Cash App initially focused on peer-to-peer payments, allowing you to pay someone instantly, but the app now offers a variety of other features, including the ability to pay bills, borrow, a Cash App card, and functionality to invest in stocks or Bitcoin through the app.

In this article, we'll cover how Cash App offers eligible users short-term loans with the Cash App Borrow feature. We'll go over the details of Cash App Borrow, including who’s eligible, how much you can borrow, and how much it costs to use the feature.

Read on to see how the Cash App Borrow works and alternatives if it's not available to you.

How Cash App Borrow Works

Cash App Borrow is a short-term loan feature offering up to $200 for eligible users. Loans must be paid back within four weeks and come with a 5% flat fee that is added to the borrowed amount.

If you don’t pay back the loan in full within four weeks, a weekly 1.25% service charge is added until the loan is paid back. Loans are meant to be used for any personal expenses, but cannot be used for any postsecondary educational expenses.

Eligibility Requirements

- Regular Cash App user

- Deposit cash regularly to Cash App

- Hold an activated Cash Card

- Live in a supported state

- Qualify based on your credit history with a score better than poor

How To Borrow Money on Cash App

Here’s how to borrow money on Cash App if you have the feature enabled:

- Open Cash App and look for the “Borrow” button on the home screen or banking screen.

- Select “Borrow” and choose “Unlock” to request a loan. An amount between $20 and $200 will be available, depending on your deposit activity within the app.

- Choose the amount you wish to borrow.

- Read through the loan agreement and select “Agree” to complete the loan. The funds will be deposited into your Cash App account.

How to Repay Money Borrowed From Cash App

To repay your Cash App loan, there are a few options:

Manual Payments

You can make payments through Cash App manually by depositing funds and selecting how much to pay on the loan.

Autopay

You can set up automatic payments within Cash App to pay off the loan in small increments over four weeks, or you can set up a single payment to pay it off at the end of your four-week term.

Mail Payments

If you need to mail a check, you can send it directly to Cash App (with your $Cashtag included) to “Lockbox Services 206600 Square Inc. 2975 Regent Blvd Suite #100 Irving, TX, 75063.” The check must be received by 4pm C.T. on a business day to receive credit for the payment on that day.

Why Can’t I Borrow Money From Cash App?

Cash App Borrow might not be available to you. Here’s why:

Reasons You May Not Be Eligible

If you have not completed enough required activities using Cash App, the Borrow feature may not be unlocked. Cash App only opens this feature to users who make frequent deposits, have activated the Cash Card, and qualify based on credit history.

If you want to unlock this feature, you will need to perform these activities to become eligible, and even then, it is up to the discretion of Cash App to unlock the Borrow feature on your account.

If you don't see Cash App Borrow in your account, it might be time to look elsewhere. There are a variety of other money borrowing apps available.

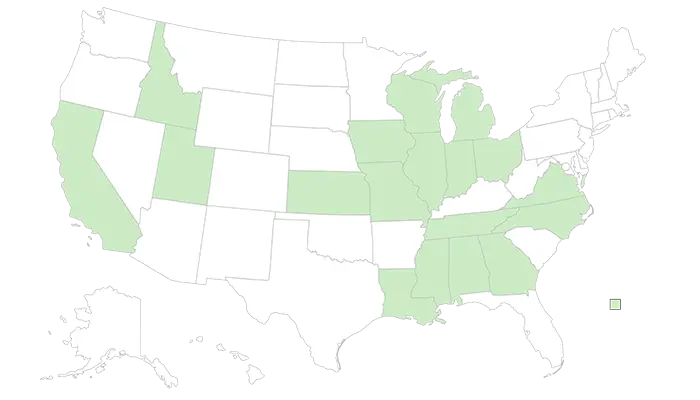

Availability is Limited by State

You can't use the Cash App Borrow feature if you don’t live in a supported state. Here are the states where this feature is currently available. If you're state isn't listed, you might want to check out some alternatives.

When To Use Cash App Borrow

Cash App Borrow is a simple cash advance and is ideal for users who need $200 or less of emergency cash. It can help you cover bills before your next payday or hold you when a paycheck or work is slow.

