Achieve Personal Loans is a reputable online lender that provides loans from $5,000 to $50,000 to borrowers with Fair to Good credit. Their standout feature is rate discounts for qualifying actions.

Whether you're looking for a way to manage your existing debt or are looking to fund a major purchase, understanding your personal loan options is a great place to start.

Personal loan lenders like Achieve Personal Loans can help you with your lending needs by offering competitive rates, a straightforward application process, and flexible terms to fit your specific financial situation.

This personal loan review assesses Achieve’s approach by laying out its terms, unique advantages, pros and cons, and eligibility requirements. Read on to compare them with other online lenders and determine if Achieve is the right online lender to assist with your personal loan needs.

Pros & Cons

Pros

- Provides a range of tailored loan options for individuals with fair credit profiles

- Allows co-borrowers when applying, improving approval odds

- Offers a variety of significant rate discounts for borrowers who qualify via co-borrowing, retirement savings, or using a creditor direct pay option

- No prepayment penalties for early loan payoff

- Flexible payment dates, so borrowers can choose the day that works best for them

Cons

- Has an origination fee, typically 4.99% of total loan amount

- Minimum loan amount of $5,000 may be more than some borrowers are looking for

Achieve Personal Loan Features & Benefits

Achieve Personal Loans offers a range of loan options tailored to meet individual needs. Loan amounts range from $5,000 to $50,000, and repayment terms range from 2 to 5 years. Whether you’re looking to consolidate debt, finance a home improvement project, or fund a significant purchase, Achieve has you covered.

With an Achieve personal loan, you can expect such benefits as:

- A streamlined application process

- Expedited approval and funding

- Multiple rate discount opportunities

- Personalized loan options, including term length, flexible payment dates

- The option to apply with a co-borrower

- High loan amounts

- Responsive customer service

When you choose Achieve Personal Loans, you’re not just getting a loan - you’re also gaining access to a host of benefits designed to make your loan experience better.

Streamlined Application Process

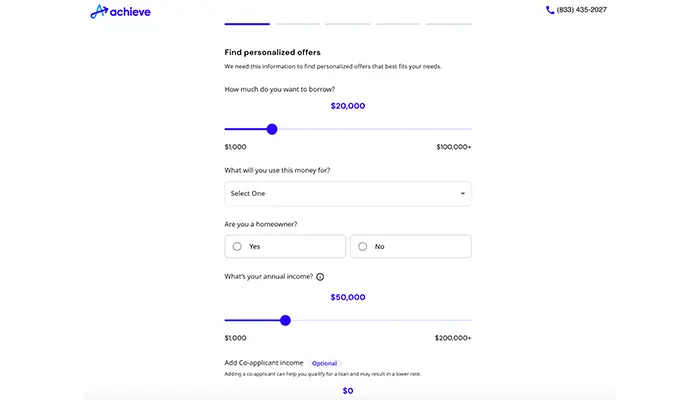

The journey toward your Achieve personal loan starts with a simple, user-friendly online application. All you need to do is enter some basic personal and financial information, which Achieve uses to complete a prequalification process and soft credit pull.

If you are prequalified, you will be able to see the loan offers and example loan terms available to you, which will include all the applicable origination fees, payment terms, and interest rates.

Once an Achieve loan consultant conducts a hard credit pull and approves your loan, funds can be dispersed in as little as 24-72 hours, allowing you to start using your loan for its intended purpose as quickly as possible.

Loan Features

Rate Discounts

One of the features of Achieve Personal Loans that helps them stand out from other online lenders is the availability of rate discounts. By leveraging a co-borrower (up to 6% discount), sufficient retirement savings (up to 5%), and direct creditor payoff options (up to 4%), you can potentially secure a significantly lower interest rate on your personal loan.

Flexible Payment Options

In addition to rate discounts, Achieve also offers flexibility with your loan agreement monthly payment date. This means that you can:

- Choose and change your payment dates to suit your financial needs

- Align your payment date with your payday

- Adjust your payments as your financial situation changes

Achieve’s flexible payment options make it easy to manage your loan in a way that works for you.

Flexible Loan Terms

When it comes to loan terms, Achieve Personal Loans offers a wide repayment periods range to suit your specific financial situation. With terms ranging from 24 to 60 months, you can choose a repayment schedule that aligns with your financial plans. You can choose from shorter loan terms with higher monthly payments or longer terms with lower payments, allowing you to find the solution that works for your budget.

Quick funding

In most cases, you will receive your loan funds one to three business days after approval. That means you will get the money you need when you need it most. You can help the funding process run more smoothly by providing all necessary information and answering any of the Achieve loan consultants' questions in a timely fashion.

