For those with subpar credit in need of up to $5,000 fast, CreditNinja is a well-reviewed and legitimate lender for a personal loan. However, higher APRs and fees mean the total cost is likely more than others.

If you don't have the best credit score and need cash fast, you're not alone. In fact, Experian reports nearly 1 in 3 Americans have subprime credit. The good news is that there are more options than ever if you are someone with Fair, Poor, or Very Poor credit and are looking for a lender to help with unexpected financial strains.

CreditNinja falls into this category: they offer personal loans up to $5,000 specifically for those who can't get approved by more traditional sources like banks or credit unions. Continue reading to understand the pros and cons of working with CreditNinja, and determine whether they are a good option for your own financial situation.

Pros & Cons

Pros

- Online application process is simple and quick

- Once approved, money is transferred fast, in some cases even same business day

- Loan amounts up to $5,000, offering a good cushion for unexpected expenses

- Strong customer service options, including online chat, email, and phone options

- Strong track record since 2018, & Trustpilot reviews are excellent

Cons

- The overall loan cost is likely to be expensive due to higher annual percentage rates (APRs) and loan terms

- Services are only available in a select number of states (listed below), so not everyone will be eligible

Credit Ninja: The Basics

Credit Ninja is an internet-based lending company that has been around since 2018 and specializes in providing personal loans up to $5,000 to individuals with less-than-perfect credit. They accomplish this by considering other factors in each application, such as income, employment status, and credit history.

This lender can serve as a valuable resource during times of urgent need; however, it’s always important to thoroughly examine the terms and conditions before being enticed by a high personal loan limit. Credit Ninja may have origination fees and higher interest than more traditional lenders, which unfortunately can be expected for those with subpar credit.

In order to receive their funds, borrowers must have a checking account since the loan will be sent via direct deposit into this specific bank account. This ensures convenient access to the loan funds, but also means eligibility requires owning or opening a checking account.

Who They Are

Credit Ninja's goal is to offer affordable, fixed rate personal loans to hardworking Americans, especially during unexpected financial circumstances. What sets them apart from traditional financial institutions is their focus on providing a high quality lending experience for individuals who may not qualify for conventional loans.

Credit Ninja holds licenses as a financial service provider, which enhances the credibility of their online personal loan services within the market. This means they are closely monitored and regulated by reputable credit bureaus and other authorities in order to provide security for borrowers seeking credit options.

