Popular credit building apps like Self can help improve your credit score by reporting consistent and responsible payment history on special credit-builder loans or credit lines to the three credit bureaus.

Maybe you haven't established credit yet, or perhaps you've had trouble with payment history. No matter the starting point, building your credit is more accessible than ever.

Good credit is crucial for anything from personal loans and increasing your credit limit to housing, car loans, and even securing your next place or live or job opportunity. Staying disciplined with timely payments, credit utilization ratio, and monitoring reports is critical to improving your credit score, and credit-building apps like Self helps you do just that.

These apps offer products like credit builder loans, credit lines, and monitoring tools to build credit from your phone as alternatives to more traditional credit cards. Credit building apps like Self can be a solid option to expand your access to credit and have become a popular tool in recent years.

Each app has unique features and services to help you build your credit score, so in this guide we'll introduce you to 10 of the best credit building apps, how they work, and review the pros and cons for each one.

Let's dive in to our top ten credit-builder apps like Self:

- Kikoff Credit Account, popular for its flat rate, $5/mo credit builder accounts

- Grow Credit, a freemium credit builder app that uses your existing monthly subscription payments to build credit

- MoneyLion, app-based no-credit-check credit builder loans

- Cushion.ai, to build credit with both subscription payments and BNPL payments

- Super Pay Card, a secured credit card option to build credit with everyday transactions

- Brigit, no interest, no upfront deposit credit builder loans

- Cleo, secured credit card with no minimums

- Possible Finance, lower cost borrowing options that also help to build credit

- Grain Credit, best for a personal line of credit

- Dovly, app option for automatic dispute resolution to resolve inaccurate items on your credit report

1) Kikoff Credit Account

Best for credit builder accounts starting at $5/mo

Kikoff is a unique credit-building app that provides approved users with a $750 credit line to establish positive payment history and lower credit utilization. There's no credit check, an account can be opened in minutes, and you can even report your rent payments with their top plan. Kikoff customers have reported average credit score improvements of up to 58 points when making on-time payments (based on users who started with a 600 score or below).

Pros

- Instant approval with no credit check

- Kikoff offers various products: a credit line, a credit builder loan, and a secured credit card

- Premium Credit Service account offers dispute credit report errors and rent payment reporting

- Flat rate plans starting at $5/mo

Cons

- Kikoff's Credit Account can only be used to finance purchases from their store (items start at $10)

- The only Kikoff product that reports to all three major bureaus is their Secured Credit Card

Read our full review of Kikoff

2) Grow Credit

Freemium app for building credit with your existing monthly subscription payments

Grow Credit offers an innovative solution that allows you to build credit with the payments you are already making for your monthly subscription services like Netflix, Hulu, Amazon Prime, and Spotify. To get started, you only need to sign up and use their interest-free Grow Credit MasterCard as your primary payment method on the subscriptions you'd like to report to the credit bureaus. Grow's unique model makes it an easy credit building app since it only requires applying and updating payment methods for services you already pay for.

Pros

- Instant approval, even if you have limited or no credit history

- Low-effort way to start building consecutive on time payments history

- Automatic payments are reported to the three major credit bureaus

- Multiple plans available, ranging from a basic free service to an unlimited plan at $9.99/mo

Cons

- The Grow Credit MasterCard can only be used to pay for recurring monthly subscriptions (but Grow supports over 100 different subscription providers)

Read our full review of Grow Credit

3) MoneyLion

Credit builder loans to create 12 months of history with the major credit bureaus

Like the Self Credit Builder Loan, MoneyLion offers credit builders loans with no hard credit check - helping you build credit through establishing timely payments. Their Credit Builder Plus membership also gives you access to credit monitoring, zero-interest InstaCash, and a fee-free RoarMoney investment account.

Pros

- Offers Credit Builder Plus loans like the Self app to build credit with a 12-month payoff and no hard check

- The Credit Builder Plus loans allow you to access loan funds (although MoneyLion may require some users to hold a portion of their funds in a reserve account)

- The Credit Builder Plus loans allow you to access loan funds (although MoneyLion may require some users to hold a portion of their funds in a reserve account)

- Reports regularly to all three credit reporting bureaus

Cons

- The Credit Builder Membership carry an annual cost of between 5.99% and 29.99% APR interest rates

- The Credit Builder Plus loans only come in 12-month durations with no options for different terms

4) Cushion.ai

Build credit with both your existing subscription & Buy Now Pay Later payments

Like Grow Credit, Cushion.ai allows you to build credit with bill payments you already make by using their virtual MasterCard, which automatically reports subscription payment history to credit bureaus. Cushion.ai also allows you to get credit for your Buy Now Pay Later (BNPL) payments (such as Klarna, Affirm, Afterpay, etc.). With the Pro plan, you can even gain access to reporting your utility payments.

