Based on their strong reputation for delivering loans quickly and fairly, Simple Fast Loans might be a good option for people with bad credit who need up to $3,000 fast and are comfortable with a high APR.

Sometimes, a lender's name says a lot; in this case, "Simple Fast Loans" does just that. This online lender is designed to get cash to people in a pinch, fast. There's nothing fancy when it comes to their loans or website, but they have a strong track record for getting the job done.

This review will walk you through what you can expect with SimpleFastLoans, including credit score and approval requirements, interest rates and fees, and what current customers say about them. We conclude by comparing Simple Fast Loans to similar loan providers so you can decide whether they are the right lender for your specific needs.

Pros & Cons

Pros

- Offers a range of personal loan amounts from $200 to $3,000

- Fast approval and funding, usually same day if the application is sent before 2 PM EST

- Also provides an "instant funding" option for Visa or MasterCard debit cards

- No prepayment penalties for paying off a loan early

Cons

- Does not share APR or interest rates up front (must apply to see your rate)

- Total costs will be significantly more expensive than loans for borrowers with good to excellent credit

What Simple Fast Loans Offers

Loans and Interest Rates

Simple Fast Loans is an extremely straightforward company: they offer installment loans (otherwise known as personal loans, but they are the same thing) ranging from $200 to $3,000.

Because these loans are designed for people with less-than-perfect credit, you can expect approval criteria to be looser and the total costs of the loan (including APR and fees) to be higher. With that said, Simple Fast Loans does not disclose specific repayment terms or APRs upfront; a borrower has to first apply for a loan before they can see exactly what their loan and APR offer is.

Based on our research, it seems that Simple Fast Loans' APRs and repayment terms vary state by state. For example:

In the state of Arizona, Simple Fast Loans' APR is between 99% and 360%, with a maximum loan repayment term of 90 days.

Your specific amounts and terms will depend on your borrowing profile, your ability to repay, and the state you reside. However, this starts to give you a sense of the kind of costs that could come with your Simple Fast Loans installment loan.

Comparing Interest Rates to Other Types of Lenders

A fixed interest rate from Simple Fast Loans will be much higher than a traditional loan for people with good to excellent credit scores, but they are still likely a better deal than a payday loan. Compare a few different lending categories to understand where Simple Fast Loans fits in:

- Payday loans: 391% to 780% APR

- Simple Fast Loans: 100% to 400% APR (rough estimate)

- Credit cards: 15% to 30% APR

- Personal loans: 14% to 35% APR

- Online lending: 10% to 35% APR

While Simple Fast Loans will always be more expensive than traditional lending products, the costs of a Simple Fast Loan could be worth it for borrowers needing quick funding to manage unexpected expenses or a short-term emergency.

Of particular note is the speed with which the lender can get their customers the funds they need, making them a competitive option among other financial institutions.

Approval and Funding Speed

When you are in a crunch, waiting for a loan approval can feel like a lifetime. The good news is that one of Simple Fast Loans' biggest strengths seems to be its speed in application approval and funding.

Their process is designed to be efficient, with loan decisions typically provided instantly or within minutes after applying. In most cases, borrowers will see cash appear in their bank account within hours of applying – same day if they apply before 2 PM EST.

Compare this timeline to other online lenders offering similarly competitive interest rates: while online lenders are faster than traditional banks, it still usually takes anywhere from one to three business days to complete the process. Simple Fast Loans might be one of the fastest ways to get cash.

Applying to Simple Fast Loans

While poor credit can lead to higher interest rates and fees, restricted loan amounts, and shorter loan terms, Simple Fast Loans strives to balance these factors.

Even if your credit score is less than perfect, Simple Fast Loans, as a direct lender, strives to be inclusive and does not impose stringent credit score requirements.

With that said, Simple Fast Loan has certain criteria you will have to meet to qualify for one of their loans.

