Swimming paycheck to paycheck? Many Americans know the struggle of living paycheck to paycheck. An unexpectedly high medical bill or emergency car repair can derail even the most carefully planned budget. Payday advance apps like Earnin offer a life line.

Payday advance apps have revolutionized personal finance, especially for those in temporary cash shortages. These apps offer a viable alternative to payday loans by letting users access a portion of their wages before payday.

Earnin, a leading player in this field, lets users easily access their earned income with its user-centric model. But, no app is perfect for everyone, including Earnin. Withdrawal caps and employment documentation requirements have led users to seek alternatives that better suit their financial needs.

In 2023, new payday advance apps are entering the market and existing ones are improving. This article covers the top 10 payday advance apps like Earnin. We explore apps for various financial needs, from those with lower fees and higher advance limits to those with unique repayment structures.

Let’s begin.

10 Apps Similar to Earnin

We have researched and identified 10 best Apps Like Earnin that are most used, user-friendly, offer unique features, and financial ease. These alternatives provide the convenience of early wage access and come with additional functionalities like budgeting tools, savings options, and even credit-building features. Here are the apps, and then we continued with their details.

- Dave

- Brigit

- Chime

- Vola

- MoneyLion

- Varo

- Albert

- Payactiv

- Empower

- Possible Finance

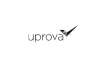

1. Dave

Dave is a popular financial app that stands out in the market for cash advance and payday loan applications. It's designed to help users manage their finances more effectively, offering a range of features tailored to those needing a quick financial boost or better budgeting tools. Here's a detailed overview of what Dave offers:

Main Features of Dave

- Cash Advances: Dave allows its users to get cash advances, helping them cover expenses until their next paycheck.

- Budgeting Tools: The app includes intuitive budgeting tools that analyze user spending patterns, offering insights to help manage finances better.

- Alerts for Upcoming Bills: Dave sends alerts for upcoming bills, helping users avoid overdraft fees.

- Side Hustle Feature: The app connects users with side job opportunities to earn extra income.

Qualifying for the Loan

To qualify for a cash advance with Dave, users need to:

- Have a steady income.

- Link a checking account with a positive balance.

- Show proof of consistent direct deposits.

- Pass an internal risk assessment by the app.

Fee Structure and Interest Rates

- Membership Fee: Dave charges a $1 monthly membership fee, which grants access to all its features.

- Zero Interest Rates: The cash advances are interest-free, making them affordable.

- Optional Tips: Users can leave an optional tip as a token of appreciation for the service.

Loan Amounts and Repayment Terms

- Advance Amounts: Users can get cash advances up to $100.

- Repayment Terms: The repayment terms are straightforward, with the borrowed amount automatically deducted from the user's linked bank account on the next payday.

User Reviews and App Ratings

Dave has garnered positive user reviews and high app ratings across various platforms, reflecting its reliability and user satisfaction.

Unique Features or Services

- No Credit Check

- Dave Banking

- Charitable Aspect

Pros

- Interest-Free Cash Advances

- No Credit Check Required

- Budgeting Tools

- Alerts for Upcoming Bills

- Side Hustle Feature

- Low Monthly Fee

- Charitable Contributions

Cons

- Limited Advance Amount for New Users (only up to $250)

- 1$ Monthly Membership Fee

- Automatic Repayment

- Dependent on Direct Deposit

- Limited to Small Emergencies

- Potential for Misuse

- App-Related Issues

2. Brigit

Brigit is a financial app designed to offer short-term financial solutions and improve overall financial health. It's tailored for users who need immediate cash access and assistance with budget management. Here's a concise overview of Brigit's features and services:

Main Features of Brigit

- Cash Advances: Brigit provides short-term cash advances up to $250, helping users cover expenses until their next paycheck.

- Budgeting Tools: The app includes budgeting features to track spending and manage finances effectively.

- Automated Alerts: Users receive alerts about their financial status, including upcoming bills and low-balance warnings.

