CreditStrong's credit builder loans are designed specifically to enhance a user's credit utilization rate and payment history. Although it may not be the cheapest option, users report a positive impact on their credit scores.

There's a specific reason why building or rebuilding a credit score can be an uphill battle: credit scores increase when you demonstrate positive behaviors with credit, but accessing credit can be really hard if you don't already have a high enough credit score. It's a vicious cycle.

The good news is that a number of credit-building products are designed specifically to help people with thin or poor credit build up a positive history with the credit bureaus, the most important step in achieving a higher credit score.

Among these products, CreditStrong emerges as a strong option thanks to its diverse plans to fit various financial situations, and a proven track record in increasing their customers' credit scores. This article explores how CreditStrong works, the kinds of plans and products it offers, its pros, cons, and alternatives to consider as well. Take a look to see if CreditStrong is the right tool for your credit-building journey.

Pros & Cons

Pros

- Reports both installment loans and revolving loans to the three major credit bureaus, specifically designed to improve a user's credit score

- Reports both installment loans and revolving loans to the three major credit bureaus, specifically designed to improve a user's credit score

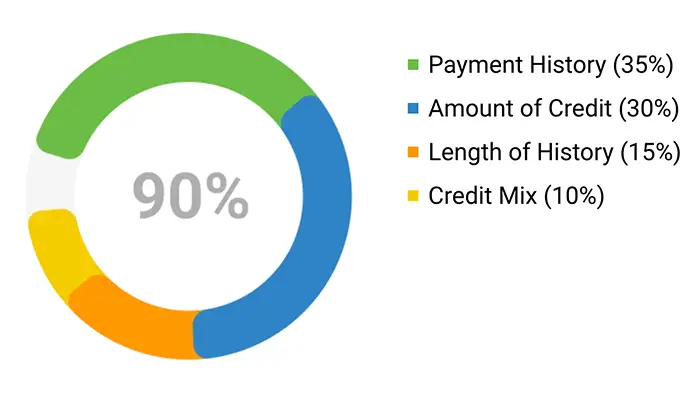

- Positively impacts factors that determine 90% of a user's FICO score, including payment history, amount of credit, length of history, and credit mix

- Increases the average customer's credit score by nearly 70 points after 12 months of use

- Reputable and secure company, owned by FDIC-insured Austin Capital Bank, with a strong track record and over one million customers since 2019

- Also provides small business credit-building loans and traditional loan solutions

Cons

- Lacks a secured credit card option, unlike other similar credit-building companies

- Pays low interest on funds locked in credit building savings accounts

- Fees, though potentially worthwhile depending on positive credit score impact, are higher than some alternatives

What is CreditStrong?

CreditStrong was founded by Austin Capital Bank in 2019 and has been dedicated to providing responsible financial services innovation, particularly assisting individuals with building credit. What sets CreditStrong apart from other platforms is its unique range of credit-building revolving and installment loans. These are designed to boost a user's credit score by positively impacting their payment history, amount of credit, length of history, and credit mix.

What is a credit builder account?

The first step to understanding CreditStrong is to understand how a credit builder account works in general. A credit builder account, also known as a credit builder installment loan, is specifically designed to assist individuals in establishing a positive credit history. Unlike traditional loans, this type of account has distinct features that set it apart:

- A user takes out a "loan," but instead of receiving funds as they would with a traditional loan, the loan funds are instantly deposited into a locked savings account until the end of the repayment term

- Each month, the user makes a single payment toward principal and interest on the loan. As they do, their positive financial behavior is reported to the credit bureaus -- boosting FICO scores

- Once the loan is paid in full, the payments the user has made are returned (less interest), making the credit builder account a unique credit-building + savings product

How does CreditStrong work?

CreditStrong works by providing individuals with credit-building accounts and reporting their payment history to all three major credit bureaus: Equifax, Experian, and TransUnion. Specifically, they offer:

- With credit-building installment loans, individuals can establish a positive payment history and demonstrate their creditworthiness through timely payments

- With credit-building revolving loans, individuals can establish low credit utilization

- For small businesses, CreditStrong provides 0% interest credit-building loans, as well as a marketplace to connect small businesses to lenders offering traditional loans

It is worth noting that customers can have up to two CreditStrong accounts at the same time, boosting the impact on both their credit utilization and payment history.