Some use cases for Cash App Borrow include:

- Emergency vet visit

- Covering a utility bill before payday

- Emergency car repairs

- Last-minute unexpected expenses

- Late paycheck

Is Cash App Borrow Safe?

Cash App is a safe and secure app, and the Borrow feature is protected by all the security and privacy policies of the app. This includes:

- Biometric access protection

- End-to-end encryption

- Remote disable of the app

- Built-in fraud protection

- Account alerts that detect suspicious activity

Cash App Borrow Alternatives

Cash App Borrow isn’t available to everyone, and if you’re in a tight spot, you might not be able to instantly borrow funds using the app.

Here are a few alternatives to Cash App Borrow and apps like Dave to borrow quickly:

Cash and Paycheck Advance Apps

A cash advance is a short-term loan that allows you to borrow up to $500 (or more) as a way to bridge the gap between now and payday. Several online and in-person services offer these types of loans. But be warned, the interest rates are typically very high, and some payday loan companies may charge exorbitant fees if you’re late paying it back.

As a safer and often less expensive option, there are cash advance apps available that give you quick access to cash right from your phone:

Dave

Dave is a checking account and cash advance app that lets you borrow up to $500 and pay it back when your next paycheck deposits. You must have a Dave ExtraCash account ($1 per month) and a Dave Spending (checking) account open to be eligible for a cash advance. There are no extra fees unless you want the money quicker, then you pay up to $13.99.

Cleo

Cleo is a financial app that helps you build credit and analyze your spending habits. It also offers interest-free cash advances up to $100. If you want rush delivery of your cash advance, it’s a $4 charge. You need a Cleo+ account to access the cash advance feature; the monthly subscription is $5.99.

Albert

Albert is a mobile banking app that includes borrowing, automated savings, and investing. Albert offers cash advances up to $250, but you must be on a Genius plan ($8 monthly subscription fee minimum). The cash advance is based on your upcoming paycheck and will need to be repaid in full when you get paid next.

Personal Loans

If you need more than a few hundred dollars, personal loans can be a good option for accessing funds for emergencies, larger projects, or other personal needs. A personal loan is an unsecured loan of up to $50,000 that requires completing an application, income check, and credit check and might take up to a week (or more) to arrive.

Interest rates on personal loans are typically much lower than on cash advance apps, and there is more flexibility in the repayment terms. However, they have higher income and credit requirements.

Frequently Asked Questions

How Much Can You Borrow With Cash App Borrow?

Cash App Borrow lets you borrow from $20 up to $200 (for eligible users).

Why Don't I See Borrow on My Cash App?

Borrow is only available in select states, and users must meet the Cash App qualifications to enable the Borrow feature. This includes making regular deposits to Cash App, activating the Cash Card, and having an active user history and qualifying credit history.

Where is Cash App Borrow Available?

Cash App Borrow is available in 19 states currently, including Alabama, California, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Michigan, Mississippi, Missouri, North Carolina, Ohio, Tennessee, Texas, Utah, Virginia, and Wisconsin.

How Do I Activate Borrow on Cash App?

To activate Cash App Borrow, you must live in an eligible state, and regularly use Cash App. This includes depositing funds on a frequent basis, activating your Cash Card, and having a decent credit profile. Once you see the Borrow feature on the Cash App home screen, select it and hit “Activate” to start using it.

Will Cash App Borrow Check My Credit Score?

Cash App Borrow does not do a hard check on your credit score, but it may do a “soft-pull” on your credit profile to qualify you based on your credit history. Cash App Borrow terms and conditions state that “submitting a loan application or accepting a loan may result in an inquiry on Your credit report that may affect Your credit score.”

What Happens if You Don’t Pay Cash App Borrow Back?

If you don’t pay back your Cash App Borrow loan within the specified time frame (four weeks), you will be charged a 1.25% interest charge for every week you are late. Cash App also reserves the right to attempt to collect payment from your Cash App balance and your Cash Card and may even shut down your Cash App account for non-payment.

Does Cash App Borrow Charge a Prepayment Penalty?

There is no prepayment penalty for paying off your Cash App Borrow loan early.