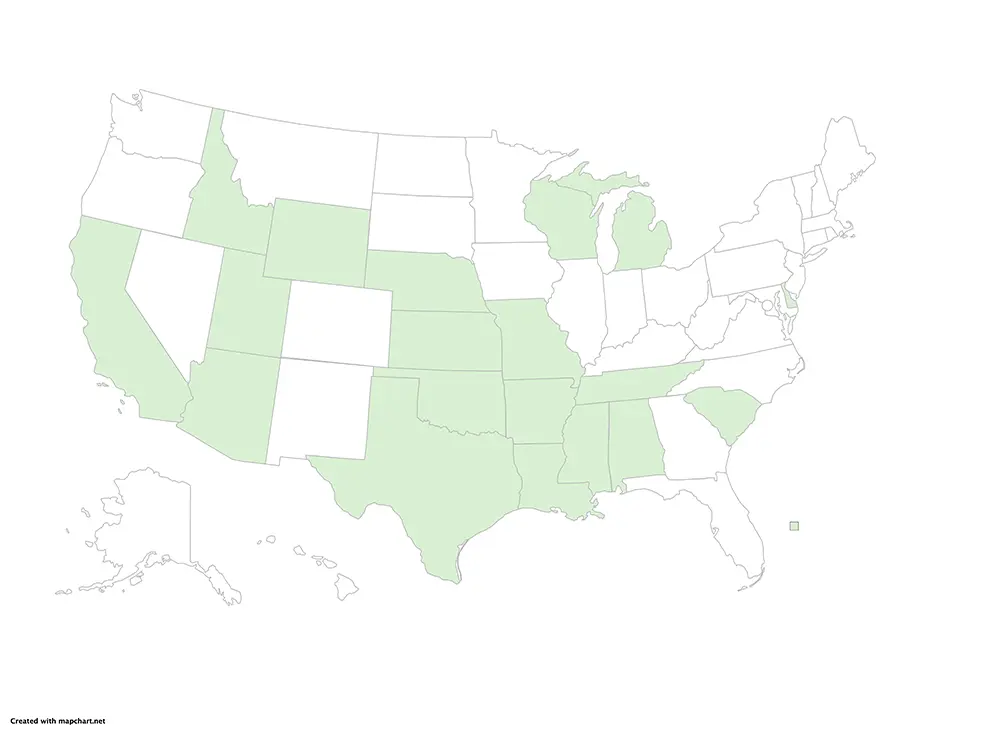

Where They Are Available

Credit Ninja's corporate headquarters are located in Chicago but they lend across the United States. Licensing and loan amounts vary by state law, but the typical range appears to be up to $5,000.

Credit Ninja is licensed to offer online loans in the following states:

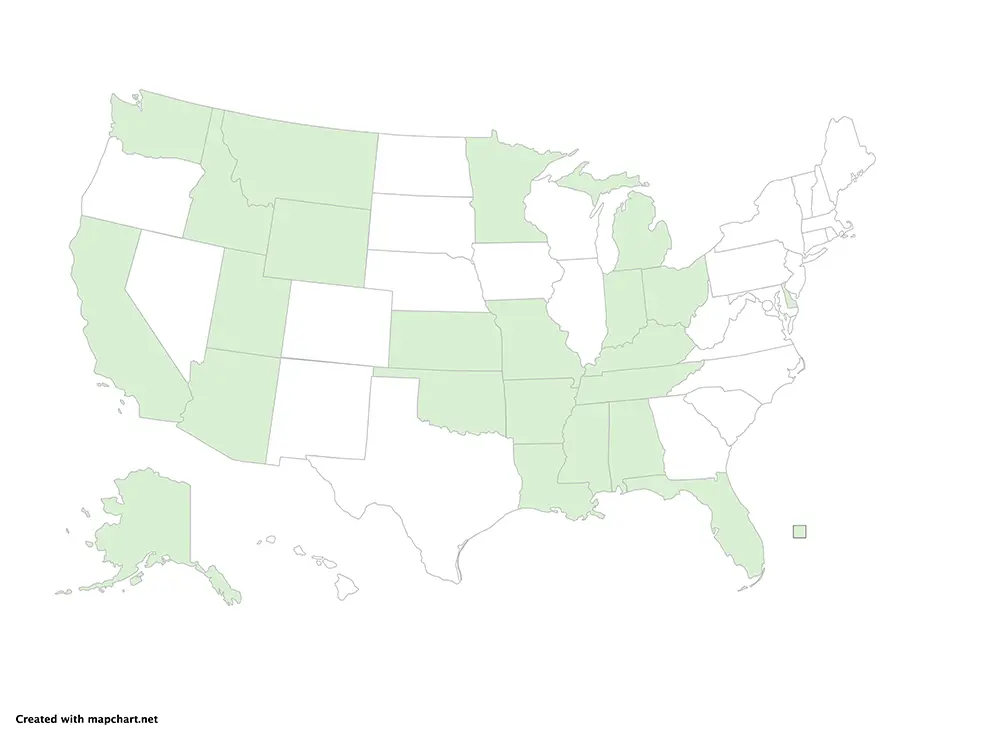

If your state is not listed, Credit Ninja may still be able to offer you a personal loan through a third-party bank. For example, they also offer personal loans through CC Connect, a division of Capital Community Bank (CCBank), a Utah Chartered bank, in these other states:

How Credit Ninja Works

1) Application Process

CreditNinja personal loans sidestep long bank forms and instead offer a quick online request process with certain requirements for eligibility. Applicants must be 18 years old and have a Social Security number, along with an active bank account. Individuals from Alabama and Nebraska need to be at least 19 years old in order to apply.

To complete the application, individuals will need to provide personal information as well as their Social Security number and details of their checking account.

During the application process, there will be a soft credit check, which does not impact your score negatively but helps determine what interest rate would be applied to your loan agreement. Users report that upon completing the application, they receive confirmation about their approval status quickly.

