Upstart's AI-driven borrower evaluation looks beyond just a credit score to help more people qualify for personal loans up to $50,000 and access lower rates.

Imagine if credit scores were no longer the make-or-break factor in whether you get approved for a loan. In fact, it's happening and Upstart is a lending platform at the head of the trend.

By harnessing AI to evaluate borrowers beyond just their credit score while connecting them to hundreds of qualified banks and credit unions, Upstart is able to offer better approval odds and more competitive rates than traditional lenders.

In this lender review, discover the ins and outs of Upstart's loan offerings, how their AI underwriting differs from traditional models, and the straightforward application process that could make them the right choice for your financial needs.

Pros & Cons

Pros

- Offers a wide range of loan sizes from $1,000 to $50,000 with competitive rates (7.8% to 35.99%)

- Offers personal loans, debt consolidation loans, and auto loans No minimum credit score requirements

- AI-driven underwriting evaluates 1,500 variables beyond credit scores, making borrowers with less-than-perfect credit likelier to be approved

- Simple and fast online application process

- Fast approval and funding times: approvals are typically instant, and funding in one business day

- No prepayment penalties

Cons

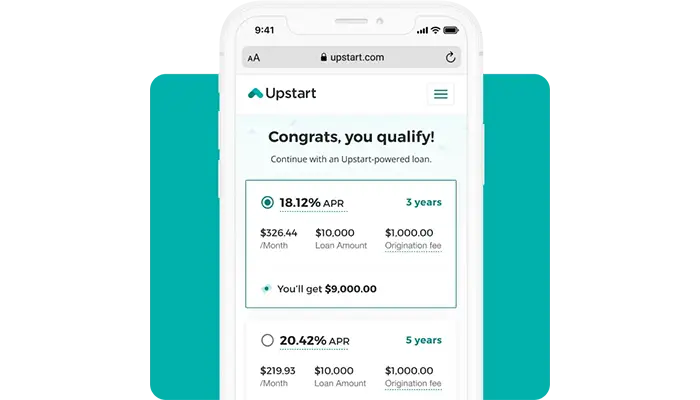

- Some loans may require an origination fee

- Limited repayment terms (3 years or 5 years)

What to Know About Upstart Personal Loans

Simply put, Upstart is an online lending platform that connects borrowers to personal loan and auto refinance loan offers from hundreds of banks and credit unions. With a wide range of loan sizes and competitive interest rates (7.8% to 35.99%), borrowers looking to consolidate high-interest debt, refinance a car, or access cash for a variety of other reasons could have met their match.

Loan amounts for personal and auto loans range from $1,000 to a maximum of $50,000, catering to a wide array of borrowing needs. With these loan funds, there are no penalties for repaying the loan early, providing great financial flexibility and an incentive to pay off loans ahead of schedule.

While there are other similar lending marketplaces, such as AmONE, Upstart has a feature that helps it stand out; specifically, its non-traditional borrower evaluation process.

What Makes Upstart Different?

The unique selling point of Upstart Personal Loans lies in its innovative use of artificial intelligence to evaluate borrower eligibility. Instead of a traditional focus on credit score, income, and assets, Upstart considers a number of other data points to make a loan decision.

Additional details like a borrower's alma mater, college major, and work history paint a fuller picture of a borrower than just a credit profile. Upstart states that their process is more inclusive and effective than the traditional model, with impressive results. According to their website:

- Upstart has a 44% higher approval rate for borrowers than other comparable lenders

- Borrowers will pay an average of 36% lower APR

- 88% of their process is fully automated and doesn't require follow-up paperwork or manual review

This approach not only expands opportunities for individuals whom traditional lenders may overlook but also recognizes and accommodates those with limited credit history or subpar credit scores. In other words, Upstart aims to provide loans to individuals with low credit scores who may not meet traditional credit score requirements.

This is a game-changer in the lending landscape, opening up avenues for a wider range of borrowers.

Upstart's Rates, Fees, and Terms

When considering a loan, understanding the terms, rates, and fees is a must. This is what will determine the total cost of your loan, your monthly payments, and how long you will be repaying.

Rates

Upstart Personal Loans come with a fixed interest rate, ensuring consistent monthly payments throughout the term of the loan. The Annual Percentage Rates (APR) range from 7.8% to 35.99%, which is competitive across a range of different borrowing profiles.

Fees

One of the downsides of Upstart is that some of their loan recommendations will come with an origination fee. You can think of this as an "administrative" fee, which is typically deducted from your total loan amount before you receive your funds.

