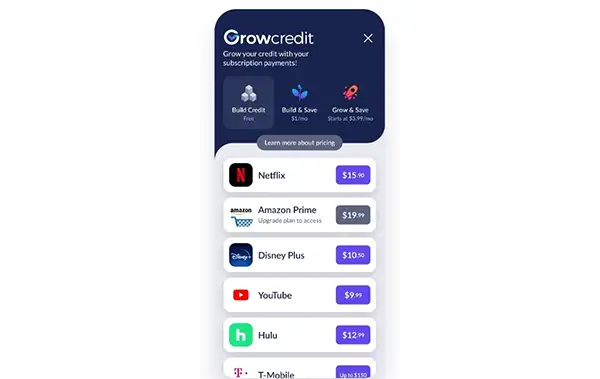

Build credit by using Grow's virtual card to pay for your existing services like Netflix, Spotify, and cell phone bills. These payments get reported to the credit bureaus, making it an easy credit-building hack to boost your score over time.

Have bad or no credit and looking for an easy way to boost your credit score?

Our Grow Credit review aims to give you the lowdown on their unique model and how they're working to provide millions of Americans a path to build and establish credit with their virtual MasterCard. Just by signing up and using it to pay some of your existing bills, your account with Grow gets counted as a line of your credit on your credit report, which helps your credit mix (10% of your FICO), build a positive payment history (35% of your FICO), and starts the clock on account age (15% of your FICO).

Many users report up to a 44-point boost using Grow – but is it right for you? We'll help you weigh the pros and cons, costs, and how Grow Credit compares to other credit-building alternatives, offering you the details to decide if it is the best choice for your credit-building needs.

Key Takeaways

- Grow Credit offers a unique credit-building approach by allowing users to build credit through payments for monthly subscriptions they already have – making it a relatively easy and low-effort approach

- The Grow virtual MasterCard is interest-free and does not require traditional credit checks (instead, you'll connect your bank account to Grow, which will help them determine your eligibility)

- Grow is designed for low and no-credit customers

- The virtual MasterCard can only be used on specific services such as streaming services and certain utilities; it is not a traditional credit card you can spend on anything you'd like

- Payments made through Grow are reported to all 3 major credit bureaus

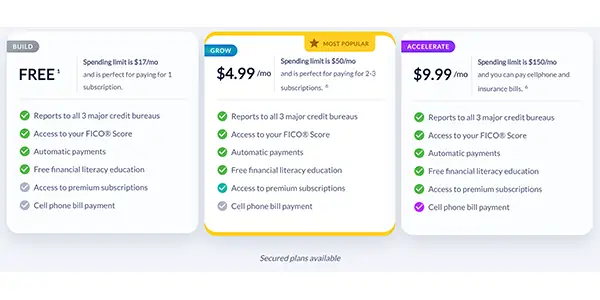

- Users can choose from multiple membership plans with varying credit limits, starting with a free, limited plan and their most comprehensive plan at $9.99/mo

Grow Credit Might Be Right For You If

- You have no credit, limited credit, or bad credit

- You want a credit builder with a low risk of falling into a debt trap. (Grow requires you to pay on time and in full, and the card only works with services they've made available)

- You want a credit builder card that helps on-time payment history but doesn't require much attention or maintenance once it's setup

Grow Credit's Approach to Credit Building

Grow Credit has emerged as a timely and innovative option among credit-building apps. Rather than relying on hard credit checks or a traditional credit builder loan, Grow Credit utilizes proprietary technology to assess users' income and banking activity in their checking account.

This innovative approach allows Grow to extend credit to users to build credit by paying for qualifying monthly subscriptions and bills using the Grow Credit Mastercard, which is then reported to credit bureaus to help establish a credit history.

This method provides a unique opportunity for individuals with no credit or poor credit history to build their credit score without risking new debt accumulation.

Grow Credit Pros & Cons

Grow Credit Pros

- No hard credit check inquiry to qualify

- Extremely easy to use: just update your payment method for your existing bills to the Grow Credit MasterCard and you're building credit

- Virtual card gets reported as a line of credit to the credit bureaus, which helps with credit mix

- Helps improve your positive payment history, a key factor in determining your credit score

- Reports to all major credit bureaus every month

Grow Credit Cons

- Missed payments (especially rent and utility payments) may have a negative impact on your credit score, just like with any other forms of credit

- Must link a checking account or debit card to qualify

- Secured cards might be a more cost-effective option in the long term for disciplined budgeters and spenders

Grow Membership Options

Grow Credit offers a variety of membership plans to cater to different credit-building needs.

