AmOne is a reputable personal loan marketplace that automatically matches borrowers to multiple lenders at once. With personal loans up to $50,000, it could be a good option for people who want to efficiently comparison-shop for a wide range of loan sizes.

If you’re curious about what AmOne is and how it can help you get a loan, this review is for you. We will cover how it works, the pros and cons of using AmOne, how hard it is to get approved, and what real customers say about it. We'll also compare AmOne to other types of lending companies so you can feel confident you know everything you need to know about this company before taking the next step.

Pros & Cons

Pros

- AmOne lender network serves a range of credit profiles, from poor to excellent

- Loan sizes up to $50,000

- Competitive terms (12 to 84 months) and APRs (6.4% to 35.99%) based on creditworthiness

- Offers personal loans for both consumers and small businesses

- Makes it easy for borrowers to compare multiple loan offers tailored to their profiles

- One fast and simple application process is all it takes to start reviewing loan offers

- Service is free to use

Cons

- Potential fees aren't transparent until after a borrower matches with a lender

- Some borrowers get frustrated by repeated contact from lenders

- Using AmOne does not offer approval (borrowers still need to apply to individual lenders on the network)

How AmOne's Loan Matching Service Works

Founded in 1999 and owned by QuinStreet (a large publicly traded company), AmOne has a long track record of streamlining the loan search process for borrowers. In short, they bring qualified lenders to borrowers rather than borrowers having to spend hours searching for individual lenders.

As a personal loan facilitator rather than a direct lender, AmOne’s free service connects consumers to an array of loan choices tailored to their unique financial needs and credit profile. (It is important to note that AmOne does not dictate the loan terms themselves; they are just the intermediary between the borrower and potential lenders.)

The company is designed to make the process simple and straightforward for borrowers: filling out one application on the AmOne website reveals a number of potentially good lender matches based on what the borrower described as their loan need and credit profile.

Using AmOne does not impact a borrower's credit because the company does not do a hard credit pull; instead, it uses information provided by the borrower to serve up the most likely lender matches.

Immediately after they submit their AmOne application, borrowers can compare different lenders and loan offers (including APRs, fees, and repayment terms). Once they settle on a lender they are satisfied with, borrowers then go to that lender's website and complete a full application before getting approved and funded.

In short, AmOne acts as a trusted go-between, steering you toward potential loan providers that meet your specific needs.

Loan Types Presented by AmOne

AmOne provides personal loans and small business personal loans, with amounts ranging from $1,000 to $50,000. AmOne's loans tend to have competitive rates from 6.4% to 35.99% and repayment terms from 12 to 84 months.

These loans are originated through AmOne's vetted network of lenders. While it's unclear exactly how many lenders AmOne works with, they do list out their "featured partners" on their website. These include big and very well-regarded names in the personal loan industry, including:

Because the majority of loans provided are personal loans, borrowers have wide flexibility in how they choose to define the loan purpose. The AmOne site notes the following ways that their loans could be used: debt consolidation, emergency expenses, home renovation, medical/dental costs, moving costs, vacation/special events, and the list goes on.

The process to see lender matches is more or less the same whether you are looking for a personal loan for yourself or for your small business. One straightforward application connects a borrower to multiple lender offers, whether it's for credit card debt consolidation or to meet the diverse financial needs of small business owners.

