Self Credit Builder is designed to help individuals with poor credit or fair credit scores to build credit by fostering responsible borrowing and saving habits with a no-credit-check loan and credit card.

For those with poor or fair credit looking to boost their score, anything they can do to prove they are making payments responsibly is going to work in their favor.

A number of factors determine someone's FICO score, but one of the most important is payment history. In fact, up to 35% of a FICO score is based on payment history alone – meaning that this factor can really help make or break your score.

The catch is that it can be hard for people with subpar scores to get credit, which makes it hard to prove they can make repayments responsibly.

Enter Self Credit Builder (formerly known as Self Lender). It is designed to support those with poor or fair credit scores through structured repayment plans in the form of a unique loan and credit card, without requiring a credit check.

This review offers an in-depth look into the workings of Self Credit Builder and its ability to improve both your credit health and overall financial position.

What is Self Credit Builder?

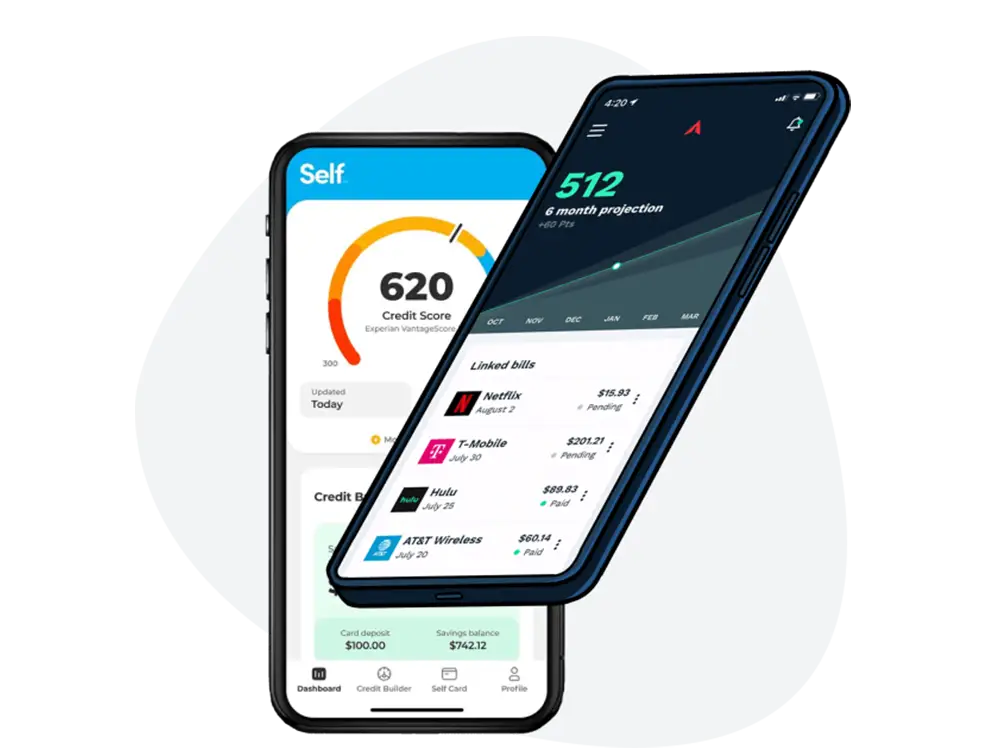

Self functions as a unique financial app with the purpose of helping individuals improve their credit scores and save money. Unlike traditional tools that solely focus on credit ratings, this program emphasizes responsible borrowing practices and building positive financial habits.

This service is designed for those with very low to moderate FICO® scores, specifically those under 670. To qualify for a Self Credit Builder loan, applicants must:

- Be at least 18 years old

- Have an active bank account in good standing

- Provide their Social Security Number

What makes this service even more appealing is that no credit check is required during the application process, making it accessible to people from various backgrounds regardless of their current credit situation.

How Self Works

The company offers two products to choose from: the Credit Builder Loan, and the Self Visa® Credit Card.

How the Self Credit Builder Loan Works

Users who choose Self's Credit Builder Loan:

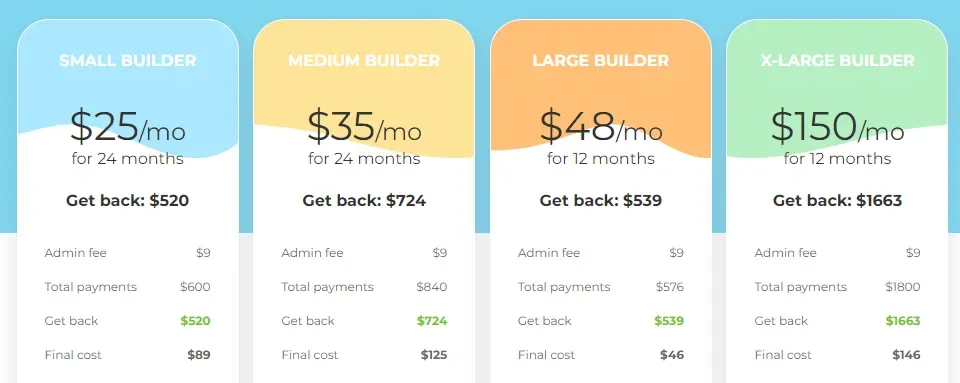

- Pay a one-time, nonrefundable fee of $9

- Choose a loan amount between $600 and $1,800, and choose from a variety of monthly payment plans starting at $25 over a 24-month term

- Make monthly payments, which are held in a certificate of deposit (CD) account until the end of the repayment term

- At the end of the term, the money (less fees and interest) is returned to you. At this point, funds can be used for future investments or larger purchases.

