Due to its competitive rates, wide range of loan sizes, and friendlier approval criteria, Prosper is worth a serious look from borrowers with Fair credit or better.

Seeking more information about Prosper personal loans? This comprehensive review will cover everything you need to know, from loan sizes, interest rates, and approval criteria, to the customer experience and real user reviews. We'll also compare Prosper to similar lenders to make sure that you are well-informed in your loan selection process.

Pros & Cons

Pros

- Offers a wide range of loan sizes, from $2,000 to $50,000

- Competitive interest rates from 8.99% to 35.99%

- No prepayment penalties for early loan payoff

- Approves borrowers with Fair credit or higher

- Allows co-borrowers

- Allows up to two active loans at the same time

- Provides hardship program for temporary relief

- Excellent user reviews and ratings

Cons

- Has an origination fee ranging from 1% to 7.99% of amount borrowed

- Charges late fees starting at $29

- Does not offer rate discounts

How Prosper Personal Loans Work

The first thing to understand about Prosper has been operating consistently since 2005 as one of the first peer-to-peer lenders.

This means that Prosper connects qualified borrowers to a platform where investors commit funds for the loans. The benefit of this approach is that approval criteria tends to be a bit looser, because different individual investors may have varying risk appetites and are willing to lend to a broader range of borrower credit profiles than traditional financial institutions.

While Prosper connects borrowers with individual investors, as a borrower you will only have to interact with Prosper. The company takes care of the entire loan servicing process, from underwriting and approval to loan repayments.

Let's dig into the specifics of what you can expect from a Prosper loan.

Loans For a Variety of Uses

Prosper’s services are centered around personal loans, a versatile financial tool tailored to a wide range of personal financing needs. Whether you’re looking to consolidate debt, refinance high-interest credit card debt, fund home improvements, or cover other significant expenses, a Prosper loan is likely to meet your needs.

With debt consolidation loans and personal loans ranging from as low as $2,000 to as high as $50,000, Prosper caters to a broad spectrum of borrowing needs.

Term Length Flexibility

In addition to loan amount flexibility, Prosper offers a choice of loan terms ranging from 2 to 5 years. This flexibility allows borrowers to tailor their monthly payments based on their budget and financial circumstances.

For instance, shorter loan terms often require more aggressive monthly payments, while longer terms result in smaller monthly payments but incur more interest over the life of the loan.

By offering a range of term lengths, Prosper enables borrowers to opt for the repayment plan that aligns with their financial circumstances.

Interest Rates

The APR or Annual Percentage Rate a critical aspect of any personal loan, as it determines how much it will cost you to borrow. Prosper’s personal loan APRs fall within a competitive range of 8.99% to 35.99%. This wide spectrum caters to a variety of borrowers based on their creditworthiness.

Whether you have an excellent credit score and are eligible for the lower end of the APR range or have a less-than-stellar credit score and fall into the higher APR category, Prosper has options for you.

It’s important to remember that the final APR offered is based on various factors, including credit score, income, loan amount, and loan term.

Origination Fees & Late Fees

Prosper has two different types of fees to be aware of: an origination fee, and late fees:

- Origination Fee: Like many similar lenders, Prosper requires an origination fee, which is essentially an administrative fee they charge for reviewing applications and facilitating loan funding. Prosper's origination fees vary from 1% to 7.99% of the total amount borrowed (with the specific amount depending on your creditworthiness). The origination fee is deducted from the loan amount before it is distributed, so make sure to account for this difference in total funds you receive.

- Late Fees: Unlike similar lenders, Prosper has late fees. The cost is $29 for the first late payment, but if you are late again within six months, the fee jumps to $40 per late payment. It is always important to stay current on your monthly payment to protect your credit, but especially so with Prosper, as falling behind can become costly quickly.

Hardship Support for Borrowers

Life is unpredictable, and Prosper recognizes that borrowers may face hardships beyond their control. That’s why they offer support for borrowers affected by natural disasters or financial challenges.

If you’re experiencing hardship due to such events, Prosper can work with you to discuss relief options for your monthly payments, by either reducing your monthly costs or extending your loan terms, providing the support you need in challenging times.

Co-Borrower Opportunities

By allowing joint applications, Prosper provides an avenue for borrowers with less-than-perfect credit to enhance their application with the inclusion of a co-borrower with a good credit score.

This collaborative approach to debt consolidation can lead to financial advantages such as securing a lower interest rate and potentially qualifying for a larger loan amount due to the combined economic profiles.