- Earn & Save Feature: Brigit offers opportunities to earn extra money through various means, such as full-time jobs, part-time gigs, and online surveys.

Qualifying for the Loan

To qualify for a cash advance with Brigit, users typically need to:

- Have a regular income with consistent direct deposits into their checking account.

- Maintain a positive bank account balance.

- Show a history of maintaining a sufficient balance on payday to cover the repayment.

Fee Structure and Interest Rates

- Monthly Membership Fee: Brigit charges a monthly membership fee for access to its features.

- No Interest Rates: The app offers cash advances without interest, making it a cost-effective option for short-term borrowing.

Loan Amounts and Repayment Terms

- Advance Amounts: Users can access cash advances ranging from $50 to $250.

- Repayment Terms: The repayment is typically aligned with the user's next payday, ensuring straightforward and predictable repayment.

User Reviews and App Ratings

Brigit has received a mix of user reviews and app ratings, reflecting its effectiveness and user satisfaction across different platforms.

Unique Features or Services

- No Credit Check

- Financial Health Tools

- High-Level Security:

Pros

- Interest-Free Cash Advances

- No Credit Check

- Budgeting Tools

- Automated Alerts

- Earn & Save Feature

- High-Level Security

Cons

- Monthly Membership Fee

- Limited Advance Amount

- Eligibility Criteria

- Automatic Repayment

- Dependence Risk

- App-Specific Limitations

3. Chime

Chime is a financial technology company that offers banking services through its mobile app. It's designed to simplify banking for its users, providing a modern and efficient way to manage finances. Here's a concise overview of Chime's features and services:

Main Features of Chime

- Online Banking: Chime offers user-friendly online and mobile banking experiences.

- Automatic Savings: The app has features to help users save money automatically.

- Fee-Free Overdrafts: Chime provides fee-free overdrafts up to $200.

- Daily Balance Notifications: Users receive daily account balance notifications and transaction alerts.

- Mobile Check Deposit: The ability to deposit checks through the mobile app.

- Send Money: Easy and quick money transfers to friends and family.

Qualifying for the Loan

Chime primarily offers banking services and does not provide traditional loans. However, it offers a fee-free overdraft feature called SpotMe, which users can qualify for by receiving direct deposits totaling at least $200 monthly.

Fee Structure and Interest Rates

- No Monthly Fees: Chime does not charge monthly fees or require a minimum balance.

- No Overdraft Fees: The SpotMe feature allows eligible members to overdraw their account up to $200 on debit card purchases without overdraft fees.

Loan Amounts and Repayment Terms

- SpotMe Limits: Based on account history and activity, the overdraft limit starts at $20 and can be increased to $200.

- Repayment Terms: The overdraft amount is automatically repaid when receiving the next direct deposit.

User Reviews and App Ratings

Chime has received positive reviews and high ratings for its user-friendly interface and fee-free banking services.

Unique Features or Services

- Early Direct Deposit

- No Hidden Fees

- ATM Network

- Security Features

Pros

- Fee-Free Overdrafts

- No Hidden Fees

- Early Direct Deposit

- Automatic Savings Tools

- Large ATM Network

- User-Friendly Interface

- Security Features

Cons

- No Physical Branches

- Limited Product Offerings

- Depositing Cash Can Be Cumbersome

- Customer Service Limitations

- Eligibility for SpotMe

- No Interest on Savings

- Mobile-Dependent

4. Vola

Vola is a financial app that offers cash advances and various other financial services. It's tailored for users who need quick access to funds and assistance in managing their finances.

Main Features of Vola

- Cash Advances: Offers cash advances up to $300, providing a quick solution for short-term financial needs.

- Overdraft Fee Protection: Helps users avoid overdraft fees, adding a layer of financial security.

- Spending Analysis and Budgets: Includes tools for analyzing spending habits and setting budgets.

- Debit Card: Vola offers a fee-free debit card, which can help reduce monthly service fees.