Pros

- Tracks all your bill & BNPL payments in a calendar view in one app, and reports the payment history to credit bureaus

- Tracks all your bill & BNPL payments in a calendar view in one app, and reports the payment history to credit bureaus

- Linking your email and bank account allows you to organize your bills and BNPL into a neat view, helping you manage cash flow

Cons

- Paid service only, with only two plans available: $4.99/mo and $12.99/mo

5) Super Pay Card

Build credit history with everyday transactions

Super.com's Pay Card is another secured credit card option that allows you to build your credit with no credit check or interest. The Pay Card works like most secured credit cards, establishing your credit limit by funding it with cash. However, with Super.com, you link your bank account instead of a security deposit, and your credit limit equals your balance.

Pros

- Unlimited cash back on everyday purchases

- No hidden fees

- No minimum income or bank account balance

Cons

- Credit limit only equals the balance maintained in your Super Deposit Account and linked debit card account

- Monthly fee is on the high end at $15/month

6) Brigit

Hybrid savings and credit builder app

Brigit, a popular personal finance app, sets up a credit builder loan and deposits the funds into a new account that you will make monthly payments against. Each month, payments are reported to the credit bureaus, and once you've made all the payments – you get back the money you put in.

Pros

- No credit approval required

- No interest or security deposit

- Save as little as $1 per month to get started

- Brigit is also very popular for overdraft protection

Cons

- Brigit's is built as a savings and credit builder program so, it doesn't offer any features to extend credit

7) Cleo

Secured credit builder card

While Cleo initially gained popularity for its savings account and Autosave features, Cleo's Credit Builder Card also aims to help your credit journey with a secured credit card that starts with a $1 minimum deposit and no hard credit check. Cleo will then report your account status to the three major bureaus and help you build your credit over time, eventually helping you access better credit opportunities.

Pros

- No hard credit check

- No annual fees, no interest will accrue

- Payroll direct deposit allows you to access your paycheck up to 2 days early

Cons

- Cleo's secured card-based Credit Builder program costs $14.99 per month

8) Possible Finance

Possible Finance provides an excellent opportunity to build good credit with two credit builder products at a low cost and 0% APR. Both accounts offer similar features but differing credit limits of $400 and $800, and monthly membership costs of $8 and $16.

Pros

- Offers the Possible Loan and Possible Card as two options to build your credit profile

- Fixed monthly cost: no late fees and no interest charges

- Pay over time option available

Cons

- Possible Loan holders can't apply for the Possible Card until their loan is paid in full

9) Grain Credit

No credit check personal line of credit

Grain Credit offers instant approval to a credit line (which looks much like a credit builder account) by linking your primary checking account. They can offer an instant no-credit-check option to limited and poor credit borrowers because instead of relying on the three credit bureaus, they prioritize evaluating your cash flow (income and expenses).

Pros

- Personal credit line of up to $5,000 is not only larger other credit builder loans on this list but also offers instant access to cash if approved

- Reports your credit line, current status, and payment history to Equifax, Experian, and Transunion monthly

- A solid choice for users who have cash flow but still need to bridge a gap

Cons

- Unlike some others, Grain Credit is not fee-free: there's a small activation fee, a monthly service fee, a 15% APR, and a 1% finance charge for the offer you take

- Currently available only for iPhone users; Android users can join a waitlist

10) Dovly

App-based credit repair option

For many, building credit isn't just about starting from scratch; it's also about repairing credit history and negative, inaccurate items from the past. As an alternative to a credit builder loan, Dovly aims to help users rebuild credit by finding errors or inaccuracies on your credit history automatically.

Pros

- Scans your credit report and identifies items pulling your credit score down

- Offers an automatic dispute resolution process

- Provides ongoing credit monitoring for tracking and improving your credit

Cons

- Doesn't offer a credit builder product that establishes new payment history; it's most suitable for identifying and resolving inaccurate or unfair items on your credit report

How Do Credit Building Apps Work?

If you want to improve your credit score, any of these credit-builder apps might be able to help. These apps offer a range of tools and services designed to boost your credit score and many do it without charging high interest rates or fees. They also work directly with credit bureaus so that your timely payments and positive impacts are correctly reported. They aim to help you achieve a better score by offering products like credit builder loans, credit monitoring, and tools that will help you establish a positive payment history to keep you on track.

