If you are looking to apply for a loan of any kind, you want to ensure a good credit score with the three credit bureaus. Favorable credit reports and a high score can mean the difference between approval, lower interest rates, and more favorable repayment terms.

If you're planning to buy a home or car, now is the time to boost your credit score so that when you apply, you can find the best rates, terms, and monthly payment to suit your needs.

In this guide, you will find the best ways to improve your score, apps to build and maintain a good credit score, and tools that can help speed up the process. By following some of the tips listed below and staying on top of your credit score, you will be better prepared when you need access to credit.

Key Takeaway

- Your credit score is comprised of a number of factors, each weighted differently and including payment history, credit utilization, overall debt, length of credit history, and credit mix.

- Improving your credit score requires regular reviews of your credit report and taking steps to prove your financial literacy by paying your bills on time and properly managing your debt.

- Credit score apps, monitoring apps, and credit builder tools are designed to help you improve your credit score more quickly.

- Most lenders require a minimum credit score to qualify for certain loans and credit cards, which makes maintaining a good credit score crucial.

- Building your credit can take up to six months, and achieving an excellent credit score can take years, so the sooner you get started, the better.

- Credit repair agencies can help remove negative marks or inaccuracies from your credit report for a fee. It may be worth the cost if you need to improve your credit score quickly.

How To Improve Your Credit Score

While there are quite a few ways to increase your credit score, there are some things you can do that will make a greater and quicker positive impact on your score. Improving your score doesn't have to be a mystery; in fact, following the tips below or using apps, such as Experian Boost, can help improve your credit score by an average of 12 points in a few short months.

#1 Keep up with payments

Many people mistakenly believe that having any debt makes for a bad credit score. That's not the case. In fact, having good debt—like a mortgage or car loan—that you pay off in full every month contributes to your credit since it shows a history of successful borrowing.

Making on-time payments is crucial for building and maintaining a good credit score. If you have trouble staying on top of paying your bills or managing your monthly cash flow, try a solution like You Need A Budget.

#2 Lower your credit utilization ratio

One factor that goes into your credit score is your available-to-used credit ratio. People with the healthiest credit scores usually use less than 30% of their available credit. To determine your ratio, you can divide the total of your outstanding credit balances by the total of all your credit limits.

So, for example, if you have a $5,000 limit on your credit card, this would mean having a balance of less than $1,500 to keep it under 30%.

If you need a little help getting your credit utilization into the healthy range, an apps like Experian and Credit Karma can give you a near real-time look into how much credit you are currently using and help you focus on ways to lower it quickly.

#3 Pay down balances

Your credit score is also affected by how much overall credit card debt and loan debt you have. You can decrease the amount of debt you have and spread your debt by paying off credit cards with low balances.

Concentrate on cards you don't use often with the highest interest rates and monthly payments, such as store-specific cards, and get those paid down with any spare cash you have. Reducing your total number of balances can give your credit score the bump it needs to help you reach your financial goals.

#4 Review your credit report for mistakes

According to a study done by the FTC, one in five people has errors on their credit reports. In some cases, these mistakes may be in your favor, and in some cases, they may not be, but either way, it's important to check.

You can obtain your free credit report once a year or use an app that allows you to download your credit report from all three major credit bureaus. Check for accuracy in the number of credit accounts that are reported, any late payments you don't remember, or any applications or credit pulls that seem false.

If you do find an error, you can call the creditor to get it removed from your report or report the error to the three credit bureaus. You can also work with a professional credit repair agency to remove errors and negative information from your credit report, which can help boost your score much quicker.

#5 Contact debt collectors

If debt collectors are after you, you probably spend a lot of time trying to avoid their calls. However, to improve your credit score, you'll need to do the opposite.

Debt collectors report your failure to pay to the credit bureaus; the damage can last up to seven years. Paying off any debt in collections won't automatically stop this reporting, but it will ease the burden, as a paid collection will affect your score more positively than an open one.

You can also try contacting your collectors to see if they'll be flexible about reporting you to the credit bureaus. If you have received a newer collection notice, see if they will waive reporting if you set up regular payments or pay the debt in full.

