CreditFresh offers lines of credit from $500 to $5,000 with transparent pricing. Although it has higher fees, it also has higher approval odds, making it a viable option for borrowers with fair to poor credit.

If you're looking to access credit or borrow cash, CreditFresh offers an interesting alternative to personal loans: a line of credit.

A personal loan provides a lump sum that is deposited into a borrower's account. Alternatively, with a line of credit, the borrower is approved for a total amount but only withdraws what they need. As they repay what they've drawn, the full balance of the line of credit is restored, ready to be used again if the need arises.

Let's explore CreditFresh, an online lender that provides lines of credit ranging from $500 to $5,000.

CreditFresh Pros & Cons

Pros

- Offers a line of credit with flexible access to funds ranging from $500 to $5,000

- Transparent fee structure: pay a monthly billing charge, but no origination fees or late fees

- May positively impact credit scores by reporting to credit bureaus like TransUnion

- Approval odds may be higher with this lender

- Generally positive reviews from current and former borrowers

- Simple digital platform makes applying for and managing credit easy

- As a bonus, provides free credit monitoring services to their customers

Cons

- Billing cycle fees can be high

- Access to a larger line of credit can make nonessential spending tempting for borrowers

How It Works

CreditFresh is a unique financial service that offers individuals a personal line of credit, giving them the flexibility to access their available credit whenever needed. Users can choose to withdraw the full amount or make smaller withdrawals over time. They also have the option to repay and borrow more funds, maintaining a revolving line of credit at their disposal.

What sets them apart from other lenders is its focus on providing flexibility with its personal lines of credit compared to traditional short-term loans, which have fixed terms.

1) Flexible Access to Credit

One of the key features that sets the CreditFresh line of credit apart is its flexibility. Once approved, borrowers can draw from their balance, repay, and redraw over and over again.

Borrowers also have the ability to transfer requested funds into their bank accounts on short notice, even within one business day if the withdrawal request is made before 3.30 PM EST.

This convenient feature comes in handy for unexpected expenses by giving users greater control over how they use their credit. It allows them to make incremental withdrawals as needed instead of having to take out the entire available balance at once (as they would with a traditional personal loan).

CreditFresh provides personal lines of credit with various attractive attributes, including:

- Flexible repayment terms based on individual qualifications ranging from a minimum limit of $500 up to a maximum amount of $5,000

- Convenient access through an online account that enables customers to make quick drawdowns from their remaining available credit, as needed

- Option for borrowing either all or smaller portions depending upon what suits your financial needs best

As you pay off any drawn amounts, those funds become reusable again so that your line stays open and accessible whenever required.

2) No Hidden Fees

At CreditFresh, transparency is key. Borrowers can rest assured that there are no hidden fees – including no origination fees, late fees, or early prepayment fees. What you see is exactly what you get.

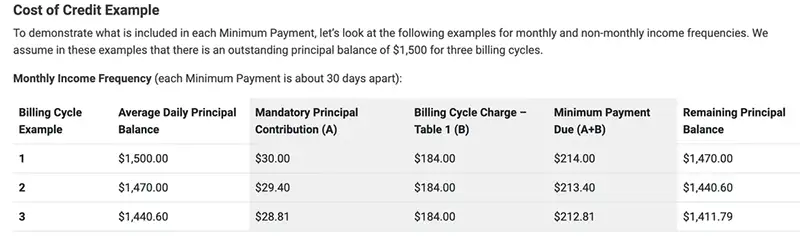

The main charge for borrowers is the Billing Cycle Charge, determined by the Average Daily Principal Balance for each billing cycle. (Specifically, it is calculated by taking the daily principal balance for each day in the billing cycle, and dividing that sum by the total number of days in that billing cycle.)

To keep their account in good standing, borrowers must make monthly payments towards this charge, plus a mandatory principal contribution so that the total amount owed decreases each month. This acts as the monthly minimum payment required.

The typical billing cycle charge per month ranges from $5 to $350, depending on how much is owed. It’s worth noting that these charges may be higher than those of other lenders, so it is always worth comparing other options before making a decision.

3) Impact on Credit Score

By reporting account status and payments to TransUnion and the other major credit bureaus, repayment may help with building credit.

To optimize the chances of improving your credit score, it is highly recommended that you make timely payments and keep balances low.

Using funds from a CreditFresh Line of Credit responsibly and always avoiding late payments can improve one’s creditworthiness over time as it will have a positive impact on a borrower's payment history. Payment history is one of the most important factors that go into calculating a FICO score, comprising 35% of the total score.