High Loan Amounts

Not only does Achieve offer competitive interest rates when compared with other personal loan lenders, they also offer loan contract options with one of the highest minimum loan amounts. If you meet the underwriting criteria with Achieve, you will be offered a loan amount ranging from $5,000 to $50,000. This makes Achieve the perfect solution for large purchases and debt consolidation.

Responsive Customer Service

Although Achieve Loans does not have as many methods of contacting customer service as some other lenders (such as live chat, email, or texting), Achieve customer support is well reviewed by current and former customers, and is noted as being responsive and helpful when addressing customer questions or issues. Achieve customer service can be reached via offline chat on their website, or via phone at: 1-800-920-0045.

Approval Odds

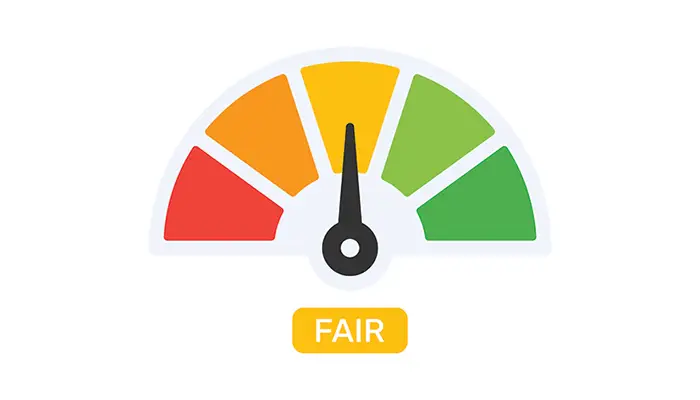

Tailored for Fair Credit Profiles

Achieve Loans are specifically designed to cater to borrowers with fair credit profiles, making them an excellent choice for individuals with a minimum FICO score of 620 or above. Achieve understands that not everyone has a flawless credit history, and as equal housing lenders, they are committed to providing fair and accessible loan options to a broad range of borrowers.

By considering a multitude of factors beyond just credit score, Achieve provides a more holistic approach to loan approval, ensuring that a wide range of individuals can access their loan products. Although Achieve loans do require some financial checks, the loans themselves are issued by Cross River Bank, which ensures competitive rates and terms.

Before applying for an Achieve Personal Loan, it’s important to understand the basics of their eligibility criteria:

Financial Requirements

When it comes to financial requirements, Achieve takes into account a variety of factors. Apart from a minimum credit score of 620, the company also considers your income and debt-to-income ratio.

Achieve does not have a specific minimum income requirement; however, proof of income is required to assess your ability to repay the loan. As for the debt-to-income ratio, ideally, it should be no more than 43% of your gross income.

Employment Verification

In addition to financial requirements, Achieve also verifies your employment status. This is done through income verification and sometimes a call or letter to your employer to verify your employment. Achieve is ultimately looking for proof of steady income to ensure that you have the means to repay your loan.

Co-Borrower Advantages

Applying with a co-borrower can significantly enhance the chances of loan approval and may lead to more advantageous terms, including lower interest rates, a rate discount (up to 6%), and a higher loan amount. Since the co-borrower also assumes the risk that comes with the debt, Achieve can use the combined credit histories and incomes of both parties.

Debt Consolidation with Achieve

When it comes to tackling debt, Achieve takes a personalized approach. They understand that each borrower’s situation is unique, and they offer tailored loan solutions to help you manage and reduce your debt.

From consolidating multiple debts into one manageable payment to refinancing high-interest credit cards, Achieve’s flexible loan options can help streamline your finances and make your debt more manageable.

Note that Achieve offers a rate discount for "direct pay," which is when a borrower authorizes Achieve to make a payment directly to one of their high-interest creditors. Refinancing directly through Achieve can be extra rewarding when this rate discount is applied.

Efficient Debt Consolidation

One of the main ways in which Achieve personal loans can help you manage your debt is through debt consolidation. Achieve helps by:

- Providing you with a new loan to pay off multiple debts

- Effectively consolidating your debts into one single payment at a lower interest rate

- Simplifying your repayments into one low monthly payment

Achieve’s debt consolidation loans are specially designed to make managing your high-interest debt as simple and efficient as possible, helping you free up more of your income to work toward other financial goals.

Refinancing High-Interest Credit Debt

In addition to debt consolidation, Achieve also offers credit card refinancing. This involves taking out a personal loan to pay off one or more of your high-interest credit cards to help you lower your interest payments and pay your debt down quicker.

Credit card refinancing may be the best option if you have only one or two credit cards with high interest and your other debt is at a lower interest rate or close to being paid off.

Calculating Loan Terms & Origination Fees

Understanding the terms that go along with personal loans is critical to ensure that they are a proper fit with your current financial situation. While Achieve Personal Loans offers a host of benefits, it’s also important to understand the potential fees associated with their loans:

- Origination Fees: Achieve imposes an origination fee ranging from 1.99% to 6.99%, with the majority of borrowers being assessed a 4.99% fee based on the loan amount. While this fee is typically deducted from your loan proceeds, it’s crucial to take this into account when calculating the total cost of your loan.