How is your credit score calculated?

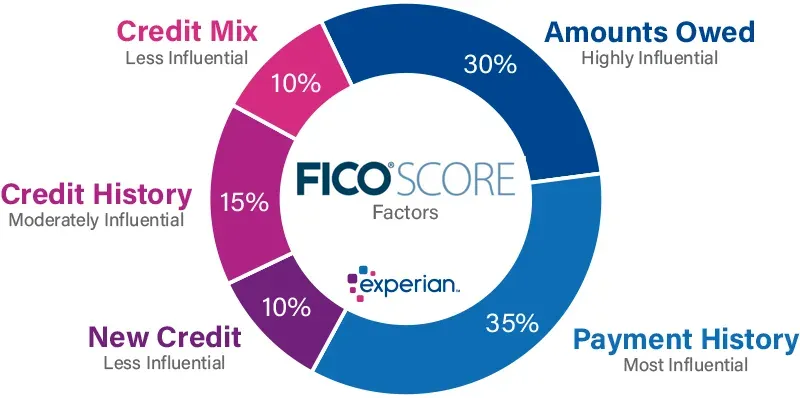

One of the keys to building credit is understanding what goes into your credit score and how each of these pieces affects your credit report. Credit scores are calculated by a variety of financial factors that each carry a different weight when calculating your overall score. While a variety of things can affect your score, below are the five most significant factors.

Payment history

Your payment history is what affects your credit score significantly and represents 35% of your credit score. Having an established history of on-time payments to your creditors will improve your score while having late payments or a defaulted account can drastically drop it.

Credit utilization ratio

Your credit utilization is a calculation of how much credit you have available vs. how much debt you have. When this debt utilization ratio is low, it shows creditors that you aren't maxing out credit when you get it. To keep your score in a healthy range, you will want your utilization to be 30% or less.

Age of credit history

The length of your credit history is considered in your score, which is why keeping your oldest credit accounts open (such as your first credit card) is important. Even if you don't use your older card, keeping it open with a zero balance will improve your credit history age as well as your credit utilization ratio.

Credit mix

Having a mix of different types of credit accounts can also help your score, though it does not hold as much weight as timely payments and low utilization. A good mix may include multiple types of loans, credit cards, or other credit accounts. This shows that you have the ability to manage multiple types of credit and keep them in good standing.

New credit accounts

Opening a new credit account can impact your score, as it changes your risk profile in the eyes of the lender. This may not have a big impact, but multiple new accounts in a short time span can lower your score. On the flip side, opening a new credit account may lower your credit utilization as you have more credit available.

Apps Best for Credit Monitoring

Free credit monitoring services and paid credit monitoring apps help you manage your credit and provide tips for improving your credit health. These apps often offer some form of identity theft protection by notifying you of newly opened accounts and keeping you updated on your payment history and credit utilization ratio.

While there are several types of credit monitoring apps out there, some of the most popular options include:

Experian Boost

Experian is one of the three major credit bureaus, and their Boost product connects to your payment accounts to report on your monthly rent and utility payments as well as payments for memberships, subscriptions, and other monthly bills.

This can help improve your score on your Experian credit report. The downside is these payments aren't recorded by the other credit bureaus, and not all lenders use Experian to qualify you for loans and other products.

Credit Sesame

Credit Sesame is a free service for credit monitoring, though you can upgrade to a paid subscription for more features. The app will monitor your credit activity with all three credit bureaus and let you know when there are changes, such as new accounts or an increase in credit card usage. These alerts will help you stay on top of your credit and alert you to any potential identity theft.

In addition to their credit monitoring app, Credit Sesame also offers a secured credit card as a credit builder feature to help establish credit or improve your credit score.

Credit Karma

Another free credit monitoring app is Credit Karma which provides you with notification of how your credit changes so that you can make sure your credit is moving in the right direction and also protect yourself from identity theft.

Credit Karma's app provides you with regular updates on your credit score, your payment history, and credit utilization ratio. They also offer recommendations for credit you are likely to qualify for and tips to help improve your credit health.