Eligibility Criteria

One of the first things to know is that Simple Fast Loans does not have a minimum FICO score requirement to qualify for a loan, unlike many other lenders. However, it clearly states on its website that a borrower must have the following to qualify for one of their loans:

- Valid government-issued photo ID (it does not have to be a driver's license)

- Active Checking account where most of your income is deposited

- Valid phone number to be contacted

- Valid Social Security Number

- Must be at least 18 years old

- Cannot be a regular or reserve member of the military (Army, Navy, Marine Corps, Air Force, or Coast Guard), serving on active duty, or a dependent of a member of the Armed Forces on active duty.

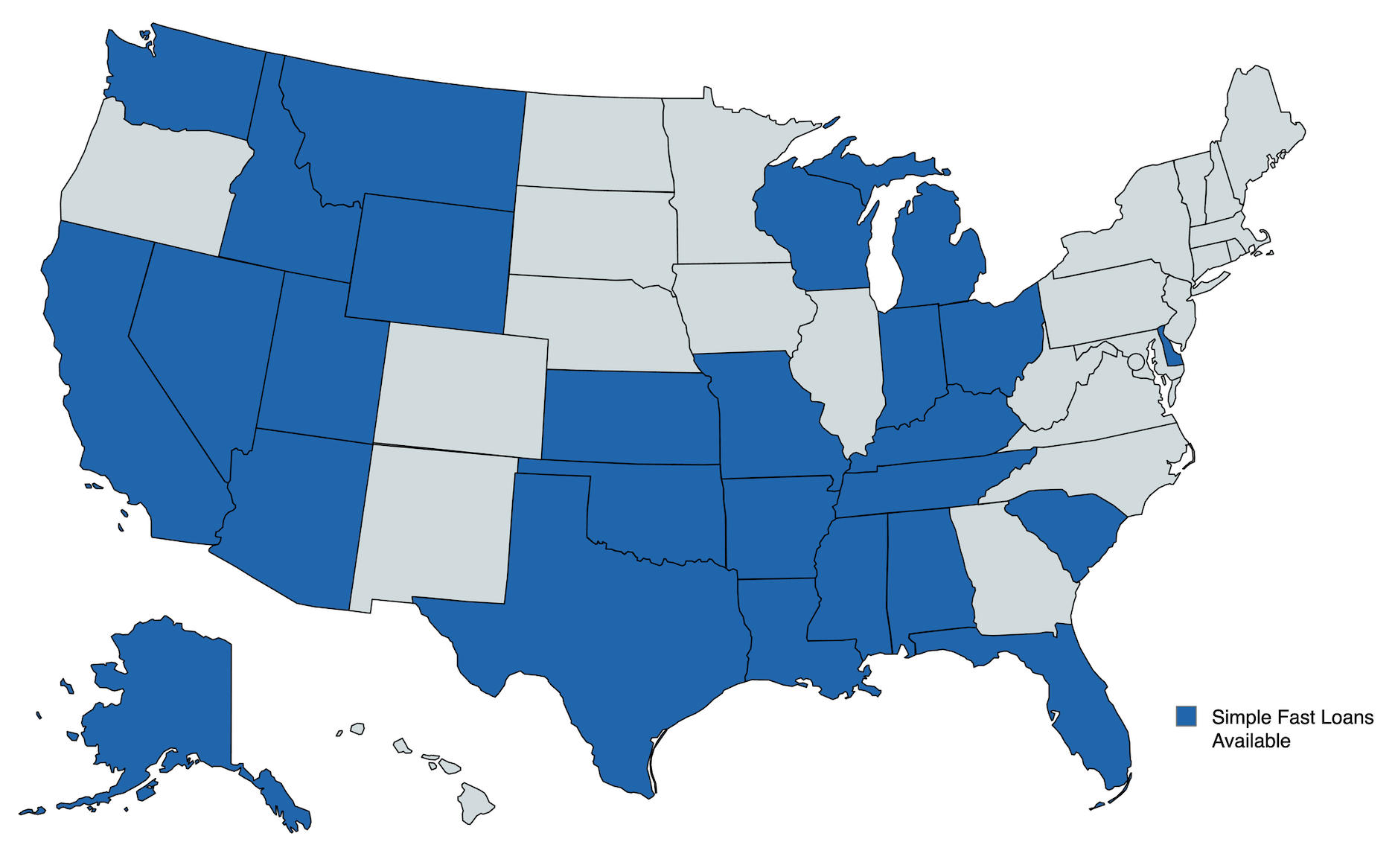

In addition, Simple Fast Loans operates only in 27 states. If your state is not represented in blue on the map, you will not be eligible for a Simple Fast Loan:

Additional Fees and Charges

Beyond the interest rate or APR, additional fees and charges can impact the total cost of borrowing.

The good news is that Simple Fast Loans specifically states that they do not charge an origination or prepayment fee. This means that a borrower won't see any of their loan amount shrink before it hits their bank account, nor will they have to pay anything extra if they want to pay off the loan early.

However, Simple Fast Loans doesn't note on its website what kinds of other fees a borrower might pay, specifically in terms of late fees or returned payment fees. Although the lender states that all fees will be clearly laid out on a borrower's contract prior to signing, the most transparent lenders make this information more easily findable on their websites.

How to Apply to Simple Fast Loans

One of the biggest benefits of Simple Fast Loans is, well, how simple and fast getting a loan is. The process begins with a brief loan application on the lender's website and typically gets completed in only a few minutes.

Online Application Process

The online application process is comprised of three steps: Verification, Decision, and Funding:

- Verification: A potential borrower will fill out basic personal and financial information about themselves. This includes their name, address, telephone, email, social security number, and bank account information. Additionally, they will provide their income information. Borrowers will need to upload digital documentation to verify some of their information, such as a recent bill to verify their address and a photo of their government-issued ID.