CreditStrong Plans

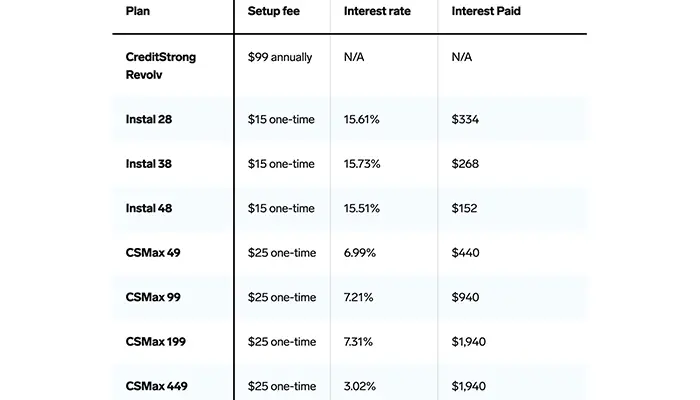

At CreditStrong, there are three core plans that cater to personal finance needs: Revolv (an affordable way to build credit and lower utilization), Instal (which functions more like traditional installment credit builder loans), and CS Max (similar to Instal, but with larger loan amounts).

For small business customers, CreditStrong offers both credit building accounts using a business' EIN, as well as a traditional loan marketplace that matches businesses to lenders based on a ten question application.

(CreditStrong also links to FreeKick, a company that provides credit-building products especially for teens and whole-family identity protection and credit monitoring. Because this is a separate company from CreditStrong, this product is excluded from this review.)

Revolv Accounts: Best for Boosting Credit Utilization

Revolv accounts report a credit line to the credit bureau with a starting limit of $1,000 – which can increase up to $3,000 over time.

This account helps boost credit scores by instantly lowering a user's credit utilization rate, because in the eyes of the credit bureaus it increases the total amount of available credit that the user has access to, but isn't using.

The way it works is simple:

- Open a Revolv Account

- Pay a one-time fee of $99, plus $8.95 per month to keep the account open

- CreditStrong reports that you have a revolving line of credit being used at 2% to 9% of the total amount, the optimal range for credit score boosting

- Over time, the Revolv account loan size may increase, further enhancing a low credit utilization rate and increasing your credit score

Amount of credit, or credit utilization, accounts for 30% of a FICO score, so this revolving credit option can have a big impact.

Instal Accounts: Best for Building Positive Payment History While Saving

An Instal loan is similar to traditional credit-building accounts. With this option, users select a loan size and make fixed monthly payments, which includes a principal and interest payment. Instead of having access to the loan funds as they would with a traditional loan, payments instead go into a locked savings account.

As users make monthly payments, that positive payment history is reported to the three major credit bureaus. (Because payment history is the most important factor in determining a FICO score -- it accounts for 35% of the score -- an Instal loan can have a significant impact on a user's credit.)

At the end of repayment term, the savings account that payments have gone into gets unlocked and users can access the money. That's how an Instal loan serves as both a credit building product and a savings product at the same time.

After paying a one-time fee of $15, customers can choose from one of three Instal loan with CreditStrong:

- Instal 28: $1,010 installment account reported to the credit bureaus over 48 months. Get back $1,010 less interest at the end of the repayment term. Payment is $28 per month, with an interest rate of approximately 15.6%

- Instal 38: $1,100 installment account reported to the credit bureaus over 36 months. Get back $1,100 less interest at the end of the repayment term. Payment is $38 per month, with an interest rate of approximately 15.7%

- Instal 48: $1,000 installment account reported to the credit bureaus over 24 months. Get back $1,000 less interest at the end of the repayment term. Payment is $48 per month, with an interest rate of approximately 15.5%

CreditStrong reports that the average account holder increased their FICO score by more than 25 points within three months. However, remember that a positive impact on credit score is dependent on regular and on-time payments, so it is important to make sure your budget allows for these credit-building products before starting.