Qualifying for the Loan

To qualify for a cash advance with Vola, users need:

- Regular accounting activity.

- An average account balance of at least $150.

- Notably, regular direct deposits are not a requirement for eligibility.

Fee Structure and Interest Rates

- Monthly Subscription Fee: Vola requires enrollment in a monthly plan starting at $4.99.

- Interest Fee: The cash advances come with a 0% interest fee.

- Variable Monthly Costs: Monthly costs range from $2.99 to $28.99, depending on the services enrolled and monthly activity.

Loan Amounts and Repayment Terms

- Cash Advance Limit: The limit for cash advances is set at $300.

- Repayment Terms: Specific repayment terms are based on the user's financial situation and the terms agreed upon at the time of the advance.

User Reviews and App Ratings

Vola has received various user reviews and app ratings, reflecting its effectiveness and user satisfaction across different platforms.

Unique Features or Services

- Vola Score

- No Direct Deposit Requirement

Pros

- Quick Access to Funds

- No Interest Fees

- Easy Qualification Criteria

- Overdraft Protection

- Financial Management Tools

- Vola Score System

- Fee-Free Debit Card

Cons

- Monthly Subscription Fee

- Limited Information on Website

- Limited Advance Amount

- Variable Monthly Costs

- Repayment Terms Not Clear

- App-Specific Limitations

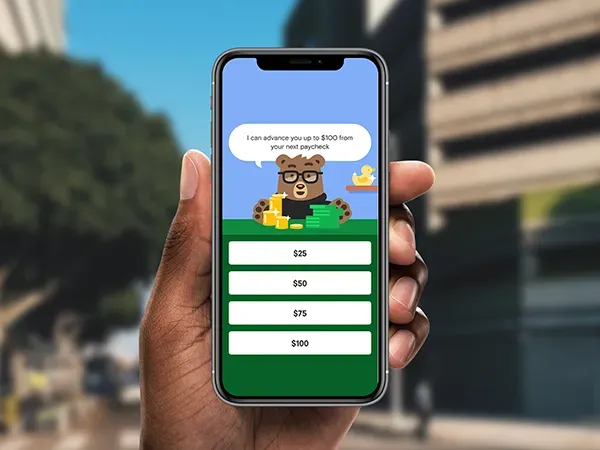

5. MoneyLion

MoneyLion is a comprehensive financial app offering services from banking to borrowing, saving, and investing. It's designed for users who seek an all-in-one platform to manage their financial lives. Here's a concise overview of MoneyLion's features and services:

Main Features of MoneyLion

- Mobile Banking: Offers online banking services with easy account management.

- Cash Advances: Provides cash advances up to $500.

- Investment Account: Users can invest in diversified portfolios.

- Credit Builder Plus: A program designed to help users build credit.

- Cashback Rewards: Rewards for everyday spending.

- Round Ups: Automatically rounds up purchases to the nearest dollar for savings.

Qualifying for the Loan

To qualify for a cash advance or loan with MoneyLion:

- Users typically need to have a MoneyLion account.

- The qualification criteria may include factors like income stability and financial history.

Fee Structure and Interest Rates

- Membership Fee: MoneyLion's Credit Builder Plus program has a membership fee.

- Interest Rates: The app offers competitive interest rates for its loans and credit builder program.

- No Hidden Fees: Emphasizes transparency with no hidden fees.

Loan Amounts and Repayment Terms

- Cash Advance Limit: Up to $500 for cash advances.

- Credit Builder Loans: Offers loans that are part of the Credit Builder Plus membership, with terms and amounts varying based on the user's profile.

User Reviews and App Ratings

MoneyLion has received positive reviews and high ratings for its comprehensive financial services and user-friendly app.