- Decision: Once a borrower hits "submit," the decision-making process usually takes only seconds (in fact, Simple Fast Loans says the decision is usually "instantaneous"). It's worth noting that this lender doesn't look only at a borrower's traditional FICO score from the three major credit bureaus to make a decision. Instead, they use what they call an "alternative credit bureau," which looks at a borrower's profile in a more inclusive way. This enables Simple Fast Loans to say "yes" to a borrower when others say "no."

- Funding: Once approved, funds are deposited into the borrower's checking account either on the same day or the next business day. Usually, the funds are transferred on the same day as long as the borrower has submitted their application by the 2 PM EST cutoff time.

Customer Reviews and Experiences

Customer reviews provide valuable insight into the performance of a lender and the kind of experience you can expect if you become a customer yourself. For Simple Fast Loans, these reviews are mixed, with both positive and negative experiences reported. Understanding these perspectives can aid in your decision-making process.

Positive Feedback

Over 9,500 customers have reviewed Simple Fast Loans on Trustpilot, and it has an "Excellent" score of 4.9 out of 5 stars. Notably, this is one of the highest scores we have ever seen for a lender on Trustpilot.

Positive reviews from customers emphasized the swift approval process and prompt funding options. Customers often said they were in a pinch and needed money quickly, and Simple Fast Loans came through for them.

Additionally, customers appreciated the speed of customer service, and that helpful customer service agents were available in three different ways: email, live chat on the website, and by telephone at (866) 521-1445.

Although many customers were quick to point out that Simple Fast Loans was more expensive than what a prime-credit-score lender would offer, they noted that fees and costs were all very clear when they reviewed their contract before signing.

In short, the positive reviews confirm that Simple Fast Loans is a legitimate company that does what it says it will do.

Negative Feedback

On the other hand, the Better Business Bureau has given Simple Fast Loans an "F" rating based on 44 customer ratings. It is important to keep in mind that far fewer customers have given this lender a negative review than customers who have given them a positive review. However, the negative reviews provide some "watch-outs" to remember.