2) Understanding the cost of a personal loan

Credit Ninja offers subprime borrowers a vital cash lifeline when they need it most, but it can come with a cost. The interest rates offered for their loans can vary significantly depending on the specific loan type and the borrower’s financial circumstances. It is important to note that these rates may be quite high and could have a significant impact on the overall cost of borrowing.

Along with a high interest rate, borrowers should also consider potential fees associated with these loans such as application fees, an origination fee, processing fees and funding fees. In addition, there are other possible expenses like late payment penalties or overdraft costs which can increase the total cost of the loan if a borrower falls behind. Prepayment penalties may also apply if a borrower wishes to pay off their debt early.

Bearing this in mind, it is important to remember that Credit Ninja's typically higher APRs (annual percentage rates) and other potential costs like origination fees will make them less ideal for long-term financial solutions.

As always, it would be prudent for individuals seeking financing options from different lenders to compare terms carefully in order to find the most suitable choice available.

3) Receiving Funds

Real users report that Credit Ninja follows through on their promise of providing loan funds in a very timely manner for approved borrowers, sometimes on the very same business day as the loan is approved. However, the actual speed at which a loan is processed and disbursed via direct deposit can be affected by several factors.

Some elements to keep in mind include weekend/holiday schedules, temporary deposit holds by your bank, and the volume of loans that Credit Ninja is funding at a given time. Potential customers should take into account these variables before considering taking out a loan.

Contacting Credit Ninja Customer Support

Credit Ninja has a range of customer service options available for their clients designed to offer a quick answer to questions. These include phone, email and online chat services. Live customer support is offered during business hours on weekdays, specifically from 8am to 6pm Central Time. This includes:

Customer Support Phone Number: 855-NINJA-01 or (855-646-5201)

Email: support@creditninja.com

Postal mail:

CreditNinja, Attn: Customer Service Group

27 North Wacker Drive, Suite 404

Chicago, Illinois 60606

Additionally, existing customers can access the Credit Ninja login page here:

Overall, customers have given positive feedback about the company's customer support system. The loan process is praised for its efficiency and simplicity as it includes fast approval and up to same-day funding assistance, which proves valuable to many clients in need of emergency cash. And once a customer, users say that the customer service team is responsive and helpful in addressing questions and issues.

Alternatives To Credit Ninja

Credit Ninja is not the only company designed for people with a less-than-perfect credit score in need of fast money. In fact, there are a number of other options that could be also worth considering if you are doing research on lenders. These include:

For smaller loan amounts, peer to peer lending or instant loan apps may be also be an option worth exploring.

Some of these alternative options may offer clearer and more transparent cost information as well as lower fees or APRs, so it is worth thinking about before submitting a loan application.

The Bottom Line

For individuals in urgent need of funds who may not meet the criteria for traditional loans, Credit Ninja is a solid option to consider. It is an established and trustworthy company that offers a speedy and effective application and approval process, which is supported by dedicated customer service.

However, before deciding to obtain their services, one must weigh the advantages against the disadvantages which include high interest rates and possible fees associated with their loan terms.

It should also be noted that loan availability may be limited only to specific states. Therefore, prospective customers should carefully check qualification before applying to this lender.

Frequently Asked Questions

Is CreditNinja a real site?

Yes, it is a legitimate and accredited online lender headquartered in Chicago, offering personal loans to those with less-than-perfect credit in a safe and timely manner.

Based on its credentials, banking license, and strong customer reviews, those looking to obtain a loan can be confident that it is a legitimate company, and not a scam.

What types of loans does CreditNinja offer?

CreditNinja offers unsecured, fixed rate personal loans, bad credit loans, and online installment loans up to $5,000 with a fast and simple application process.

Does CreditNinja check your credit?

Yes. They will first utilize a soft credit check to determine loan eligibility, and then a hard FICO score pull before originating the loan. This pull is required to confirm the applicant's income, current outstanding loans, and credit history – all important factors in determining a total loan amount and APR.

Is CreditNinja a secured loan?

No. CreditNinja offers unsecured loans, meaning that borrowers do not need to offer collateral. This makes these types of loans less risky for individuals seeking financial assistance.

What is the maximum personal loan amount provided by CreditNinja?

Personal loan terms max out at $5,000 for individuals, although it appears that many loans tend to fall within the $1,000-$2,500 range.