Lenme is a peer to peer lending app that connects borrowers and direct lenders for transparent and quick short-term loans. Due to the nature of connecting individual borrowers with individual lenders (investors), user reviews vary across speed and repayment.

In the innovative world of finance, peer-to-peer lending platforms have become a helpful way to access loans without having to borrow from traditional lenders, which may have more strict approval criteria or charge higher fees for their services.

Lemme is a standout example of a P2P app that gives you more choice when you borrow money. They're popular for their unique lending marketplace, easy-to-use app, and ability to secure funds as soon as the next business day after approval.

In this review, we'll explore how Lenme works, how to borrow from the app, its unique flexibility, pros & cons, and a few alternatives you might want to consider as a shop for your next loan.

How Lenme Works

What is Lenme? Lenme is an app that is disrupting the traditional lending and borrowing model, introducing a new peer-to-peer loan platform that aims to simplify how loans are handled. The app’s primary objectives are to reduce underwriting costs that come with conventional loans from traditional financial institutions and offer borrowers access to quick funding ranging from $50 - $5,000. Lenders who use the platform may find these loans a suitable investment option for them to diversify their investments.

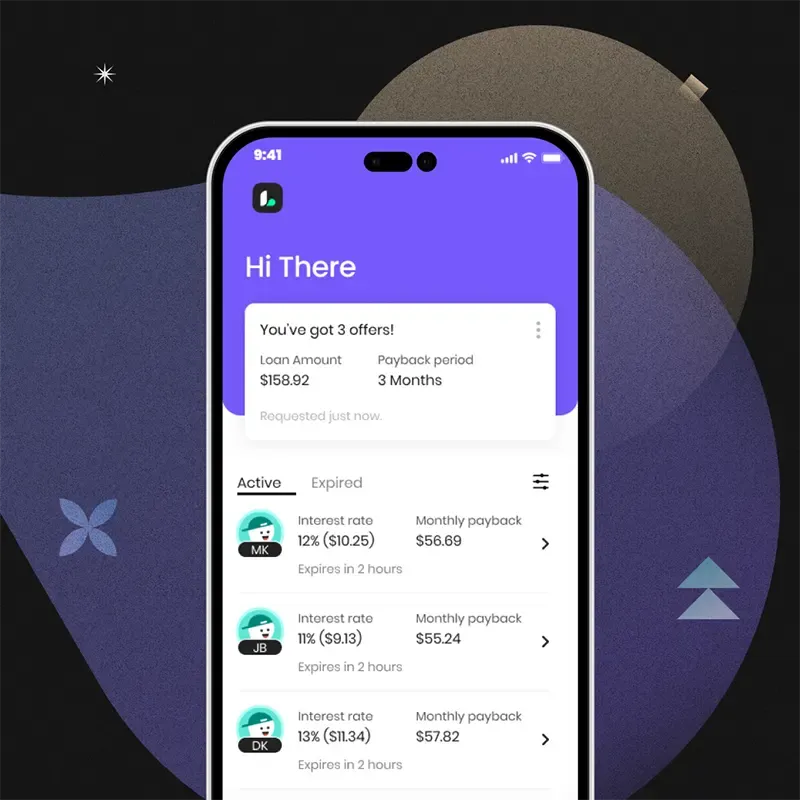

The Lenme approach is simple yet effective. They bring together borrowers and lenders, and lenders can compete with interest rates to secure the investment opportunity that will best fit their financial needs. Borrowers can then evaluate lenders to find the best option for them to borrow money for a purchase or other financial need.

With Lenme, there are few limitations or restraints on the money the lenders lend, which allows borrowers to secure the funds they need quickly and at a cost that will keep them on the right financial track. While the system and premise behind the Lenme app are sound, let's look a little deeper to see if the app checks other boxes, such as customer service and a positive overall experience.

Borrowing With Lenme

Getting started with Lenme is quite easy. The simple yet robust technology behind the app makes it user-friendly and easy to navigate. In fact, you can get started using Lenme with just a few simple steps.

- Download the Lenme app from Google Play or the Apple App Store. Then, you need to simply input your your personal details, submit a valid government-issued ID, and link an online bank account.

- Enter the details of the loan you are looking for and the repayment terms that would work for your situation.

- Receive offers from various lenders and find the best fit for your repayment schedule and desired interest rate.

- Choose the lender that provides the terms you are looking for, or wait for more offers to come in.