Positive payment history and low credit utilization are imperative to building strong credit, and these apps for credit building are designed to help you in these areas and much more. Credit building apps can help improve your financial management skills and overcome limited or adverse credit history obstacles.

How Credit Building Apps Help Improve Your Credit Score

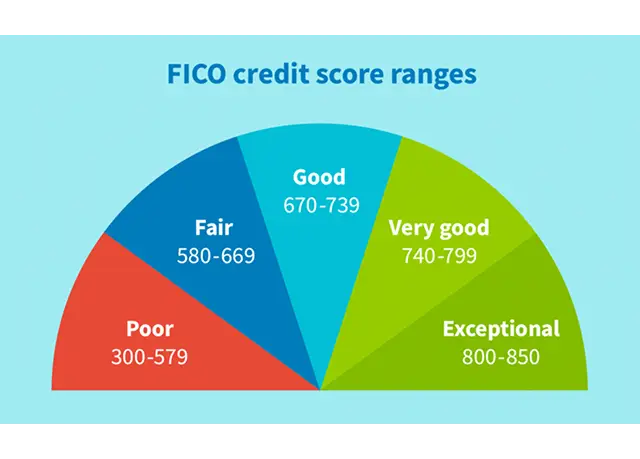

Credit building apps have several tools to help improve your FICO credit score, such as credit builder loans. These loans are available to those with lower credit scores and limited credit history. Once the loan is set up and the funds have been transferred to a savings account, you can improve your credit score by making timely payments, which will be regularly reported to the credit bureaus.

In addition to credit builder loans, credit building apps will offer credit monitoring services. Tracking your credit score and receiving alerts about any changes in your credit reports helps ensure your credit score accurately depicts your financial behavior and creditworthiness. Credit building apps also offer personalized advice based on your credit utilization ratio and credit history, helping you make informed decisions and take the necessary steps to improve your credit score.

With careful and regular credit monitoring, many people have significantly improved their credit scores in as little as 30 days. These apps are designed to address the most weighty parts of your credit score: timely payments and credit utilization.

How to Get the Most Out of Apps Like Self

Now that we've explored the best credit building apps, it's time to learn to maximize the benefits of credit building apps to improve your credit score, credit line, and financial management.

Whether a credit building app or a credit card, success hinges on regular, timely payments, keeping a tab on your credit utilization ratio, and consistently scrutinizing your credit reports for errors or inaccuracies. You can unlock better credit opportunities and achieve your financial goals by staying diligent and proactive in your credit management.

1) Make Consistent On-Time Payments

Consistently making on-time payments is crucial for building and maintaining a good credit score, as payment history is a significant factor in credit scoring. A positive payment history demonstrates to lenders that you are financially responsible and can manage your credit wisely.

To ensure consistent on-time payments, consider setting up automatic payments, setting reminders, or creating a budget that accounts for your monthly payment obligations. Maintaining discipline with your payments constructs a solid foundation for your credit score, opening up superior credit opportunities in the future.

2) Monitor Credit Utilization Ratio

Monitoring and maintaining a low credit utilization ratio (the percentage of available credit being used) can help improve credit scores and demonstrate responsible credit management. A low credit utilization ratio shows lenders that you can manage your credit wisely, which can lead to a higher credit score and better credit opportunities.

To monitor your credit utilization ratio, regularly check your credit reports and ensure your credit balances stay within acceptable limits. Keeping a low credit utilization ratio and making punctual payments can enhance your credit score and give you superior financial opportunities.

3) Check Credit Reports

Regularly checking your credit reports for errors and disputing any inaccuracies can help ensure that your credit scores accurately reflect your financial behavior. By staying proactive and diligent in monitoring your credit reports, you can catch and correct any errors before they negatively impact your credit score.

Access the websites of the three major credit bureaus (Experian, Equifax, and TransUnion) for regular credit report checks or leverage a credit monitoring service. By staying on top of your credit reports and addressing any inaccuracies, you can maintain a good credit score and enjoy the benefits of better credit opportunities.

The Bottom Line

Whether you are looking at apps like Self or options like Kikoff that take a slightly different approach, there are a number of solid credit building programs to choose from. These credit building apps and credit card options provide valuable tools and services to help you improve your credit score, work towards your financial goals, and achieve financial stability. By understanding how these apps work, leveraging their unique features, and following our tips for effective credit management, you can unlock better credit opportunities, take control of your financial future, and save on interest and fees.