How to Apply for CreditFresh

To qualify for a CreditFresh Line of Credit, you must meet specific criteria. This includes being the legal age to enter into a contract in your state and having an income source that can be verified. You also need to hold US citizenship or permanent residency status, as well as a valid bank account and email address.

There is no publicly stated minimum credit score requirement for eligibility with CreditFresh. Instead, they prioritize reviewing your current financial situation rather than solely relying on credit scores when considering applicants.

Bearing borrower criteria in mind, it may still be possible to access a line of credit even if you have subpar credit or a thin credit history.

Eligibility Requirements

Eligible individuals must have: a valid bank account, proof of identity, proof of residency, and proof of income. Applicants will also undergo a hard credit pull to confirm their FICO credit score and financial history.

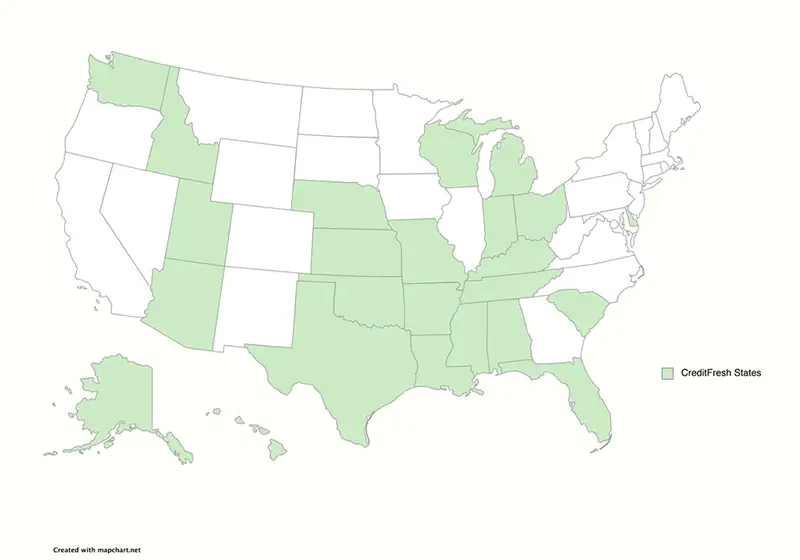

It is important to note that currently, CreditFresh does not operate in the entire country. Make sure to check the map to see whether your state is covered:

If your state is not highlighted, you will be ineligible for qualification. In that case, there are like Credit Ninja to consider instead.

Application Process

The application process for a CreditFresh Line of Credit is all digital, and designed for ease of use.

To complete the online application, you will need to provide personal information and documents such as proof of identity and ownership of a bank account. The approval process involves a credit check and evaluating creditworthiness before a final credit line amount is determined. Past borrowers have described the process as extremely quick and clear.

Upon approval, the borrower can request either the full amount or a smaller portion of that amount to be transferred to their bank account – the same business day, if the request is made before 3:30 PM EST.

Managing Repayment

Making Payments

You will receive a statement prior to your due date, which will itemize the activity on your account and the minimum payment due. The minimum payment due is a combination of the mandatory principal contribution plus the billing cycle charge. You can pay just the minimum balance, or pay more to reduce the total outstanding balance.

CreditFresh is designed to be digital, so it is easy to view balances and make payments online. The online platform makes account management easy, including setting up autopay or making additional payments manually.

Remember that as you pay down your balance, your full line of credit increases, making it available if you need to borrow against it again in the future.

Responsible management of your CreditFresh account is crucial to fully unlock the benefits of their line of credit. Demonstrating a spotless payment history will eventually allow you to receive a larger line of credit, and may also result in lower Billing Cycle Charges.

Additionally, your positive payment behavior will be reported to the credit bureaus, potentially helping to build your credit score.

Customer Support Information

When it comes to managing any financial account, having reliable customer support is crucial. CreditFresh offers a support team available every day of the week for customers seeking assistance.

You can connect with their customer support through different means including email, phone, chat, and even by text message – making it convenient to get help whenever needed:

- Email: customerservice@creditfresh.com

- Phone: 1-800-766-2007

- Text: 1-800-766-2007

Customers have mostly reported positive experiences with the company’s customer service due to their prompt response in answering questions and resolving issues.

CreditFresh Reviews

Real reviews from customers provide an authentic understanding of the products and service offered by CreditFresh.

The company has a Trustpilot score of Excellent with over 2,800 customer reviews. However, not all experiences have been completely satisfactory.