Unique Features or Services

- Financial Tracking and Management

- Personal Finance Resources

- All-in-One Platform

Pros

- Comprehensive Financial Services

- Cash Advances up to $500

- Credit Building Opportunities

- Investment Options

- Cashback Rewards

- User-Friendly Interface

- No Hidden Fees

Cons

- Membership Fees

- Eligibility Criteria

- Limited Loan Amounts

- Potential for High-Interest Rates

- Complexity of Services

- Dependence on App

- Customer Service Issues

6. Varo

Varo is an all-digital banking app offering a range of financial services designed to cater to modern users' needs. It combines traditional banking features with innovative technology to provide a comprehensive financial solution. Here's a concise overview of Varo's features and services:

Main Features of Varo

- Digital Banking: Offers full-fledged digital banking services, including checking and savings accounts.

- Cash Back Rewards: Provides up to 6% cash back on purchases, rewarding users for spending.

- Mobile App Integration: All account data and services are integrated into a user-friendly mobile app.

- Varo to Anyone: A feature that allows free peer-to-peer (P2P) money transfers directly to bank accounts without fees.

- FDIC Insured: Deposits are FDIC-insured up to $250,000, ensuring security and peace of mind.

Qualifying for the Loan

Varo primarily offers banking services and does not focus on traditional loans. However, it provides overdraft protection and other banking features that users can access by opening a Varo bank account and meeting the account's specific requirements.

Fee Structure and Interest Rates

- No Hidden Fees: Varo emphasizes no hidden fees for its banking services.

- Interest on Savings: Offers competitive interest rates on savings accounts, encouraging users to save more.

Loan Amounts and Repayment Terms

- Overdraft Protection: Varo offers overdraft protection but does not specify traditional loan amounts and repayment terms as it focuses more on banking services.

User Reviews and App Ratings

Varo has garnered positive user reviews and high app ratings, particularly its user-friendly interface and efficient banking services.

Unique Features or Services

- All-Digital Banking

- Comprehensive Financial Management

- Accessibility and Convenience

Pros

- All-Digital Banking

- Cash Back Rewards

- No Hidden Fees

- FDIC Insured

- Varo to Anyone

- Competitive Interest Rates

- User-Friendly Interface

Cons

- Limited Financial Products

- No Physical Branches

- Dependence on App

- Eligibility Requirements

- Limited Loan Options

- Customer Service Limitations

- App-Specific Limitations

7. Albert

Albert is a versatile personal finance app designed to streamline various aspects of financial management, from budgeting to investing. It's tailored for users seeking an integrated approach to managing their money. Here's a concise overview of Albert's features and services:

Main Features of Albert

- Budgeting and Spending Analysis: Offers tools to track spending and set savings goals.

- Cash Advances: Provides fee-free cash advances to users.

- Investing: Allows users to invest with custom portfolios.

- Savings Tools: Features tools to help users save money effectively.

- Insurance Services: Helps users find life, auto, home, and renters insurance through the app.

- Cash Rewards: Offers the opportunity to earn cash rewards.

Qualifying for the Loan

To qualify for a cash advance with Albert users typically need to link their bank accounts and meet certain criteria based on their financial activity and history.

Fee Structure and Interest Rates

- Cash Advance Fees: Albert offers fee-free cash advances.

- Subscription Fee: There may be a subscription fee for accessing premium features of the app.

Loan Amounts and Repayment Terms

- Cash Advance Limit: Albert provides cash advances up to a certain limit, determined based on the user's financial situation.

- Repayment Terms: The terms for repaying the cash advance are typically aligned with the user's income schedule and financial capacity.

User Reviews and App Ratings

Albert has received user reviews and app ratings, reflecting its effectiveness and user satisfaction across different platforms.