Origination fees for an Upstart personal loan vary between 0% to 12%. Whether you pay an origination fee or how high it will be depends on your borrower profile and which lender you choose to accept a loan from.

Given that some borrowers have found Upstart’s origination fee to significantly contribute to the cost of borrowing, it’s crucial to consider all costs before making a decision.

Repayment terms

Planning and managing loan payments is a critical part of healthy financial and budgeting habits. Upstart offers two loan repayment term options to choose from: 3 years or 5 years. While other lending platforms may provide a greater range of repayment term periods, this only poses an issue for borrowers looking for repayment terms longer than 5 years.

Because Upstart does not have prepayment penalties, a borrower can pay off their loan as quickly as they'd like without paying any fees.

A Simple Application Process

Upstart's application process is highly automated, meaning that most decisions are made instantly with minimal need for human intervention or follow-ups requiring more paperwork (almost 88% of lending decisions are fully automated).

While Upstart employs a non-traditional underwriting model for borrowers, there still are a number of criteria that you will have to meet to get approved. These include:

- Be a U.S. citizen or permanent resident

- Be at least 18 years old in most states

- Have a valid email address and Social Security number

- Have a full-time job or an offer for one starting within six months

- Have a bank account with a routing number

- No bankruptcies in the last 12 months

- Fewer than six hard inquiries on your credit report in the last six months (not including inquiries for student loans, auto loans, or mortgage lenders)

Provided you meet these criteria, the application starts on the Upstart website. The simple digital experience involves three basic stages:

- Pre-qualification

- Approval

- Funding

Pre-Qualification

Securing an Upstart loan begins with the pre-qualification process. During this stage, applicants provide basic information, including:

- Name

- Birthdate

- Address

- Phone number

- Desired loan amount

- Primary source of income

- Total annual income (note: the minimum is $12,000)

- Account balances for savings, checking, and investments

- Highest education achieved/degree and major

- Current employment and employment history

A soft credit inquiry, which does not impact the applicant’s credit score, is conducted to generate loan offers and APRs based on their credit reports and other datapoints such as education and work histories.

This comprehensive assessment is what makes Upstart stand out from other lenders and make high quality loans at good rates accessible to a variety of borrowers, especially for those with thin credit histories.

Qualification

Upon completing the pre-qualification process, borrowers are presented with a number of different loan offers from qualified banks and credit unions on the Upstart platform. It is up to the borrower to carefully review the options to consider the loan size, fees, and repayment terms that work best for them.

Once a borrower has chosen which loan to move forward with, they transition from pre-qualification to completing a formal application. This transition is marked by a few important steps:

- A hard credit inquiry, which may affect the applicant’s credit score

- The potential need to provide additional documentation and information to complete the application process. (Not all applications will require this, but it is best to be prepared with proof of income documents such as a W-2 or paystubs to avoid delays)

In short, the qualification stage confirms the accuracy of the information provided during pre-qualification. In most cases, pre-qualification and qualification decisions are made instantly with minimal or no need for additional documentation or follow-ups.

Funding

A big benefit of using Upstart is their speed: once approved, a borrower can expect to receive funds in their checking account within one business day.

What Upstart Loans Can Be Used For

Upstart loans ranging from $1,000 to $50,000 are categorized as personal loans, debt consolidation loans, or auto refinance loans. Here we explore each in more detail:

Personal Loans

The most flexible of these loans is personal loans, which can be used for just about anything the borrower chooses.

Some of the more common purposes that people take out an Upstart personal loan include unexpected financial obligations, emergency home repairs, large purchases, vacations, weddings, moving or medical bills.

Debt Consolidation

One of the main reasons borrowers gravitate towards Upstart is for debt consolidation. By consolidating multiple high-interest debts into a single payment at a lower interest rate, Upstart loans can help simplify finances and lower monthly APR payments. A debt consolidation loan can make it easier for borrowers to budget and track their debt repayment progress.

Borrowers are encouraged to compare the costs of their existing debts against the cost of an Upstart loan to decide if it would be financially beneficial to consolidate debt.

Auto Refinance Loans

The third main category of loans that Upstart provides is auto refinancing. Borrowers may qualify for a better rate on their car loan using one of these refinance loans, which they would use to pay off their existing car loan and replace it with a new one with a lower APR.

As with debt consolidation loans, borrowers should compare the costs of their existing car loan against the cost of a new Upstart loan (including all potential fees, like origination fees) to confirm that it is a wise financial decision before getting approved.

Customer Experiences And Reviews

A great way to understand the strengths and weaknesses of a company, and anticipate the kind of experience you could expect if you became a customer yourself, is to look at the reviews of current and past borrowers.