Prosper's Application Process

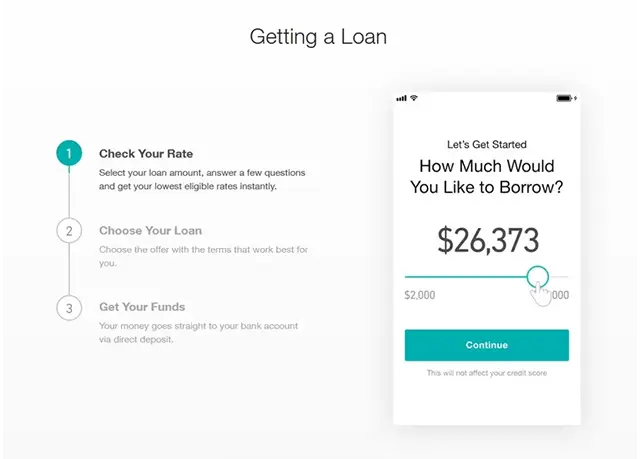

As you'd expect from a leading online lender, Prosper's application process is fully digital, fast, and straightforward. It involves three basic stages: pre-qualification, application/document submission, and funding.

It is useful to note that while approval is almost always instantaneous, it can take one to three days to have the funds in your account. Let's explore each step of the process more thoroughly:

Step 1: Loan Pre-Qualification

To begin, borrowers go to the Prosper website to enter some basic information and check the rate they are likely to qualify for if they submit a full application. You'll be asked the loan amount you're seeking, and typical information including your name, birthdate, and email, and general employment and income information.

At this point, you'll get a preview the loan offers that Prosper's network of investors are willing to extend to you. If you find a loan that meets your needs and expectations after carefully reviewing rates and terms, you would move into the application/document upload stage.

Note that because Prosper only does a "soft" credit pull, there is no impact to your credit score to pre-qualify.

Step 2: Document Submission & Verification

Once you’ve pre-qualified and accepted a loan offer, the next step is the document submission and verification stage. Here, you’ll need to provide the following documents for verification:

- Driver’s license to verify your identity

- Recent paystubs, tax returns, or bank statements for income verification

- In rarer cases, Prosper may verify your employment by contacting your employer directly or utilizing external databases.

It’s also at this stage that Prosper conducts a hard credit check with TransUnion. While this may slightly impact your credit score, it’s a temporary dip and a standard procedure in the lending industry.

Step 3: Funding

With all the necessary documents submitted and your credit checked, the final step is reviewing and signing the borrower registration agreement, and getting the loan proceeds into your bank account.

It’s important to note that loan approval and funding are contingent upon borrowers meeting credit and other conditions, including how quickly your bank processes the funds transfer to your account.

Loans through Prosper are typically funded within one to three days after final approval, and customer feedback consistently describes Prosper as an extremely fast and efficient lender who tends to "underpromise and overdeliver" in terms of their loan funding times.

Eligibility Criteria for Borrowers

Prosper is known for catering to a range of different credit profiles. With that said, eligibility for personal loans from Prosper depends on certain criteria being met. These requirements are in place to ensure borrowers can responsibly handle the repayment of their loans, protecting both the borrower and lender.

Credit Score Requirements

While their website states that the minimum credit score required for a loan through Prosper is 600, some borrowers have claimed they've been approved with scores as low as 560. Prosper notes that a co-borrower on a loan must have a minimum credit score of at least 600.

This range of minimum credit scores makes Prosper accessible to a wide range of borrowers, from those with less-than-perfect credit to those with excellent scores.

It’s important to note that while a lower score doesn’t automatically exclude you from securing a Prosper loan, it may affect your loan terms, including your APR and loan amount.

Debt-to-Income Ratio Considerations

Another critical eligibility factor is your Debt-to-Income (DTI) ratio. This ratio, calculated by dividing your monthly debt payments by your monthly gross income, should be below 50% for loan eligibility. The DTI ratio is a crucial indicator of your ability to manage the monthly payments and repay the loan.

This ratio provides Prosper with a snapshot of your financial health and can have a significant impact on your loan approval and terms.

Other Borrower Requirements

Borrowers must be at least 18 years old and have a social security number. They cannot have had a bankruptcy filing within the last 12 months.

Customer Reviews and Ratings

One of the best ways to assess a lender is by hearing what people who have already used it have to say about their experience.

It is worth noting that Prosper has been around since 2005, and since then has generated over $25 billion in personal loans for over 1.4 million borrowers. They have had over one million customers, and the reviews are mainly positive.