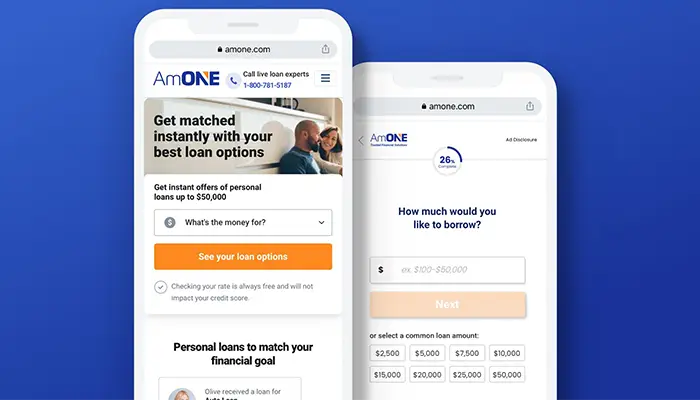

AmOne's Online Loan Request Form

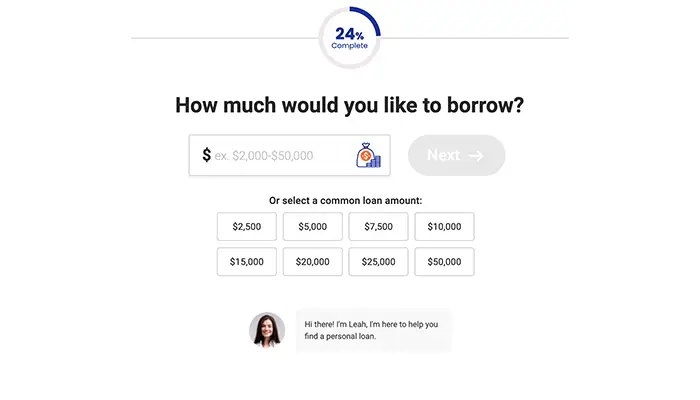

We timed it, and the process to fill out the AmOne online form is about two minutes. The fast site connection and visual nature of the application makes it extremely easy to complete.

Additionally, customers can feel comfortable knowing that the secure proceeding of the application process is protected with bank-grade encryption.

AmOne's Online Form

Here is the specific flow of questions that you will go through when filling out the application:

- What the loan is going to be used for

- Loan amount you want to borrow

- Employment status

- Estimated annual pre-tax income

- Whether you own or rent your home

- Full name

- Date of birth

- Address

- Phone

Once you have completely filled out the form, AmOne will send a text code to your phone to confirm your number. They will then conduct a "soft" credit pull, which doesn't impact your credit score, to finish verifying your identity and get a sense of your credit profile.

Finally, with loan options presented instantly, you can start comparison shopping between the best rates, monthly payments, and repayment terms.

After Lender Options Are Presented

Once a borrower has completed their comparison shopping between lenders, the next step is to select a lender to apply to. At this point, AmOne will have completed its role in the process of matchmaking a borrower and a lender.

Borrowers then move into the formal application stage, which is conducted off the AmOne platform and on the specific lender's website.

It is important to note that while completing the form on the AmOne website will not affect a borrower's credit score, completing an application with one of the lenders does involve a hard credit pull -- which lowers a borrower's credit score by a few points.

Another important call-out: just because a borrower was matched with a loan provider on the AmOne website doesn't mean that they will definitely be approved by that lender once they apply. Be as precise and honest as possible in filling out the AmOne form in order to increase the likelihood that you'll be approved by the lenders that AmOne matches you with.

Once your loan request is approved, most lenders in the AmOne network send funds to a borrower's bank account in one business day. This swift turnaround time can be a lifesaver in urgent financial situations.

Eligibility Criteria: Do You Qualify for an AmOne Loan?

Bear in mind that AmOne doesn't make loan approval decisions -- they just connect borrowers to lenders. For that reason, there are no minimum requirements for a borrower to use the AmOne network (such as a minimum credit score or income).

With that said, AmOne has intentionally created a network of lenders that cater to a wide range of loan sizes, needs, credit scores, and credit profiles.

Although they cannot guarantee that anyone comparison shopping for loans on their website will be approved for a loan, the wide range of different lenders increases the likelihood that a borrower will find the right lender for their needs, regardless of their financial and credit situation.

Accessing Customer Support

AmOne customer service is easily accessible throughout the loan comparison process. The most common and effective way to reach customer service is by phone at (888) 401-0330.

The customer service team is equipped to help with technical or troubleshooting issues, but mostly the well-informed team is there to help borrowers understand the different loan options they have been presented with. The ability to easily reach a live person to answer questions speaks to the company's mission to provide unbiased guidance to its customers.

