Best Egg is a highly reputable online lending platform offering secured and unsecured personal loans from $2,000 to $35,000 to people with Fair to Good credit. If you are comfortable paying an origination fee, they are a great option to consider.

Best Egg is an online lending platform headquartered in Delaware that's been offering personal loans to people with Fair to Good credit since 2014.

This comprehensive review covers everything a potential borrower needs to know about Best Egg, from loan amounts and eligibility requirements to fees and features of their products. In addition, we go over the pros and cons and compare Best Egg to their top competitors so that you can make an informed decision about whether they are right for you.

Pros & Cons

Pros

- Offers loan amounts ranging from $2,000 to $50,000 for a variety of different uses

- Competitive interest rates from 8.99% to 35.99%

- More flexible credit requirements mean more people will be approved

- Provides both secured and unsecured loan options

- Generous loan terms from 3 years to 7 years

- Offers direct creditor payments if a borrower is using a loan for debt consolidation

- Fast approval and funding times, typically within 1-2 business days

- Does not have late fees or prepayment penalties

- Offers additional credit-building products, including flexible rent options, credit cards, and financial health resources

- Known for having strong customer service and a great reputation among current and former users

Cons

- An origination fee is deducted from the funds a borrower receives

- Does not allow co-borrowers/co-signers

- Does not lend in Iowa, Vermont, West Virginia, and Washington, D.C.

Best Egg Loans and Uses

Best Egg states that most of their loans are used by borrowers to consolidate high-interest debt. If a borrower chooses a debt consolidation loan, Best Egg simplifies the process by making payments directly to third-party creditors.

However, a Best Egg loan can be used for just about anything the borrower chooses. For example, the Best Egg website lists the following uses for their loans in addition to debt consolidation:

- Home renovations

- Moving expenses

- Medical expenses

- Wedding expenses

- Vacation or special occasions financing

- Major purchases

- Baby & Adoption

In fact, just about the only things a Best Egg cannot be used for are post-secondary educational expenses, purchasing securities, or any illegal activity.

Whether you’re grappling with a mountain of debt or planning a home renovation, a Best Egg loan option may be the answer you’re looking for.

Loan Amounts

Best Egg provides personal loans ranging from $2,000 to $35,000 -- a range suited to a variety of budgets and needs. However, take into account that, in a few cases, there are state-specific loan minimums. For instance, the minimum loan amount for Massachusetts, Ohio, and Georgia residents is $6,500, $5,001, and $3,001, respectively. The maximum loan limit can also vary based on the state of the borrower.

Secured vs. Unsecured Personal Loans

Best Egg offers both secured and unsecured personal loans. Most loans they originate are unsecured, which means that a borrower is qualified based solely on their credit application evaluation.

However, some borrowers may want to consider the company's secured loan options. In this situation, borrowers use their car or their home's built-in fixtures (such as lighting or cabinets) as collateral. In exchange, Best Egg may offer a lower APR or provide a higher loan amount than a borrower may have otherwise been eligible for.

It is important to note that while unsecured loans can be a good tool for borrowers with lower credit, failure to repay the loan means that Best Egg may take the collateral. It is especially important to keep on top of repayments for unsecured loans.

Evaluating Eligibility and Requirements

Unlike some, Best Egg does not evaluate potential borrowers based solely on their credit score. Instead, they consider other factors such as employment, income, debt-to-income ratio, and state of residence.

Credit Score

Credit score plays a significant role in Best Egg’s loan approval process. Here are some key points to know about credit scores and Best Egg personal loans:

- A minimum credit score of around 640 is recommended for Best Egg personal loans

- Higher credit scores will qualify for better interest rates. In order to qualify for the best rates, a borrower will need a credit score of 700 or higher

- Best Egg considers credit scores from all three major credit bureaus when evaluating loan applications

- Borrowers with lower credit scores may still qualify for a secured loan if they have adequate collateral (Best Egg will consider vehicle and home fixtures as collateral for their secured loans)

Whether you’re seeking competitive rates or the lowest APR, maintaining a high credit score can open the door to better loan conditions with Best Egg and most online lenders.