This design serves as a type of forced saving method, ensuring that you regularly set aside funds while focusing on building better credit.

How the Self Visa® Credit Card Works

The Self Credit Card is a secured Visa credit card. This means that you put money into a Self Credit Builder Account, and the amount in that account determines what your credit card spending limit is. To get started:

- Make at least three on-time payments to the credit builder account, totaling a minimum of $100

- Order the Self Visa Secured Credit Card, issued by either Lead Bank or SouthState Bank, N.A., which is mailed to your home address

- Use your credit card anywhere Visa is accepted, and pay your credit card bill on time each month

- You can increase the available credit limit over time with responsible use and by adding more cash to your credit builder account

Please note that there is a $25 annual fee associated with this product and a variable APR. It’s important to use the card responsibly in order to maximize its benefits for improving your FICO score.

Self Credit Pros & Cons

Pros

- Enables users to build a positive payment history that is reported to the credit bureaus, boosting a user's score with responsible repayment activity over time.

- Offers two products to help users build payment history: the Self Visa® Credit Card, and the Self Credit Builder Loan. These are secured loans/cards, so no credit check is required.

- As a bonus, Self will also report your rent history to the three bureaus, providing further information to prove a positive payment history.

Cons

- Fees: there is a one-time $9 non-refundable administration fee, a $25 annual fee for the secured credit card, high APRs, and additional late payment fees.

- There can also be a possible negative credit history reported to credit bureaus if payments are over 30 days late.

- Some customer reviews note that customer service was not helpful in resolving their questions about fees or closing an account.

Extra Benefit of Using Self: Rent and Bill History Reporting

Self is designed to be convenient and rewarding, offering a range of benefits to assist with your credit-building goals. With the flexibility to manage your account through both online and mobile platforms, keeping track of your progress has never been easier.

But beyond its user-friendly features and products, the company also provides a bonus of reporting your rent and recurring bills history to the credit bureaus, in addition to payments you are making towards your Self Credit Card or loan.

In order to take advantage of this feature, which can build more positive history with the three major credit bureaus, a user must:

- Securely connect a valid bank account they make rent/bill payments from to the Self platform

- Indicate which rent/recurring bill payments they want Self to report to the credit bureaus

That's all it takes: Self will start reporting those histories as a service to their customers -- for free.

Building Credit With Self

Building a positive payment history is crucial for establishing good credit. Self ensures that all three major credit bureaus (Experian, TransUnion, and Equifax) receive reports of your timely payments. While this does not remove negative credit history, it can improve your score overall.

One question you may have is, "How much will Self raise your credit score?" While it has been reported that users see an average increase of 32 points in their credit scores, the answer is that it depends on a variety of elements, such as:

- A person's credit profile/history

- How consistent someone is with payments

- How long someone uses the product

The bottom line is that using the products responsibly over time is extremely likely to raise your score, but exactly by how much is unique to each person.

Potential Drawbacks of Self Credit Builder

It is essential to carefully consider the potential drawbacks of using Self, despite its numerous benefits.

These downsides include an irreversible administrative fee of $9 and a yearly fee of $25 for the credit card. Closing your account before the agreed term may result in a maximum penalty charge of $5.

It’s crucial to note that failing to make payments on Self's credit builder loan will lead to fees up to 5% of your scheduled monthly payment amount.

Delinquent payment reporting can also be reported by Self for accounts that are more than 30 days overdue.

Fees and interest rates

In order to activate a credit-builder account with Self, there is an upfront administration fee of $9 that must be paid but cannot be refunded. The APR for loans through the self-credit program ranges from 15.72% to 15.97%.

For late payments on monthly minimum payments, Self charges a flat rate of 5%. This penalty applies to all missed or overdue scheduled monthly payments received after their due date. A late fee will also apply if any payment goes beyond the grace period: either $5 for outstanding balances less than or equal to $25, or $15 for those above this amount.

Impact of missed payments

Failing to make payments on a loan or credit card can significantly impact your credit history in a negative way. These missed or late payments are reported to major credit bureaus and can result in a decrease of overall scores on your credit reports, including your Transunion credit report.

Typically these delinquent payments are not reported until they have been overdue for 30 days or more, giving borrowers some time to catch up on their payments before any negative information is recorded by the reporting agencies.

Comparing Self Credit Builder to Alternatives

When considering the best option for building credit, it’s important to compare Self with other available financial tools such as secured credit cards and traditional credit builder loans.