AmOne User Experiences and Reviews

Like any service, AmOne has its strengths and weaknesses, as reflected in its mixed consumer ratings. Assessing AmOne reviews on Trustpilot reveals a reputable company with generally positive reviews: over 2,000 customers give the company an "Excellent" score of 4.5 out of 5 stars. (79% of customers gave them a full 5 stars.)

Positives that customers called out include AmOne's efficient online application process and compassionate and knowledgeable customer service who answered specific questions about loan options.

However, not every customer had such positive reviews. For example, while the Better Business Bureau gives AmOne a "B+", a small number of customers on that review site gave AmOne only one star. Why?

This group of borrowers expressed frustration for two primary reasons:

- They were not approved for a loan after being matched to a lender on the AmOne website

- They received too many texts or emails from lenders after they provided their personal information to AmOne

These negative reviews are a good reminder to fully understand the service before using it. AmOne does not pre-approve or guarantee any approvals on behalf of the lenders in their network. They only show borrowers lenders that are likely to be good matches for their credit profile and borrowing needs.

It is also useful to understand AmOne's privacy policy. If a customer wishes to opt out of receiving messages from the lender network, they should visit AmOne's "Contact Us" page, where they can submit Unsubscribe requests, including phone calls, emails, and text messages.

Other Options Like AmONE

Although AmOne provides a host of benefits, considering other reliable options before making a final decision is always the best way to confirm that AmOne is the right platform for you.

Strictly speaking, borrowers do not need a loan marketplace like AmOne to explore loan offers from online direct lenders. In fact, many lenders in the AmOne network (such as Best Egg, Prosper, and Achieve) can be explored directly by borrowers if they wish to manually research individual lender sites.

On the other hand, there are also other lending marketplaces like AmOne that could be good choices to consider if a borrower wants to comparison shop as efficiently as possible:

5K Funds

5K Funds has over 100 lenders on their network, making them one of the largest loan marketplaces today. They offer similar loan sizes (capped at $35,000) and APRs as AmOne. However, it is important to note that 5K Funds requires a lot more personal information upfront than AmOne does, so this option may not be for everyone.

Lending Club

Lending Club shares many similarities with AmOne in terms of loan sizes (capped at $40,000), a simple digital experience, and a large lender network. The main difference is that Lending Club lenders tend to cater to borrowers with fair to excellent credit scores and credit profiles. This means that Lending Club may have stricter approval criteria than AmOne but may also be able to offer more favorable rates, fees, and terms.

The Bottom Line

AmOne is one of a small number of reliable lending marketplaces for individuals and small businesses. With its innovative technology, user-friendly interface, and accommodating range of lender eligibility criteria, AmOne simplifies the process of finding potential loan providers by making comparison shopping between offers easy for borrowers.

However, as with any financial product, comparing AmOne with other lender reviews is wise to ensure you find the best deal for your unique financial situation.

Frequently Asked Questions

Does AmONE do a hard credit pull?

Using AmONE's service will not affect your credit score as they only perform a soft credit pull. However, once you proceed with the application process with a lender, they may conduct a hard pull, which could temporarily impact your credit score.

Does AmONE do a hard credit pull?

Using AmONE's service will not affect your credit score as they only perform a soft credit pull. However, once you proceed with the application process with a lender, they may conduct a hard pull, which could temporarily impact your credit score.

Does AmONE ask for proof of income?

AmOne does not need proof of income in their application process; instead, they ask borrowers to self-report their income. However, while AmOne doesn't need proof, lenders that you match with on the AmOne network will require proof of income, identification, employment, and banking details if you choose to apply for one of their loans.

What is AmONE interest rate?

The interest rate for AmONE personal loans can go as low as 6.4% or as high as 35.99%, but the exact rates you qualify for will depend on your credit score and the specific lender you choose.

What services does AmOne offer?

AmOne is a lending marketplace that works like a matchmaker between consumer and small business borrowers and lenders who offer personal loans. Borrowers only have to fill out one simple application to begin comparison shopping between different loan offers from lenders in the AmOne network.

Does AmOne charge for its matchmaking service?

AmOne's loan matchmaking service is free for borrowers, as it earns revenue through commissions from lending partners.