- Once you have found the best loan option for you, complete the information the lender requested and wait for the funds to be deposited into your account.

- Make on-time payments to improve or build a positive credit history and increase your lending power with other traditional financial institutions.

Whether you have good credit, no credit, or poor credit, the app is likely to find a match for your lending needs.

Navigating the Lenme App

Lenme’s user interface is designed for simple navigation. The layout, symbols, icons, and general layout are designed to take borrowers and lenders through the investment process in an intuitive way. The integrated wallet is one of Lenme's features that make navigation quick and easy.

The app is known for its straightforward data visibility, which allows borrowers to be matched with the right investor and investors to make informed decisions. All the features of the app work together to create a simple and seamless process for all users.

Flexibility with the Lenme App

One of the most unique features of the Lenme app that appeals to both lenders and borrowers alike is there are no set approval criteria, which gives the opportunity for approved users to request a loan and investors to offer the terms that fit their investment model. This is especially attractive for borrowers who may not have the good or excellent credit most personal loan lenders require.

Lenme also does not require a minimum credit score to qualify for a loan. Each investor can make their own assessment in terms of risk, which means that people from all credit situations and all income levels have the potential to be matched with a lender.

Another benefit of the Lenme platform is the fact that it can provide funding fast. Applicants will be able to submit their loan request immediately and start receiving offers as soon as it is posted. This gives borrowers the chance to secure their funding as soon as the next business day.

Lenme reviews also make note of the small fees associated with the transactions. Without the high fees associated with closing costs from traditional lenders, Lenme is often a more affordable solution for borrowing money quickly.

How To Use Lenme Successfully

Using P2P lending platforms like Lenme offers a new way to borrow but comes with risks for investors, and it is important for investors to understand this prior to starting. Lenders have reported some problems that arise when managing collections, which can lead to defaults rather frequently, but those who understand the high level of risk involved often have few to no complaints.

For borrowers, the app provides quick access to money that comes with predictable monthly payments and flexible terms. Some complaints have been received about processing times taking longer than a single business day and delays in obtaining funds. However, more users report rapid funding than those do with delays.

To use Lenme and other P2P apps successfully, borrowers have to take the time to find the right loan with an interest rate and repayment structure that is manageable to avoid default. For lenders, the greatest success comes from those who understand the level of risk and perform their due diligence when determining how to invest.

Alternatives to Lenme

While Lenme is a great platform for peer-to-peer lending, there are other options worth considering. Below are just a few apps and lenders similar to Lenme that can help borrowers get cash fast and lenders make a little money on a loan investment.

Solo Funds

Solo Funds is another peer-to-peer lender that offers loans ranging from $20 to $575 and utilizes a tipping system to compensate the lender instead of a set interest rate.

Prosper

Prosper is a P2P lender that matches borrowers with lenders for loans ranging from $2,000 to $40,000 with repayment terms of up to 5 years.

Upstart

Upstart is a leading online loan marketplace designed to match lenders (online lenders, banks and credit unions) to borrowers who need amounts from $1,000 to $50,000. Underwriting powered by AI assesses over 1,500 factors besides credit ratings, increasing the chances of approval for borrowers who less than good credit.

The Bottom Line

Lenme provides an innovative solution in the P2P lending world by providing an easy-to-use app for both borrowers and lenders. It offers features such as intuitive borrower profiles that allow users instant access to numerous potential creditors. This, along with the ability to secure funding in a matter of days, makes it one of the most popular peer to peer lending apps.

If used wisely, the Lenme app provides a great tool for borrowers looking for loans outside of traditional lending institutions and also for lenders looking for a new investment opportunity.

Frequently Asked Questions

Is it hard to get a loan on Lenme?

No matter your credit score, Lenme provides you with quick and easy access to lenders who are willing to offer appealing rates for loan services. All types of borrowers, whether they have good credit or bad, have the opportunity to connect with a lender willing to take a risk on them.

How long does it take to get funded on Lenme?

Once you are chosen by a lender, and the exchange is completed, you can expect the process to take between 1 and 2 business days for funding to be available. In some cases, funds are available the next business day; in others, it may take longer.

What size loan do Lenme lenders offer?

You can request loan amounts ranging from as low as $50 to as high as $5,000 and will likely find multiple lenders in this lending range.

Does Lenme affect credit?

When you accept a loan offer from a lender, it initiates a hard inquiry into your credit which can result in a slightly lower credit score for a short period of time.