Unique Features or Services

- All-in-One Financial Solution

- Personalized Financial Advice

- Easy Insurance Access

Pros

- Integrated Financial Management

- Fee-Free Cash Advances

- Personalized Investment Portfolios

- Savings Tools

- Insurance Services

- Cash Rewards

- User-Friendly Interface

Cons

- Subscription Fee for Premium Features

- Limited Cash Advance Amount

- Dependence on App Functionality

- Eligibility Criteria for Advances

- Complexity for Some Users

- Variable User Experience

- Potential for Misuse

8. Payactiv

Payactiv is a financial wellness app designed to give users access to their earned wages before payday and a suite of other financial management tools. It's aimed at helping users manage their finances more effectively and avoid the pitfalls of payday loans.

Main Features of Payactiv

- Earned Wage Access (EWA): Allows users to access a portion of their earned wages before their scheduled payday.

- Savings and Budgeting Tools: Includes tools for saving money and budgeting effectively.

- Bill Pay Services: Offers the ability to pay bills directly through the app.

- Financial Health Measurement: Provides insights into the user's financial health and habits.

- Exclusive Discounts: Users can access exclusive discounts through the app.

Qualifying for the Service

To qualify for Earned Wage Access with Payactiv users typically need to be employed by a company that partners with Payactiv and yhey must have a verifiable work record and earnings to access their wages in advance.

Fee Structure and Interest Rates

- Service Fees: Payactiv may charge a small fee for accessing wages before payday, but it does not charge interest as it's not a loan service.

- No Interest Rates: Since the service provides access to already earned wages, no interest rates are applicable.

Loan Amounts and Repayment Terms

- Advance Limits: The amount users can access before payday depends on their earned wages and their employer's policies.

- Repayment Terms: The advanced amount is typically deducted from the user's next paycheck, aligning with their regular pay cycle.

User Reviews and App Ratings

Payactiv has received positive reviews and ratings for its innovative approach to financial wellness and easy access to wages early.

Unique Features or Services

- Digital Wallet

- Financial Education

- Flexible Access to Wages

Pros

- Early Wage Access

- No Interest Charges

- Budgeting and Savings Tools

- Bill Pay Services

- Financial Wellness Resources

- Exclusive Discounts

- User-Friendly Interface

Cons

- Employer Partnership Required

- Service Fees

- Limited to Earned Wages

- Potential for Financial Mismanagement

- Dependence on Employment Status

- App-Specific Limitations

- Variable User Experience

9. Empower

Empower is a financial app designed to offer cash advances, savings automation, and budgeting tools. It's aimed at providing users with a comprehensive financial management solution.

Main Features of Empower

- Cash Advances: Offers cash advances to eligible users, including gig workers and freelancers.

- Automated Savings: Features that automate savings transfers, helping users save money effortlessly.

- Budgeting Tools: Provides tools to monitor and manage spending by category.

- Cash Back on Debit Card Purchases: Users can earn cash back on purchases made with the Empower debit card.

- Financial Account Integration: Connects all financial accounts for a unified view of finances.

Qualifying for the Loan

To qualify for a cash advance with Empower the users typically need to have a regular source of income and the app may assess the user's financial activity and history to determine eligibility.

Fee Structure and Interest Rates

- Cash Advance Fees: Empower may charge fees for cash advances, but it does not impose interest as it's not a traditional loan.

- Subscription Fee: There may be a subscription fee for accessing premium features of the app.

Loan Amounts and Repayment Terms

- Cash Advance Limit: Empower provides cash advances up to a certain limit, typically around $250.

- Repayment Terms: The repayment terms are aligned with the user's income schedule, with the advanced amount deducted from the next paycheck.

User Reviews and App Ratings

Empower has received various user reviews and app ratings, reflecting its effectiveness and user satisfaction across different platforms.

Unique Features or Services

- Comprehensive Financial Management

- Suitable for Gig Workers and Freelancers

- User-Friendly Interface

Pros

- Accessible Cash Advances

- Automated Savings Feature

- Budgeting Tools

- Cash Back Rewards

- Financial Integration

- User-Friendly Interface

- Tailored for Varied Income Patterns

Cons

- Subscription Fees

- Limited Cash Advance Amount

- Dependence on Regular Income

- Potential for High Fees

- Repayment Terms

- App-Specific Limitations

- Variable User Experience

10. Possible Finance

Possible Finance is a digital lending platform offering small loans through its mobile app, primarily targeting users with bad credit or no credit history. Here's a concise overview of Possible Finance's features and services:

Main Features of Possible Finance

- Small Loans for Bad Credit: Specializes in providing loans to individuals with bad credit or no credit history.