Understanding how these alternatives may differ or align with Self can help you determine which solution is most suitable for your specific needs.

Self offers a unique approach to helping individuals establish or improve their credit through its program that combines savings and installment payments whereas a secured credit card requires users to make a deposit upfront.

Self Credit Builder vs. a secured credit card

Self is a unique option for those looking to build credit, as it combines the features of an installment loan and a traditional credit card. This means that using Self will help improve your credit score by reporting to all three bureaus.

Secured cards such as Discover it Secured operate like regular credit cards but require a cash deposit – similar to the Self card. However, unlike the annual fee associated with Self ($25), Discover it Secured does not charge any annual fees for its services.

Discover it Secured offers cardholders the chance to convert their account into an unsecured card and get back their initial deposit after making timely payments for seven months – this opportunity is not available with Self Credit Builder.

Self Credit Builder vs. other credit-builder loans

Self offers some unique features to other credit-builder loans. One advantage is its availability in all 50 states -- whereas not all credit-builder loan programs may not operate nationwide and may not be available in your state.

It should be noted that other providers on the market may offer more competitive rates, fees and APRs than Self. As is always the case, it is important to compare different products to make sure you are getting the best products and benefits for the best price.

To learn more about alternatives, read our full review on apps like Self.

3 Tips for Using Self Credit Builder Effectively

With a better understanding of how Self works, let’s discuss some effective strategies for using this tool. These tips include choosing the appropriate payment plan, keeping track of progress, and utilizing a secured card responsibly to improve your credit score.

The company offers an easy-to-use dashboard as well as regular email reminders, app notifications, and educational materials to assist users in achieving their financial goals.

By taking advantage of these resources and managing the use of a secured credit card wisely through Self, you can see significant growth in your credit over time.

1) Choosing the right payment plan

It is crucial to choose a plan that fits within your budget in order to make timely payments and keep a positive account status. It is important to select a payment schedule with affordable monthly amounts so as not to default on payments, thus ensuring your account remains in good standing.

Self provides helpful tools such as automatic payments which can assist individuals in avoiding late or missed payments and maintaining an impressive track record of paying on time.

2) Monitoring progress

It is important to regularly monitor your credit score in order to effectively track any improvements. For those using the Self Credit Builder account, this can easily be done through the Self platform.

Through the use of free credit monitoring on their platform, borrowers are able to view their VantageScore from Experian.

3) Utilizing the secured credit card responsibly

A vital element of Self Credit Builder is the inclusion of a secured Visa credit card, specifically the Self Visa Secured Credit Card. To be eligible for this card, individuals must first apply and get approved for a Credit Builder Account. Once accepted, it is important to make at least three timely monthly payments.

Using this secure credit card responsibly can significantly improve one’s credit score. It serves as a practical tool that can accelerate your path towards financial stability and building good standing with creditors.

The Bottom Line

Self Credit Builder (which used to be called Self Lender) is a one-of-a-kind financial tool designed to aid in building credit and promoting responsible money management. It offers a comprehensive approach through its loan and secured card options.

Although it has some drawbacks like fees and the possibility of negative effects from missed payments, these are outweighed by the benefits for those who use it wisely with careful planning.

The key to maximizing the potential of Self Credit Builder lies in selecting an appropriate payment plan, regularly monitoring progress, and utilizing the secured card responsibly.

Frequently Asked Questions

Is Self a good way to build credit?

It can be a useful method for establishing credit since it reports payment activity to the three major credit bureaus. By gradually improving credit, individuals will have better chances of obtaining future lines of credit and more favorable loan rates.

What are the downsides of Self Credit Builder?

Drawbacks that should be considered before signing up include various fees (such as APRs, annual fees, and one-time fees), and the potential for negative reporting to the credit bureaus if you are delinquent in your payments. Always make sure to review the terms and conditions to understand the costs and potential impacts on your credit score before signing up.

How fast does Self build credit?

It generally takes at least six months to build your credit score from scratch, but some customers have reached a credit score in the mid 600s in just over 6 months using Self. Your repayment activity should generate a FICO score after about six months, and your VantageScore can be generated sooner.

Do you get all your money back from Self Credit Builder?

Once your credit builder loan is fully paid off, Self will refund the amount you deposited. This sum will be reduced by any fees and interest that were incurred during the repayment period.

Essentially, after completing payments for your credit builder program with Self, you can expect to receive back the money you put in initially minus any additional charges or fees applied throughout its duration.

Who is Self Credit Builder for?

It is specifically designed for individuals who have a low credit standing, particularly those with FICO® scores below 670. Its main goal is to assist in the gradual improvement of their credit.

This program targets individuals with poor or fair credit ratings and aims to help them gradually build up their self-credit over time.

How much will Self raise your credit score?

While it has been reported that Self users see an average increase of 32 points in their credit scores, the answer is that it depends on a variety of elements, such as credit profile/history and how consistent someone is with payments.

The bottom line is that using Self responsibly over time is extremely likely to raise your credit score, but exactly by how much is unique to each person.