CS Max: Best for Those With Higher Disposable Incomes

CS Max is essentially the same product as an Instal loan, except the loan amounts are supersized up to $25,000. These accounts are designed for people who have higher disposable incomes, but have either thin credit profiles or looking to increase their personal credit scores for business purposes. After paying a one-time fee of $25, customers choose from one of four CS Max loan options:

- CS Max 49: $2,500 installment account reported to the credit bureaus over 60 months, with funds less interest returned at the end of the payment term. Payment is $49 per month, with an interest rate of approximately 7%

- CS Max 99: $5,000 installment account reported to the credit bureaus over 60 months, with funds less interest returned at the end of the payment term. Payment is $99 per month, with an interest rate of approximately 7.2%

- CS Max 199: $10,000 installment account reported to the credit bureaus over 60 months, with funds less interest returned at the end of the payment term. Payment is $199 per month, with an interest rate of approximately 7.3%

- CS Max 449: $25,000 installment account reported to the credit bureaus over 60 months, with funds less interest returned at the end of the payment term. Payment is $449 per month, with an interest rate of approximately 3%

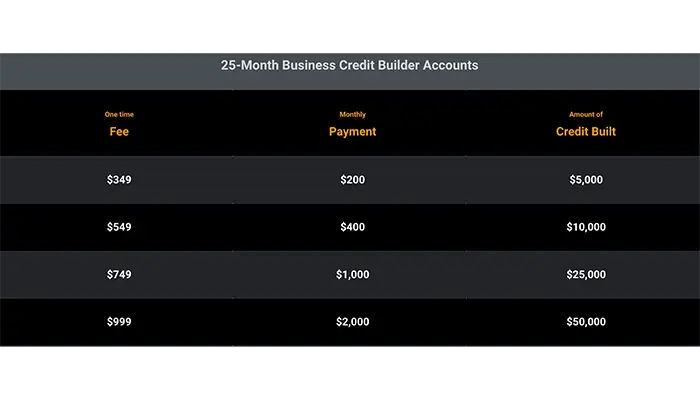

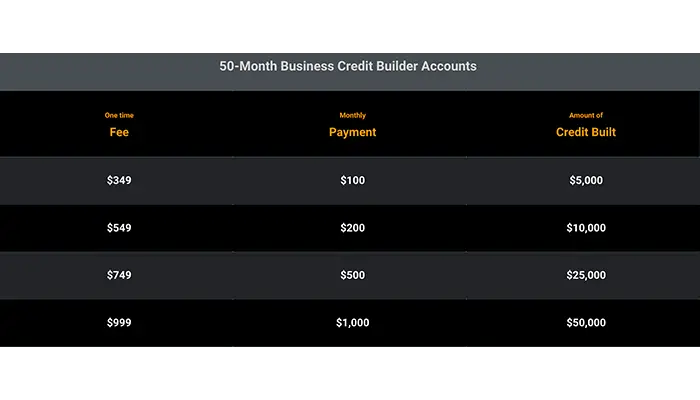

CS Business: The Only 0% Interest Business Credit-Builder Loan

Small businesses need a FICO SBSS credit score of at least 155, but more likely 160 to 180+, in order to qualify for the most favorable rates and types of business loans, including an SBA loan. CreditStrong describes itself as the only bank in the nation that offers a 0% interest small business credit-building loan, up to $50,000, to help boost a business credit score. Here's how it works:

- Small business owners pay a one-time fee and open the Business account using their EIN (Employer Identification Number). The account reports to the credit bureaus as an installment loan, but all payments go into a locked savings account

- The business owner makes a monthly payment for a repayment term of either 25 or 50 months

- At the end of the term, 100% of the funds in the loan account are unlocked and returned to the business owner

- Due to the larger loan size reported and longer repayment period, positive payment history boosts the business' FICO SBSS credit score

Note that the one-time fee amount depends on the loan size and repayment period selected. Review these charts to understand the fee structure for the CS Business loan:

How To Get Started With CreditStrong

Getting started on your credit-building journey with CreditStrong is a straightforward and user-friendly process. To begin, simply access the company’s website and complete an application for an account. Familiarize yourself with the pricing options available to determine which plan best suits your credit building goals.