- High-Interest Rates: Loans come with high APRs, typically ranging from 150% to 249%.

- Loan Amounts: Offers loans up to $500.

- Flexible Repayment Schedule: Unlike some payday loan services, Possible Finance allows loan repayment to be broken into four payments over two months.

Qualifying for the Loan

To qualify for a loan with Possible Finance:

- Users must have a monthly direct deposit income of at least $750.

- No requirement for a banking account or debit card enrollment with Possible Finance.

Fee Structure and Interest Rates

- Interest Rates: The loans have high interest rates, between 150% and 200% APR, varying by state.

- No Subscription or Monthly Fees: Possible Finance does not charge a subscription or fixed monthly fee, unlike some platforms.

Loan Amounts and Repayment Terms

- Cash Advance Limit: The maximum loan amount is $500.

- Repayment Terms: The loan is repayable in four installments over two months, offering more flexibility than typical payday loans.

User Reviews and App Ratings

Possible Finance has received mixed reviews and ratings, with users noting its usefulness for immediate financial needs and concerns over high interest rates.

Unique Features or Services

- Accessibility for Users with Poor Credit

- Loans are available in specific states, including CA, ID, LA, OH, WA, UT, AL, DE, IA, FL, IN, KS, KT, MI, MS, MO, OK, RI, SC, TN, and TX.

- No Banking Requirements

Pros

- Accessible to Individuals with Bad Credit

- Flexible Repayment Schedule

- No Subscription or Monthly Fees

- Quick Loan Access

- Digital Lending Platform

- State-Specific Availability

Cons

- High-Interest Rates

- Limited Loan Amount

- Restricted State Availability

- Potential for Debt Cycle

- Not a Long-Term Financial Solution

- Risk of Financial Strain

Earnin Alternatives: Conclusion

After exploring 10 apps similar to Earnin, it's clear that payday advance apps offer a similar solution in different ways. Financial situations are unique to the individual and options help to meet the user where they are. From Dave and Brigit, which combines cash advances with budgeting tools, to Possible Finance, which helps offers instant credit and aims to build credit history.

Our research into Earnin alternatives highlights the importance of finding a payday advance app that best fits your financial situation and goals. Each app can meet your needs differently for fees, advance limits, or repayment terms so, compare wisely.

Remember that these apps are short-term solutions and should be used responsibly while navigating your finances. They can help manage cash flow between paychecks but cannot replace long-term financial planning.

We recommend visiting these services' websites and apps to learn more. Explore the details, compare the features, and make a financially sound choice.

FAQs

1. Is there a better app than Earnin?

Depending on financial needs and preferences, an app may be better than Earnin. Earnin's no-fee structure and ease of use make it popular, but Dave and Brigit may offer budgeting tools or higher advance limits. You must compare each app's features, fees, and eligibility requirements to determine which fits your financial situation.

2. What’s the difference between Earnin and Dave?

The main differences between Earnin and Dave are their features and fees. Earnin offers no-fee paycheck advances to users. Dave, however, offers small cash advances, budgeting tools, and a monthly membership fee. Dave's feature helps users find side jobs.

3. What app lets me borrow money instantly?

Dave, Brigit, and Payactiv offer instant loans. These apps let you get part of your paycheck before payday. Many apps offer same-day or next-day fund disbursement, making them convenient for immediate financial needs.

4. What is the app that gets $100 before payday?

Dave and Earnin give users $100 or more before payday. Dave offers advances up to $100 with higher limits based on account history, while Earnin offers earned wages with a limit that varies by situation.