Each plan has different spending limits, and these credit limits are determined by evaluating creditworthiness through bank account activity and qualifying direct deposits (rather than a hard credit check).

- Build (their free option, limited to 1 subscription)

- Grow ($5/mo with a $50/mo spending limit, intended for 2-3 subscriptions)

- Accelerate ($9.99/mo with a $150/mo spending limit)

For those that may be less qualified, they also offer secured plan options.

Included Features

- Reports to all 3 major credit bureaus

- Access to FICO scores

- Automatic payments

- Free financial literacy education

Comparing Apps Like Grow Credit

While Grow Credit offers a unique and effective way of building credit, it’s always important to understand your options. Some popular apps like Grow include Self, Kikoff, and Cushion.ai, each offering advantages and features tailored to different financial situations and objectives.

Grow vs Self

- Self's most popular product is a 24-month credit-builder loan

- While Grow doesn't charge interest and Self does, Self returns loan payments at the end of your credit builder program. This means when comparing costs between the two products, be sure to compare Grow's monthly subscription fees with Self's interest charges and fees.

- Both report to the three major credit bureaus

Read more in our full Self review

Grow vs Kikoff

- Kikoff establishes a $750 line of credit that can only be used in the Kikoff online store. The intent isn't to get access to cash, but rather to establish positive payment history

- Grow and Kikoff both offer a credit builder account that helps users build credit but minimizes the risk of a debt trap (as both options offer cash that can only be used in specific places)

- Grow's most popular plan and Kikoff's most popular plan are similar in terms of monthly cost at $5/mo and the credit limit that gets reported (Kikoff reports a $750 line of credit and the Grow plan reports $600 on an annual basis)

- As a bonus, Kikoff offers both rent reporting and a secured credit card (once you've shown progress with their Credit Account product)

- Grow has 5 stars with 7.8k reviews and Kikoff has 5 stars with 102k reviews

Read more in our full Kikoff review

Grow vs Cushion.ai

- Cushion.ai offers the most similar credit-building service like Grow Credit, which you can use to pay bills, subscriptions, and "buy now pay later" purchases like Affirm and Klarna

- Cushion.ai also helps you view and manage all your bills within a single app

- Transactions made through Cushion.ai are reported to Experian, which can help users build their credit history. (However, Grow reports to all three credit bureaus, which is a benefit)

- Cushion.ai could be the better choice for users who are looking to build positive payment history with their "buy now pay later" purchases, such as those made through Klarna and Affirm

Additional Options To Consider When Your Score Needs a Boost

There are also other options to consider when aiming to boost your credit score. Some of the major examples include secured credit cards, getting access to credit with a co-signer, being added as an authorized user, and credit builder loans.

A secured credit card, in particular, can be a valuable tool and stepping stone in this process. It helps you build credit but only allows you to spend with what cash you already have.

Also, remember that monitoring your credit reports for progress and errors is an important aspect of anyone's credit-build journey. Tools like CreditKarma and SmartCredit provide users with features like credit score tracking and credit report monitoring, which are crucial for personal credit management. As a bonus, apps like these (especially Credit Karma) can also help match you with credit cards and loans for your specific credit and financial profile.

While different from apps like Grow, these alternatives can offer significant benefits and should be considered based on your unique financial situation and credit-building goals. If used effectively, these options can make your credit reports look more attractive to financing and credit card companies.

The Bottom Line

Grow Credit is a credit-building tool designed for fair credit, low credit, and no credit users. It is unique for its simplicity and effectiveness. It allows you to boost your credit score simply by paying the recurring bills you'd be paying anyway.

Once you set up payments with a Grow Credit MasterCard, those payments automatically are made against a "line of credit" in the eyes of the major credit bureaus, which, over time, will help boost a responsible user's credit score.

However, other apps like Grow Credit, such as Self, Kikoff, and Cushion.ai, also offer varying credit-building benefits and should be considered based on your own needs and situation. Remember, the best credit-building strategy is the one that aligns with your financial habits and goals.

Frequently Asked Questions

How does Grow Credit help to build credit?

Grow Credit helps build credit by reporting users' payments for qualifying monthly subscriptions and bills made with the Grow Credit Mastercard to the major credit bureaus, thereby establishing a credit history.

What are some alternatives to Grow Credit?

Consider looking into Self, Kikoff, and Cushion.ai as alternative options to Grow Credit. Each option has unique features and benefits, so choosing based on your specific financial needs and goals is important.

What are some other options to consider for credit building?

You can consider secured credit cards, credit builder accounts, leveraging a co-signer, or becoming an authorized user on someone else's credit card to build your credit. These options can help you establish a positive credit history and improve your credit score.