The most common complaint was Simple Fast Loans did not provide enough flexibility to borrowers if they fell behind in their repayments. Customers were frustrated that the lender appeared to have debited accounts even if the customer requested a temporary delay in processing payment.

Additionally, instances of aggressive collection practices have been reported. These criticisms highlight the importance of thoroughly understanding the loan agreement and being prepared for the commitment of repaying a loan.

Simple Fast Loans vs. Alternatives

Choosing the right loan for your financial needs involves comparing various lending options. While Simple Fast Loans offer numerous benefits, including simplicity and speed, they may not be the best fit for everyone's needs.

For the purposes of this review, we have rounded up three other lender options for people with fair to poor credit: 5k Funds, CreditNinja, and Universal Credit Loans. (If you have good or excellent credit, there are plenty of other options to consider with lower rates, including Best Egg and SoFi.)

5k Funds

Could be best for: People who want to see multiple offers at once and/or need a larger loan size

Unlike Simple Fast Loans, which is a direct lender, 5k Funds acts like a matchmaker between potential borrowers and a large network of different lenders. Borrowers fill out one application and can see loan offers from up to 100 lenders at once. On the plus side, loan sizes could be bigger with 5k Funds, ranging from $500 up to $35,000. On the downside, like Simple Fast Loans, 5k Funds does not make approved loan sizes and interest rates visible to borrowers until after they have provided a lot of personal information in the application process.

CreditNinja

Could be best for: People who need to borrow up to $5,000

CreditNinja offers loans up to $5,000. They are very similar to Simple Fast Loans in terms of a streamlined online application process and generally positive customer reviews. Also, like Simple Fast Loans, CreditNinja does not reveal their APRs or fees to a borrower until after they have submitted an application, meaning they lose points for transparency.

Universal Credit Loans

Could be best for: People with fair credit looking to borrow up to $50,000

Universal Credit Loans is a well-regarded lender that provides loans from $1,000 to $50,000. Because they target people with Fair or better credit, their APRs are lower than some of the other lenders mentioned here, including Simple Fast Loans. While Universal Credit Loans has APRs that top out at around 36%, it's important to note that they charge fees, including an origination fee and late fees. However, they are a transparent lender, making this information easier to see on their website to potential borrowers than lenders like Simple Fast Loans.

The Bottom Line

Simple Fast Loans offers a versatile and convenient lending option for individuals in need of quick funding. With a range of loan amounts, a simple application process, and extremely fast funding, they could be a great resource for fast cash in a pinch.

However, as with any financial decision, doing your homework is crucial. High APRs and strict repayment rules mean that a borrower should fully understand the total cost of the loan and their ability to repay it before signing on with Simple Fast Loans.

Frequently Asked Questions

What is the easiest loan to get right now?

The easiest loans to get right now are payday loans, car title loans, and pawnshop loans, although they come with extremely high interest rates and fees, making them predatory in nature.

How long does it take Simple Fast Loans to fund?

Simple fast loans can typically be funded the same day someone applies for a loan if they apply before 2:00 PM ET on a bank day. Otherwise, the loan proceeds are deposited into the borrower's account the next business day. "Instant funding" is also available from Simple Fast Loans if the borrower is using a Visa or Mastercard branded bank debit card.

Does Simple Fast loans pull credit?

Yes, Simple Fast Loans will conduct a hard credit check when you apply for a personal loan.

Is Simple Fast loans legit in USA?

Based on customer reviews and their licenses in the states in which they do business, Simple Fast Loans is considered a legitimate lender in the USA. They are a fully-licensed financial service company offering online installment loans in about 25 states.

What are Simple Fast Loans?

Simple Fast Loans is an online lender providing personal loans from $200 to $3,000 to people with bad credit. They are known for a very straightforward and quick application process, and fast funding – often same day.