How To Apply

Registering for CreditStrong is a quick and streamlined process that can be completed in under five minutes. The necessary details include basic personal information, including full name, email address, identification such as a driver license, and your SSN.

Note that CreditStrong does not conduct a hard credit pull as part of the application process. It only requires basic information and a valid bank account or debit card to set up monthly payments.

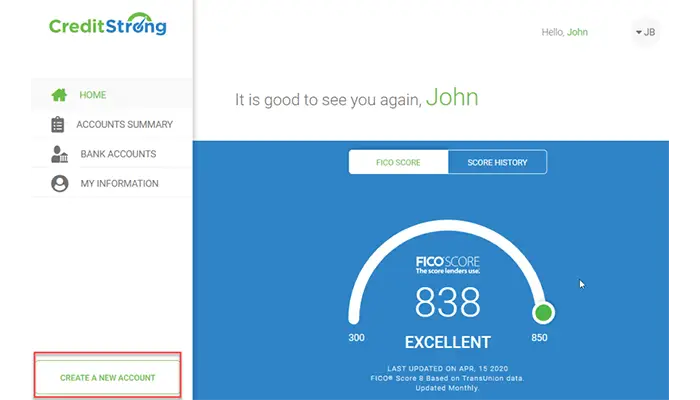

Once a customer has opened an account, the CreditStrong login page is easy to locate on their website and allows users to access a simple account management page. Here, you can check your credit score using free credit monitoring; set up or manage payment plans; and check on the status of your account.

CreditStrong's Customer Service

Customer reviews suggest that CreditStrong has a customer service team that is both responsive, and effective at answering questions or helping resolve issues.

The service team is available through two primary channels: by phone, and by live chat on the CreditStrong website.

- Phone: 1-833-850-0850 (available 8AM-5PM, Central Time, Mon-Fri)

- Live online chat is available 8AM-5PM, Central Time, Mon-Fri)

Making the Most of a CreditStrong Account

Using CreditStrong is first and foremost about boosting your credit score, but there are a number of benefits that come with an account:

- Positively impact factors that account for 90% of your FICO score, including Payment History, Amount of Credit, Length of History, and Credit Mix

- Effectively raise your credit score in as little as three months

- Increase loan readiness by exhibiting responsible use of credit

- Enhance overall financial stability through positive establishment of a strong credit background

- With Instal, CS Max, and CS Business loans, save at the same time you are making credit-enhancing monthly payments

It is important to remember, however, that CreditStrong's impact on your credit score will only be as positive as your financial behavior. It is critical that payments are made regularly and on time, every month.

If payments slip, negative reporting may appear on your credit profile and your credit score may decrease as a result. Some helpful tips to consider before using this (or any) credit-building product includes:

- Use CreditStrong as part of a broader credit-building strategy. Make sure to have a mix of other credit types and open accounts, keep your credit utilization rate down, and make sure to keep on top of all payments

- Be clear about your goals for building credit, which can help you stay on track

- Identify an affordable monthly payment amount. Never take on more than you can comfortably repay each month, otherwise a credit-building account may end up hurting more than it helps

Customer Experiences with CreditStrong

An assessment of customer reviews across sites like Trustpilot and Better Business Bureau reveals a mix of positive and negative sentiment. Positive reviews noted that the service significantly boosted credit scores, was easy to use, and that customer service was responsive to questions and concerns.

Negative reviews noted that the total cost of the service (in terms of interest rates) was more expensive than anticipated when it came time to collect the money saved in an Instal account. These comments suggest customer confusion prior to signing up, and is a good reminder that you should be completely clear on fees, interest rates, and total costs of the product before starting.

Alternatives to CreditStrong

While CreditStrong offers a comprehensive platform for improving credit, it is important to compare this platform with other options, to confirm which best aligns to your specific needs. There are several other credit builder loan companies worth considering as part of your research on CreditStrong.

In addition, some people may also need help clearing up negative marks on their credit report, which can significantly boost a credit score. For these cases, credit repair services are a good choice and we list a few to consider as well.

Credit Builder Loan Alternatives

Aside from CreditStrong, there are other reputable credit builder loan providers to consider, including Cheese Credit, Self, and Kikoff. It is important to carefully review the features and requirements of options like these before making a decision.