Apps Best for Building Credit

Credit building apps work by providing loans and other financial vessels that you can use to show positive payment history and financial literacy so your credit score can improve. Some credit builder apps offer credit builder loans with fixed monthly payments, while others may offer their own credit cards for site-specific shopping.

While there is a wide range of credit building apps out there, below are some of the best credit building apps based on customer reviews.

Self Credit Builder

Many reviews call the Self Credit Builder app the best credit building app because of its ability to create monthly payments and repayment terms that best fit your financial situation. Self works by allowing you to take out a loan against yourself which you will make monthly payments to.

At the end of the loan term, which is often 12 or 24 months, the money that you paid will fund a CD account to allow you to continue to grow your savings.

Each payment is reported to the three main credit bureaus, helping establish a payment history. The loans aren't free, though, with a $9 administrative fee and a high-interest rate (14% - 15%). Essentially you will pay the interest on your account balance in return for establishing credit over the next year or two.

If you don't have a credit history, Self is a simple credit builder account without the need for a credit card or other debt balance.

Read our full review of Self

Kikoff

Kikoff is a unique credit building app. Instead of using a credit builder loan to improve your credit score, they provide you a credit line of $750, which you can use at their marketplace. Their online store offers mainly books on self-help topics and finance.

There are no fees or interest associated with the line of credit itself, but there is a $5 monthly charge. Each payment to the line of credit will be reported to the credit bureaus to help you establish credit or improve your current score.

Read our full review of Kikoff

Dovly

Dovly offers a combination of credit monitoring and credit repair to help you improve your overall credit score so you can work toward your future financial goals. The credit monitoring service is free, but the repair service requires an upgrade to Dovly Premium.

Unlike a credit builder loan, Dovly helps to build your credit by looking for errors or issues on your credit accounts that can be corrected or removed to help increase your score. Dovly offers real-time monitoring with Transunion and constantly reviews your credit to see what may be in need of repair.

In addition to credit repair services, Dovly Premium also provides users with $1 million in identity theft protection.

Grow Credit

Grow Credit takes a different approach to credit building than other apps, such as the ones that offer credit builder loans. Grow Credit helps you show a positive payment history to the credit bureaus by making your monthly payments to the subscription services you already have.

When you sign up, they will provide you with an interest-free credit card that can be used for subscription services such as Netflix. You simply need to get your card and update the automatic payments on your subscription account.

The balance will be paid each month, and each of the three major credit bureaus will be notified. It is a low fee to sign up, and after 12 payments have been made, the fee will be refunded.

Read our full review of Grow Credit

Cushion.ai

Cushion.ai is one of the credit building apps that combines credit monitoring and credit building opportunities. The app helps you monitor all of your credit debt, including "buy now, pay later" online purchases, to help you manage your debt and keep a strong payment history.

They also provide the opportunity for you to build good credit with their virtual card. The virtual card can be used for your "buy now, pay later" automatic payments as well as subscription services. Payments for your virtual card will be automatically drafted from your bank account each time the payment is due, so you don't have a growing balance. However, a positive payment credit history is reported to the bureaus each month.

Alternative Option: Secured Credit Cards

Your score may be low if you haven't established much of a credit history. A quick way to establish credit and keep your spending in check is using a secured credit card.

Secured cards are more like prepaid debit cards than credit cards, as you are usually required to put down a deposit before using them. And the credit limits are low - typically around $500. They act as a bank account credit line where you can use funds that you already have in a more convenient way

But if you consistently use this card and then pay it off regularly, you can build a history of payments, and your credit score can rise over time.

The Bottom line

Improving your credit score is worth it. It can save you hundreds or thousands in interest when borrowing and give you access to the best terms and services from products like store cards, car loans, and mortgages. A better score can also help you get a higher credit limit on your favorite credit cards.

There are several ways to improve your score, but focusing on a few tips above can give you the most improvement in the shortest time frame. When you add a quality credit-building app or monitoring service, you can get a higher score even quicker.