The majority of complaints stem from borrowers not understanding the fee structure once they receive a monthly statement. It is a good reminder to always make sure you fully understand the terms and conditions of a loan before hitting the submit button.

Despite these grievances, the overwhelming majority of customers express satisfaction with CreditFresh’s customer service team and the lines of credit it offers.

5 Alternatives to CreditFresh

Other Personal Lines of Credit

Although lines of credit may not be as common as traditional personal loans, a couple of main competitors may also be worth considering as part of your research: Elastic and Rise.

Elastic

- Provides a line of credit from $500 to $4,500 as quickly as one business day

- No hidden fees or prepayment penalties

- Has a 5-10% cash advance fee every time a withdrawal is requested, plus a monthly carried balance fee

- Not available in all states

- Has more lenient lending criteria, which is good for borrowers with fair or poor credit

Rise Credit

- Provides a line of credit from $500 to $5,000 as quickly as one business day

- Offers free credit score access and credit report monitoring

- Flexible payment scheduling allows borrowers to choose payment dates and amounts

- Not available in all states

- Has more lenient lending criteria, which is good for borrowers with fair or poor credit

Personal Loan Lenders To Consider

Depending on your financial needs and what you are looking for in a loan, there may be other products besides a line of credit that may be worth exploring. Some may offer lower total costs than CreditFresh and may provide additional features or benefits that could be of interest. Consider a few alternatives here:

CreditNinja, for personal loans

- Offers loans up to $5,000

- Same business day funds transfers

- Good for borrowers with fair to poor credit scores

- Excellent customer reviews

- Not available in all states

Self Credit Builder, for building credit & savings

- Offers a secured personal loan up to $1,800

- Build credit history as you repay your loan

- Can report your rental history to credit bureaus to boost credit scores

- Excellent customer reviews

- Available in all states

Discover It Secured Credit Card, for revolving credit

- Helps build credit by demonstrating a responsible payment history

- Borrowers provide a refundable security deposit

- Card limit starts at $200

- Offers real rewards, including cash back and points

- Available in all states

Tips for Borrowing Responsibly

To ensure responsible borrowing, it is recommended to avoid exhausting the entire credit limit unless necessary, and to only borrow after you fully understand monthly costs and have assessed your ability to repay.

Timely payments are essential for maintaining good financial health. Conducting thorough research and comparing options before choosing CreditFresh can help you make informed decisions and avoid overpaying on fees or interest.

Repaying the loan early can also reduce overall costs by lowering total fees paid throughout its duration.

The Bottom Line

CreditFresh offers flexible access to credit, a transparent fee structure, and highly responsive customer service, making it an interesting alternative to a traditional installment loan. While it may have higher fees than some alternatives, it may also have looser approval criteria, making it a good option for borrowers with bad credit or a thin credit history.

As with any financial service, it’s crucial to thoroughly research, compare options, and assess your financial situation before making a decision.

Frequently Asked Questions

What is CreditFresh, and how does it work?

CreditFresh is an online lender that provides personal lines of credit ranging from $500 to $5,000. Once approved, borrowers can draw against their line of credit, but don't have to take out the full amount all at once. As they repay what is used over time, their line of credit is restored, so it's available for use again down the line.

Is CreditFresh a legitimate company?

CreditFresh is a legitimate and reputable business that provides lines of credit to individuals who have less-than-perfect or poor credit scores. They have a Trustpilot score of Excellent and over 2,800 reviews, which is a strong signal that they are a dependable company with generally satisfied customers.

What kind of loan is CreditFresh?

They provide a type of financing called a personal line of credit, which is similar to a credit card with a set limit. Borrowers can access funds up to $5,000, but don't have to take out the full amount all at once. As they repay what is used over time, their line of credit is restored, so it's available for use again down the line.

What happens if you don't pay CreditFresh?

Neglecting to make payments may result in added charges, accrued interest, and potential harm to your credit score. Taking prompt action towards addressing any missed payments can help mitigate these effects. It is crucial to handle the situation promptly in order to minimize any negative outcomes that could arise from nonpayment.

Who is eligible for CreditFresh?

Eligible individuals must have: a valid bank account, proof of identity, proof of residency, and proof of income. Applicants will also undergo a hard credit pull to confirm their FICO credit score and financial history.

Note that they are only available in the following 24 states: Alabama, Alaska, Arizona, Arkansas, Delaware, Florida, Hawaii, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nebraska, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, Washington, and Wisconsin.