It may be invisible most of the time, but nothing will have a greater impact on your financial life than one little number that ranges from 300 to 850. This number makes or breaks your ability to get a credit card, a loan, a mortgage, an apartment, a car, and even a job.

We are, of course, talking about your FICO score. The higher the score, the easier it will be for you to access the best financial products at the best rates. That's why it's critical that everyone know their credit score, regularly monitor it, and take all the steps necessary to get it as high as possible.

The good news is that today, more apps than ever are designed to help you do just that. In this article, we review the 10 best credit-building apps of 2024.

1) Self Credit Builder

🏆 Best For: Building Your Credit History with a Credit Builder Loan

Key Features:

- Self provides individuals with poor credit or fair credit scores with a unique credit builder loan and Visa secured credit card. (No credit check required to qualify)

- Regularly reports to the three credit bureaus, helping to to establish a positive payment history for those who use the app responsibly

- Also helps users develop healthy financial behavior in terms of saving money and using credit responsibly, because the payments a user makes toward the credit builder loan are returned to them at the end of the payment term

- Users report seeing an average increase of 32 points to their credit score after using Self products (although this number could be higher or lower for you, depending on your specific credit profile and financial behavior)

- As a bonus, Self can boost a user's payment history even more by reporting the their rental payment history to the credit bureaus. This service is free and entirely optional

Pros

- Credit Builder Loan also acts as a savings plan – get your money back at the end of the payment term (less interest)

- Offers rent & bill reporting

- Self Visa card available as another tool to build credit

Cons

- Credit monitoring isn't their core offering, so it's best used alongside an app like Credit Karma

2) Sesame Cash by Credit Sesame

🏆 Best For: Accessing Your Direct Deposit Paycheck 2 Days Early as You Build Credit

Key Features:

- Sesame Cash offers a prepaid debit card with a range of unique features. This includes receiving direct deposit payments two days early, and the ability to build credit through purchases made on the card

- Instant approval, with no hard credit pull or upfront security deposit required

- Provides free credit monitoring, with a unique "Sesame Grade" feature that breaks out the different inputs of a user's FICO score and provides specific tips to improve in each area

- Uses AI to provide customized recommendations to improve credit scores

- Also offers a range of loans, credit cards, and digital banking products designed for a range of credit scores: customers "graduate" to different products as their credit score increases

Pros

- Instant approval

- No security deposit required

- No interest charges

Cons

- Credit line only equals your checking account cash balance

- $9.99 monthly fee replaces interest charges

3) Grow Credit

🏆 Best For: Using Your Monthly Subscriptions to Build Credit

Key Features:

- Grow Credit offers a unique unsecured debit card product that is used to pay off only subscription-based bills (such as Netflix, Spotify, Doordash, and Hulu)

- Users pay off their Grow card in full each month, and payment history is reported to all three credit bureaus

- Provides a range of plans depending on how many subscriptions a user wishes to pay using Grow Credit. Plans range from Free for a 1-subscription plan, to $9.99 per month for unlimited subscription payments

- Determines a user's eligibility by assessing the last 60-90 days of their banking activity -- not their FICO score. There is no hard credit pull to qualify

- Users report an average credit score increase of 44 points after eight months of use

Pros

- A range of pricing options to suit different needs and budgets

- Ease of use: takes only minutes to sign up and update your subscription payment method to Grow Credit

Cons

- Requires linking a bank account before Grow Credit reveals what subscription plan and monthly cost a user qualifies for

Read our full review of Grow Credit

4) Boom Pay

🏆 Best For: Using Your Monthly Rent Payment to Build Credit

Key Features:

- Boom Pay reports a user's rental payments to the credit bureaus, providing a major datapoint to show positive payment history

- To get started, users connect the bank account they pay their rent from to Boom Pay and verify their identity. The process typically takes just a few minutes

- The fee is only $3 per month, billed annually at $36. (Users can also request that Boom Pay report their past rental history for a one-time $25 fee)