Income Requirements

Best Egg suggests a minimum gross income of around $50,000 per year. This income can come from a number of different sources, including full- or part-time employment, rental income, alimony, retirement, child support, and Social Security payments.

For the best rates, however, a borrower should have a minimum income of $100,000.

Income is verified during the application process, where Best Egg may request documentation such as paystubs or bank statements to confirm the income stated on the application.

Other Factors

Keep in mind a few other factors when applying for a Best Egg loan:

- Debt-to-income ratio. The maximum debt-to-income ratio accepted by Best Egg for personal loan applications is 30%

- State of residence. Best Egg lends in all states with the exception of Iowa, Vermont, West Virginia, and Washington, D.C.

- Residency requirements. Applicants must be U.S. citizens or permanent residents currently living in the U.S.

- Co-signers/Co-borrowers. Best Egg currently does not allow for a co-signed application

What To Expect: Best Egg Application Process

Best Egg has designed the fully online journey from application to funding to be as smooth and straightforward as possible. Here are the three steps you can expect:

- Pre-qualification

- Application

- Loan approval & Funding

Pre-qualification

Starting the loan process with Best Egg begins with pre-qualification on their website. This is the stage when you can determine the loan proceeds and interest rates you can expect to qualify for if you submit an application and everything checks out.

In order to complete this process, a potential borrower fills in basic information such as their name, email, address, and how much they are looking to borrow.

Best Egg will do a preliminary screening and a soft credit pull -- which does not impact your credit score -- to verify identity and provide tailored loan and APR amounts.

Besides loan and APR, another important factor to consider at this stage of the process is what a monthly payment will look like based on your estimated loan amount and rate. It is very important to review this information to make sure your budget can cover the costs of the loan.

Application Process

Once you’re prequalified and you've found a loan amount and APR that fits your budget, the next step is to fill out the full Best Egg application. The process is done entirely on their website and typically only takes a few minutes.

In order to verify key parts of the application, Best Egg will require borrowers to upload documents such as paystubs and bank statements to verify income and government ID such as a driver's license to verify identity.

In most cases, this is the only verification a borrower will need to do, although sometimes Best Egg will reach out for additional verification requests.

The final step in the application process is a hard credit pull, which is likely to cause your credit score to temporarily drop a few points.

Loan Approval and Funding

After your application is submitted, the next step is loan approval. If your application is approved, Best Egg typically deposits the loan amount directly into your checking account within 1 to 3 business days. (They note that about half of their borrowers receive funds the day after they apply.)

This quick turnaround time ensures that you have prompt access to the funds you need.

Customer Service

Before, during, and after the application process, Best Egg is known for having an outstanding customer service team that is both responsive and helpful in answering questions and resolving issues. There are two primary ways to access Best Egg's customer service:

- Phone Hotline: 1-855-282-6353 (Monday through Saturday)

- Email: loan_assistance@bestegg.com

While some lenders have introduced live chat on their website and the ability to text with customer service, Best Egg currently offers just phone and email for now.

Assessing Best Egg's Interest Rates and Fees

One of the most critical aspects to consider when applying for a personal loan is the interest rates and associated fees, which will determine how expensive it is for you to borrow from a particular lender.

Always make sure to understand these figures in the pre-qualification stage and compare them to other lenders to ensure you are getting the best rates possible based on your creditworthiness.

Interest Rates

Best Egg's interest rates range from 8.99% to 35.99%. It’s worth noting that these rates are competitive and that borrowers with higher credit scores will enjoy lower rates.

Borrowers looking to get the lowest rate should also consider Best Egg's secured loan options, which can help someone secure a lower rate than they may have otherwise been eligible for.