Simply put, Upstart has an excellent track record and overwhelmingly positive customer reviews online. They have a score of 4.9 out of 5 stars on Trustpilot, with over 45,000 customer reviews, and a Better Business Bureau rating of A+.

Positive reviews of Upstart tend to call out the speed/convenience of the loan approval process, which required less paperwork than other lenders; the speed of funding once approved; the high-quality customer support reachable by phone seven days a week; and the good rates that borrowers were able to secure even with less-than-perfect credit.

However, keep in mind that Upstart reviews include some negative comments, like any company. A minority of Upstart borrowers noted that they encountered unexpectedly high-interest rates and loan denials. Others were frustrated by repayment terms and perceptions that Upstart was not flexible enough in accommodating late payments.

These negative reviews are a good reminder that pre-qualification is not a guarantee of approval, and that a borrower should always fully understand a loan's repayment terms and monthly payment amounts before signing on the dotted line.

Loans Like Upstart

Comparing Upstart to other online lending platforms can help you fully appreciate its strengths and potential drawbacks and confirm they are the right lending platform for you.

AmONE

May be best for: borrowers looking for longer repayment terms

- AmONE is a reputable lending marketplace that, similarly to Upstart, matches borrowers with a number of different loan options after filling out a single application

- Both lending platforms have the same loan sizes of up to $50,000 and similar range of interest rates (6.4% to 35.99%)

- AmONE's major benefit over Upstart is the greater flexibility in repayment terms, up to 7 years, whereas Upstart lenders offers repayment terms only up to 5 years

- However, keep in mind that lenders on the AmONE network use more traditional underwriting criteria, so they may not be as flexible as Upstart in terms of approvals

Achieve Personal Loans

May be best for: borrowers looking to save with interest rate discounts

- Achieve offers personal loans of a similar size to Upstart, from $5,000 to $50,000

- Although they have higher interest rates (8.99% to 35.99%) and origination fees (1.99% to 6.99%), they uniquely offer rate discounts for qualifying actions. Such actions include proving minimum retirement savings amounts and applying with a co-signer

- It's important to do the math after pre-qualifying, but Achieve could be a good alternative for some borrowers to consider if they have a minimum credit score of 620 and meet rate discount criteria

Universal Credit

May be best for: borrowers with fair to poor credit

- Universal Credit offers the same loan sizes as Upstart but have higher interest rates (11.69% to 35.99%) and origination fees (5.25% to 9.99%)

- This lender is intended for borrowers with credit scores as low as 560

- While total costs for a Universal Credit loan may be higher than other lenders, including Upstart, they could be an option worth considering for borrowers with thin credit profiles or poor credit who are looking to maximize their chances of getting approved for a loan

These comparisons provide a snapshot, but your unique financial situation and needs should be the key deciding factors when choosing among multiple lenders.

The Bottom Line

Upstart Personal Loans offers a unique and data-driven approach to personal lending. By leveraging artificial intelligence and considering non-traditional factors, Upstart extends borrowing opportunities to a wider range of individuals.

With competitive rates, no prepayment penalties, and a highly automated application process, Upstart stands out in the personal lending landscape. However, like any financial decision, it’s important to consider all aspects, compare options, and choose what best suits your financial needs.

Frequently Asked Questions

Is taking a loan from Upstart a good idea?

Yes, taking a loan from Upstart can be a good idea, especially if you need to borrow an amount between $1,000 - $50,000, need quick funding, and have a low credit score or limited credit history.

How much would a $8,000 loan cost per month?

The monthly cost for an $8,000 loan varies depending on the APR and loan duration. For instance, a one-year loan with a 36% APR would result in a monthly payment of $804.

Is Upstart loan fake or real?

Upstart is a legitimate lending platform with an A+ rating from the Better Business Bureau and positive user reviews (4.9 out of 5 stars on Trustpilot).

Does everyone get approved from an Upstart personal loan?

Although not everyone will get approved for an Upstart loan, Upstart uses an AI model in their underwriting process that takes into account other factors besides the traditional credit score. Information like level of education and employment history are considered, which means that people with lower credit scores or no credit history have a better chance of getting approved with Upstart than with many traditional lenders.

What sets Upstart Personal Loans apart from other lenders?

Upstart Personal Loans stands out from other lenders by using an AI model that takes into account over 1,500 variables beyond the traditional credit score, such as education, employment, and credit history. This enables a more holistic assessment of borrowers' creditworthiness, and means that more borrowers will be Upstart loans than from other traditional lenders.