- Unlike other rental reporting services, Boom Pay reports only positive payment history, preserving a user's credit score if they have a slip-up

- As a bonus, offers free access to credit score monitoring

Pros

- Reports only positive rental payment history

- Simple and affordable pricing plans allow for both go-forward reporting and historical reporting

Cons

- Boom Pay focuses only on rent reporting, with few other features or benefits

5) Dovly

🏆 Best For: Using AI to Monitor & Fix Your Credit With One App

Key Features:

- Dovly offers a complete range of services, from credit score and report monitoring, to disputing derogatory marks on credit reports as they pop up

- Every month, Dovly's AI analyzes and prioritizes inaccurate or negative items on a user's credit report based on their impact -- then works on behalf of their users to dispute them directly with the credit bureaus

- Provides best-in-class financial education resources, so users can grow their knowledge alongside their credit scores

- Offers a free version with limited services, and a Premium version for $39.99 per month.

- Users of Dovly Premium report an average credit score increase of 79 points

Pros

- Uses advanced technology to automatically scan for errors

- Manages dispute resolution process on behalf of their users

Cons

- Limited plan options (either Free or $39/month)

6) Kikoff

🏆 Best For: Lowering Your Credit Utilization With a Credit Line

Key Features:

- Kikoff offers a $750 revolving credit line with no hard credit pull, hidden fees or interest (only a $5 monthly charge)

- By using only a small fraction of the $750 credit line and making regular monthly payments, users will show a strong payment history and low credit utilization rate – two major factors that drive up FICO scores

- Reports to two of the three credit bureaus, Equifax and Experian

- As a bonus, allows users to monitor their credit score with free access to VantageScore

Pros

- No hard credit check

- Only $5/mo and easy cancellation

- Up to $750 credit limit for use within the Kikoff store

Cons

- Does not report to TransUnion – only Equifax and Experian

Read our full review of Kikoff

7) Cheese Credit Builder

🏆 Great For: Saving Cash While Building Credit

Key Features:

- Cheese provides a credit builder loan that is a great alternative to a secured credit card

- Here's how it Works:

- Open a savings account and select a target amount of money to save (either $500, $1,000, or $2000)

- Begin making monthly payments (as low as $24 per month). These payments are reported to the credit bureaus

- At the end of the term -- either 12 or 24 months -- the saved cash (less interest) is returned to the user

- No hard credit pulls or fees, only a fixed and low APR

- Cheese reports to all three credit bureaus

- Also offers free credit monitoring through the app

Pros

- Credit builder loan also serves as a savings plan

- Loan amount and payment duration is customizable

Cons

- Financial penalty for early termination

8) Credit Versio

🏆 Best For: DIY Credit Repair

Key Features

- The Credit Versio app automatically imports a user's three credit bureau reports, and AI identifies which accounts are negatively impacting credit scores incorrectly or unverifiably

- Versio then generates customized professional letters (which are more effective than online disputes) for the user to send to the creditors who are negatively impacting their credit report

- Users can dispute an unlimited number of accounts with the app

- Monthly credit report monitoring, included with the service, allows users to track their progress as they clean up their report

- While the credit dispute feature is free, users are required to sign up for a credit monitoring and identity protection package, which costs either $19.95 or $29.95 per month

Pros

- Free when subscribed to SmartCredit's 3-bureau monitoring

- Works similar to credit repair firms like Lexington Law, but as a do-it-yourself option

- Pro 1

- Pro 2

Cons

- Requires a more significant time commitment than other options

9) Lexington Law

🏆 Best For: Enlisting the Credit Repair Experts to Help You

Key Features:

- Founded in 2004, Lexington Law is a firm dedicated exclusively to credit repair

- The process begins with a free comprehensive review of a user's credit reports. Lexington Law helps identify items which may be appearing unfairly or incorrectly