Cheese Credit Builder: A credit-builder loan similar to CreditStrong's Instal loan. Users can open an account for either $500, $1,000, or $2,000 and make monthly payments as low as $24 per month. Payments are reported to all three credit bureaus. At the end of either a 12 or 24 month term, the saved cash is returned to the user

Self Credit Builder: Offers a credit builder loan, similar to CreditStrong's Instal loan, as well as a secured Visa credit card (a product that CreditStrong does not currently offer). The loan has a one-time fee of $9, and users can choose a loan amount between $600 and $1,800 with a repayment term of 24 months. The secured card product has a $25 annual fee and the credit limit is based on how much a user puts into a Self account.

Kikoff: Provides a $750 line of credit whose funds can be accessed by the user (unlike most other credit builder loan products). However, funds can only be used in the Kikoff store, which sells financial educational materials. Keeping the utilization rate low and making monthly payments will increase your credit score. There is a $5 monthly fee, plus payments due if you have used the line of credit in the Kikoff store.

These alternatives offer various terms and conditions for their respective credit builder loans that should be thoroughly understood in order to make an informed choice.

Credit Repair Services

Typically, credit repair companies help individuals in eliminating inaccurate or unproven information from their credit reports. They also provide guidance and assistance with disputing errors on the report.

Although these services can potentially boost one’s credit score by addressing negative items and working towards improving it, some are dishonest or outright scams. It is important to only consider proven companies -- and Loanfolk has previously reviewed a couple trustworthy and effective credit repair services, including:

Credit Versio: This app automatically imports a user's three credit bureau reports, and AI identifies which accounts are negatively impacting credit scores incorrectly or unverifiably. Versio then generates customized professional letters (which are more effective than online disputes) for the user to send to the creditors who are negatively impacting their credit report

Lexington Law: Founded in 2004, Lexington Law is a firm dedicated exclusively to credit repair. After a free review of a user's credit reports, they help identify items which may be appearing unfairly or incorrectly. Leveraging their expertise in consumer protection regulations, Lexington contacts creditors requesting they either validate negative items, or remove them promptly

The Bottom Line

CreditStrong stands out among other credit builder loan products because it reports both installment loans and revolving loans to the three credit bureaus. Their array of repayment terms, loan sizes, and small business options makes it suitable for a wide range of needs and circumstances. Although fees may be higher than some alternatives, its effectiveness at boosting credit scores makes it a company worth considering.

Frequently Asked Questions

Is CreditStrong legit?

CreditStrong is a legitimate business that has been operating since 2019 and is owned by Austin Capital Bank, an FDIC insured institution. This company has been verified by trusted sources such as the Better Business Bureau, showing their credibility and trustworthiness to customers.

What type of loan is CreditStrong?

CreditStrong offers two kinds of credit building loans: a revolving loan and an installment loan. Although users cannot access cash from these loans until the end of the repayment term, they are reported to the credit bureaus as traditional loans, helping customers improve their credit scores by building positive credit utilization and payment history.

How fast does CreditStrong work?

It usually takes about 30-60 days for CreditStrong to show up on your credit report after you make your first payment. This is because the three main credit bureaus require some time to process and update their records with this new information.

Does CreditStrong help your credit score?

Although the impact of CreditStrong will depend on your unique credit profile and financial behavior, CreditStrong notes that, on average, customers see an increase of more than 25 points within 3 months of opening their account. Credit Strong account holders that make all their payments on time for 12 months more than double that score increase to almost 70 points after 12 months.

How does a credit builder account work?

CreditStrong reports either an open revolving line of credit or an installment loan to the credit bureaus, helping to increase credit scores by demonstrating low credit utilization rates and positive payment history. However, these are not traditional loans: customers cannot access the cash until after the repayment term is completed because it is locked in a savings account. At the end of the term, the cash is returned to the customer, less interest fees.

What are the advantages of choosing CreditStrong?

CreditStrong reports a unique mix of both revolving and installment loan accounts to all three credit bureaus. This mix can help customers enhance both their credit utilization and payment histories, two of the largest factors that determine a FICO score.

With its notable benefits, CreditStrong serves as a valuable option for those aiming to improve their credit standing.