- APR: These range from 8.99% to 35.99%, depending on the borrower's financial profile, and whether or not they are using a co-borrower.

- Prepayment Penalties: When it comes to prepaying your loan, Achieve stands out from many other lenders by not charging a prepayment penalty. This means that you can pay off your loan early without incurring any additional fees.

Before accepting a loan, always take the time to understand what your specific APR and origination fee will be. Calculate how much the monthly payment will be, and how long it will take you to pay off the loan, so you can make sure you have sufficient income to make timely payments.

To help ensure that you are not taking on a monthly payment that is more than you can afford, Achieve offers an online calculator that can help you estimate your monthly payments. Simply input your desired loan amount, term, and interest rate to get your estimated monthly payment and see if it will work within your budget.

Alternatives to Achieve

Researching and comparing personal loan providers is crucial to ensure that you are making the best choice for your financial situation. Different companies may have different interest rates and terms, so finding the one that will work with your financial situation and budget is critical to ensure you get the funds you need and are able to stay on top of repayment.

Achieve Personal Loans offer a range of benefits, including competitive rates, flexible terms, and special features. See how they compare with other lenders like:

Happy Money

- Happy Money Personal Loans - formerly known as Payoff - is a personal lending company similar to Achieve Personal Loans offering minimum loan amounts of $5,000 (like Achieve), but capping the max loan amount at $40,000 (less than Achieve's highest amount of $50,000)

- They have origination fees ranging between 0% and 5%, depending on the size of the loan.

- Known for quick fund disbursement, which averages one to three business days.

- Stricter credit criteria: a 640 score or higher and debt-to-income ratio of less than 50% to be approved

- Higher interest rates compared to competitors, which range from 11.52% to 24.81%

Best Egg

- Best Egg offer smaller loan amounts ranging from $2,000 to $35,000

- Offers flexible repayment terms, with repayment periods ranging from 36 months to 60 months

- Simple and streamlined application process, which makes prequalification and final loan approval quick and easy.

- Requires a minimum credit score of 640 to be approved, which is 20 points over the Achieve requirement.

- Potentially high origination fees depending on the borrower's profile, ranging from 0.99% to 8.99%

- Not authorized to provide loans in all states, so not all qualified borrowers will be eligible

SoFi

- SoFi offers loans from $5,000 to $100,000

- Well known in the lending market and popular with many borrowers due to its same-day funding for some loans and lack of fees

- Boasts some of the most competitive interest rates and a variety of repayment periods

- Offer interest rate discounts for autopay, and as well as unemployment protection

- Require a higher credit score of 680 to qualify for loans, which makes those with a less-than-stellar credit history unlikely to be approved

LightStream

- Lightstream offers loans up to $100,000, with same-day funding

- No origination fees or prepayment penalties

- Offers an autopay discount

- No pre-qualification process means a borrower will have to apply and have a hard credit pull before knowing if they are approved and seeing their rates and terms

- Borrowers must have good credit or excellent credit to get the best rates

Upgrade

- Upgrade offers loans from $1,000 to $50,000

- Praised for its user-friendly mobile app

- Provides direct creditor payoffs when requested

- Lower credit score requirements (560+) makes it a good choice for those with subpar credit

- Higher origination fees of 1.85% to 9.99%

The Bottom Line

Achieve Personal Loans offers personal loan products designed to meet a variety of financial needs for borrowers with Good to Fair credit. From debt consolidation to home improvement, Achieve’s flexible terms and competitive rates make it a viable option for individuals seeking personal loans for additional funds.

Although it has an origination fee, the benefits including rate discounts, a user-friendly online application, quick disbursement of funds, and no prepayment penalties helps Achieve stand out as a lender worth considering.

Frequently Asked Questions

Is Achieve a legitimate company?

Yes, Achieve is a legitimate company with positive ratings from the Better Business Bureau and TrustPilot, indicating a strong reputation.

What is the minimum credit score for Achieve loans?

What credit score do you need for Achieve? The minimum credit score required to qualify for an Achieve loan is 620. This is considered a "fair" score; however, meeting this requirement does not guarantee approval as other factors, such as employment and debt-to-income ratio, are also taken into account.

How long does it take to get a loan from Achieve?

It generally takes 1 to 3 business days to receive funds from Achieve after loan approval, with many customers receiving a decision on the same day they apply

What is the range of loan amounts offered by Achieve Personal Loans?

Achieve Personal Loans offers a range of loan amounts from $5,000 to $50,000, with the final approved amount depending on your income, credit history, and repayment terms.