Over 12,400 customers have reviewed Prosper on Trustpilot, giving them an average score of 4.6/5. The lender also has a Better Business Bureau rating of A+. The most common theme in reviews included praise for Prosper's:

- Easy-to-use interface

- Straightforward application process

- Speed and ease of application

- Co-borrower option

- Great customer service (by email and phone)

The small minority of complaints against Prosper focused on typical issues that can occur with a lender, including confusion about autopay vs. manual payments, and frustration about being denied for a loan. It is important to remember that pre-qualifying for a loan is never a guarantee of approval.

Comparing Prosper to Other Online Lenders

While a Prosper personal loan offers a compelling array of features and benefits, how does it stack up against other online lenders? As part of the loan research process, it is always important to compare options against one another. Here, we'll compare Prosper to three strong alternatives: Upstart, LendingClub, and Lenme.

Prosper vs. Upstart

- Loan sizes: Both lenders have similar loan sizes: Upstart's loans range from $1,000 to $50,000, while Prosper has slightly a slightly higher minimum loan size, from $2,000 to $50,000

- Interest rates/Fees: Upstart's interest rates range from 7.8% to 35.99%, comparable to Prosper's rates of 8.99% to 35.99%. Both lenders have origination fees, with Upstart's going up to a high 12% for some borrowers

- Approval criteria: Upstart does not state a minimum credit score requirement and is geared toward borrowers with Fair or lower credit. Conversely, Prosper has a minimum score requirement ranging from around 560 to 600, but serves customers with excellent credit as well

- Lender Reviews: Upstart has a slightly higher rating of 4.9/5 on Trustpilot, compared to Prosper's rating of 4.6/5. Both lenders have an A+ rating from the Better Business Bureau.

Read our full review on Upstart here.

Prosper vs. LendingClub

- Loan sizes: Both lenders have similar loan sizes: LendingClub's loans range from $1,000 to $40,000, while Prosper has slightly higher maximum sizes, from $2,000 to $50,000

- Interest rates/Fees: LendingClub's interest rates range from 9.57% to 35.99%, comparable to Prosper's rates of 8.99% to 35.99%. Both lenders have origination fees.

- Approval criteria: LendingClub's minimum credit score requirement is 600, whereas Prosper's score requirements range from around 560 to 600

- Lender Reviews: LendingClub has a rating of 4.7/5 on Trustpilot, compared to Prosper's rating of 4.6/5. Both lenders have an A+ rating from the Better Business Bureau

Prosper vs. Lenme

- Loan sizes: Like Prosper, Lenme is a P2P platform. However, Lenme is more of a "micro" lender, offering loans up to a maximum of $5,000 with minimal paperwork and easier approval criteria. In comparison, Upstart is a much larger lender with loans up to $50,000.

- Interest rates/Fees: Lenme's interest rates range from 9% to 24.99%, in contrast to Prosper's rates of 8.99% to 35.99%. Borrowers with lower credit are likelier to pay less with Lenme

- Approval criteria: Lenme does not state a minimum credit score requirement and is geared toward borrowers with subpar credit. Conversely, Prosper has a minimum score requirement ranging from around 560 to 600, but serves customers with excellent credit as well

- Lender Reviews: Lenme has a lower score of 3.2/5 on Trustpilot, compared to Prosper's rating of 4.6/5. This lower rating is due to mixed experiences from investors who are not always repaid by borrowers on the Lenmen platform.

Read our full review of Lenme here.

The Bottom Line

A Prosper debt consolidation loan or personal loan offers a flexible, straightforward, and well-regarded solution for various financing needs. With their wide loan amount range, customizable term lengths, and diverse approval and APR spectrum, Prosper caters to a broad array of borrowers.

While no lender is without its drawbacks, Prosper’s commitment to customer support, particularly in times of hardship, sets it apart in the lending market.

As you navigate your financial journey, remember that the key to making the right choice lies in understanding your needs and evaluating your options. Based on our assessment, Prosper can safely be on that list of options.

Frequently Asked Questions

Is Prosper a legitimate loan company?

Yes, Prosper is a legitimate loan company with an A+ rating from the Better Business Bureau and positive customer reviews.

Is it hard to get a loan from Prosper?

Because Prosper is a Peer to Peer lender, it can be relatively easier to get a loan from them compared to other online lenders or traditional banks. Prosper accepts credit scores as low as 600, making it a more accessible option for many individuals.

What credit score is needed for a loan from Prosper?

To qualify for a loan from Prosper, you will need a minimum credit score of 600, although some borrowers have reported getting approved with a score as low as 560.

How long does it take for Prosper to approve a loan?

Loan approvals tend to be very quick – instantaneous, in some cases. However, it can take one to three business days to receive the funds in your account after your application is approved.

What is the range of loan amounts offered by Prosper?

Prosper offers personal loans ranging from $2,000 to $50,000, providing a wide range of options for potential borrowers.