part of our service quality assessment. The most highly rated companies are those that have prioritized the user experience, enabling fast and easy transactions, clear ways to view and manage their products, and offer their customers a variety of ways to connect to a responsive and effective support team.

A note on maintenance...

Loanfolk reviews are reassessed on an ongoing basis to validate the accuracy of the products/services discussed and to re-certify the rating provided as part of the review. Reassessments are conducted by our editorial team, comprised of journalists and writers with decades of combined experience in the world of personal finance, business finance, and customer insights. Team members adhere to Loanfolk's editorial guidelines at all times.