- Leveraging their expertise in consumer protection regulations, Lexington contacts creditors requesting they either validate negative items, or remove them promptly

- Lexington Law offers a few different packages depending on the level of credit repair a user needs. These range from about $100 to $200 per month, with the most popular package costing $150 per month

- Overall, the firm removes about 4 million negative marks from their clients' credit reports each year, suggesting an effective partner for credit reporting cleanup

Pros

- Free credit assessment

- "White glove service" means that customers should have less to do

Cons

- Hefty monthly pricing makes it an expensive option

- Although generally positive, user reviews are mixed

10) Credit Karma

🏆 Best For: Monitoring Your Credit Score & Credit Report – Free

Key Features:

- Credit Karma provides real-time updates on credit scores and credit reports – check as often as you like, 100% free

- Fetches credit scores and reports directly from TransUnion and Equifax for greater accuracy than other apps

- Considered to be one of the safest and secure credit apps, with over 130 million customers and a strong track record since 2007

- Offers personalized tips and insights on what is affecting your credit score and how you can work to improve it, including credit utilization and payment history

- As part of Intuit, also offers a wide range of other financial products, including high yield savings accounts and credit builder loans to help build boost a user's financial profile

Pros

- Wildly popular and respected credit monitoring app

- Great credit monitoring service to pair with a credit building app

- Personalized recommendations for credit cards and other financial products based on your profile

Cons

- Great for staying on top of your score, but the app is limited when it comes to influencing your score directly

How Credit Building Apps Can Help

Increasing a credit score isn't a one-step process. It's an ongoing project that requires:

- An accurate view of what your credit score actually is – and the ability to regularly check it for free

- Identifying any potential errors in your credit report and notifying the credit bureaus to get them fixed

- Ensuring that derogatory marks on your credit report (such as late payments or defaults) get removed accurately

- Building strong payment history, which shows financial responsibility and making payments on time. (It is the single most important factor that determines your credit score)

- Developing good financial habits around spending and saving, to keep your debt-to-income ratio and credit utilization rate down

The world of credit-building apps offer a variety of ways to boost your efforts on all of the requirements above.

Four Important Features of Credit Builder Apps

When comparing credit-building apps, be sure to look for a few key features that the best ones will have covered:

- Boosting the highest-impact areas of your credit profile (Payment History and Amounts Owed, otherwise known as credit utilization)

- Reporting to at least two (but ideally all three) of the major credit bureaus

- Offering low-cost options for credit building

- Avoiding hard credit inquiries that can lower your credit score

1) Boosting the Highest-Impact Areas of Your Credit Profile

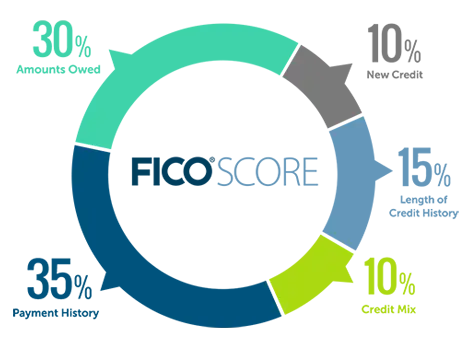

Your FICO score is comprised of five inputs: Payment History, Amounts Owed (Credit Utilization), Length of Credit History, Credit Mix, and New Credit. Any credit building app should focus on at least one or both of the top two most important areas: Payment History and Credit Utilization.

2) Reporting to at Least Two Major Credit Bureaus

Accurately reporting to the major credit bureaus—Equifax, Experian, and TransUnion—is crucial. Working hard to improve your credit score, only to not see it reflected across the board, is disappointing and could hurt you if a future lender looks at a bureau that doesn't have your full financial profile.

3) Low-Cost Options for Building Credit

Credit builder apps should offer an affordable pathway to build and track credit scores to suit the needs and situations of a variety of users. Many mission-driven apps are for-profit but have still created a business model that serves their users well – make sure you feel comfortable with how apps are structuring their fees and costs.

4) No Hard Credit Inquiry Required

A crucial feature of any credit-building app is the avoidance of hard credit inquiries. These inquiries can lower your credit score, defeating the purpose of credit building in the first place, so it’s important to look for apps that prioritize soft inquiries.

How We Rated Each App

We narrowed our list down to the 10 best by assessing them across five key areas:

- Leadership: We ranked highest the apps that outpace their competition in terms of innovation, effectiveness, and uniqueness. In our assessment, we looked for apps whose features or services are undeniably best-in-class, and that can offer a specific credit-building superpower for their users.

- Cost: Many apps offer free access to features, plus premium plans for a price. We carefully evaluated both the free and premium aspects of each app to ensure that the free components are worth signing up for, and that the premium components are worth the money.

- Reputation: If someone takes the trouble to download and use a credit building app, we expect it to deliver real value to the user. We scanned customer reviews on independent sites like Trustpilot, Better Business Bureau, and the App Store to ensure that each app delivered on their promises in safe and secure ways.

- Accuracy: Not all credit score sources are created equal. In fact, scores vary slightly across each of the three credit bureaus, and the best apps will have direct access to at least one credit bureau to provide a true view of your credit score. We prioritized apps that avoid guesswork and pull their data straight from the source.

- Extras: The best credit building apps offer a combination of high quality services, features, and benefits. In our review, we made sure that each app was a powerhouse in their respective area of credit score health, whether that was credit monitoring, credit building, or credit repair.

The Bottom Line

- Different credit-building apps provide a variety of tools and functions—from credit builder loans to reporting rent and utility payments—to align with your financial profile, help you develop good financial habits, and enhance your credit score

- Key features to look for in credit-building apps include reporting to all three major credit bureaus, boosting the highest-impact areas of your credit profile, offering low-cost credit building options, and ensuring no hard credit inquiries that could harm your credit score

- To effectively improve your credit score, consistently make on-time payments, manage your credit utilization ratio wisely, and regularly review your credit score and credit reports to ensure accuracy and positive momentum

Frequently Asked Questions

What is the best app to help you build your credit?

The best app to help build credit depends on a user's specific needs. For example, for credit monitoring the best app is Credit Karma. For credit building the best apps are Credit Sesame, Self Builder Credit, and Cheese Credit Builder. For credit utilization the best app is Kikoff. For credit repair the best apps are Credit Versio, Lexington Law, and Dovly. And for payment history reporting, the best apps are Boom Pay and Grow Credit.

What is the most legit credit app?

There are a number of legit credit apps, but selecting the best one for you depends on your specific credit needs and profile. For example, for credit monitoring the best app is Credit Karma. For credit building the best apps are Credit Sesame, Self Builder Credit, and Cheese Credit Builder. For credit utilization the best app is Kikoff. For credit repair the best apps are Credit Versio, Lexington Law, and Dovly. And for payment history reporting, the best apps are Boom Pay and Grow Credit.

How can credit builder apps help improve my credit score?

Credit builder apps can improve your credit score by offering real-time updates, tips for raising your score, and monitoring credit changes. Some credit builder apps like Credit Sesame, Self Builder Credit, and Cheese Credit Builder also provide secured loans or credit cards that can help users build positive credit history and improve their credit score over time.

What's the difference between credit builder loans and secured credit cards?

The key difference between credit builder loans and secured credit cards is that credit builder loans involve making regular payments to a lender, while secured credit cards require an upfront deposit and allow for purchases up to a credit limit.

Credit builder loans usually also come with additional features and benefits designed to help monitor and improve credit scores, which could make loans a more attractive option that some secured credit cards.

What are some strategies for maximizing my credit score using apps?

To maximize your credit score using apps, focus on making on-time payments, managing your credit utilization ratio, and and regularly review your credit score and credit reports to ensure accuracy and positive momentum