Origination Fee

In addition to interest rates, Best Egg charges a one-time origination fee. This fee, which ranges from 0.99% to 8.99% of the loan amount, is deducted from the loan amount at the time of disbursement.

Additional Fees

Beyond interest rates and the origination fee, the only other fee Best Egg may charge is a $15 returned payment fee in case a check is returned or there are insufficient funds in your bank account to make a monthly payment.

Otherwise, there are no other fees with this online lending platform.

Other Best Egg Products to Know About

Beyond its personal loans, Best Egg offers additional products and resources that might be of interest. These include:

- Flexible rent options

- Credit cards

- Financial resources such as the Best Egg Financial Health platform

Flexible Rent

Best Egg’s Flexible Rent product allows a renter to make smaller, more manageable payments toward their rent each month instead of the typical lump-sum monthly payment.

In addition, Best Egg reports these payments to the three major credit bureaus. This is a great tool for people looking to increase their credit scores because their rental payment history will add to their on-time payment history.

If you are interested in this option, Best Egg recommends you contact your landlord/property management group to see if they are participating in the program.

Visa Credit Card

In addition to personal loans, Best Egg offers a Visa credit card designed for people looking to build their credit histories with the three major bureaus. The Best Egg credit card comes with the following features:

- Credit limits starting between $1,500 to $3,000

- Cash back rewards available to qualifying new members

- No annual fee

- No over-limit fee

- $0 Visa® Fraud Liability

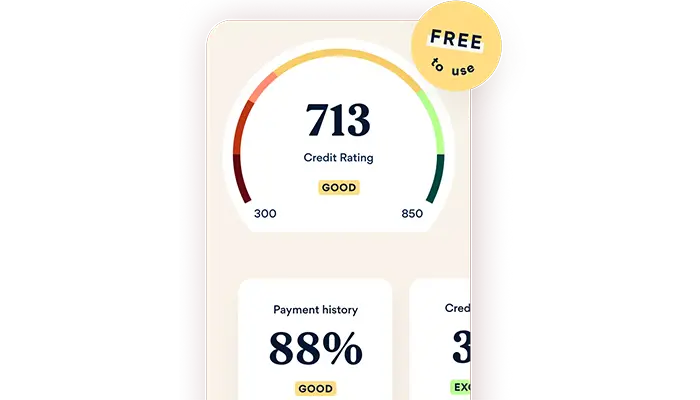

- Access to your free credit score through Best Egg credit card app

Financial Resources

Aside from lending products, Best Egg also provides resources for people looking to build credit and good financial habits.

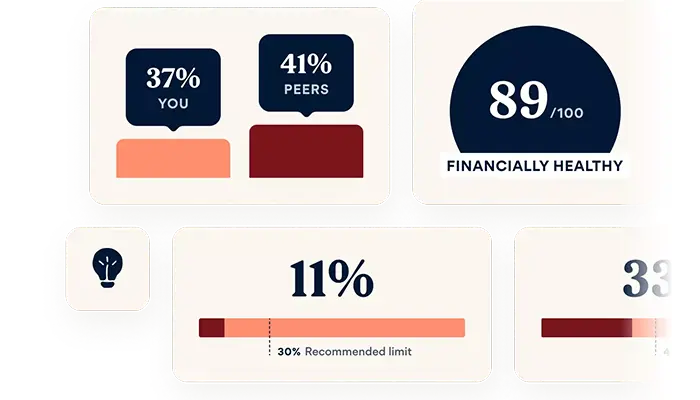

The Best Egg Financial Health platform is a free dashboard that allows users to easily view and manage their spending, saving, and debt trends. In addition, the platform provides free credit score updates, monitoring alerts, and personalized financial insights to help users reach their financial goals.

Best Egg also has a large library of free financial education resources that anyone can access in order to brush up on the best ways to build credit and manage debt responsibly.

Reputation and Reviews

Simply put, Best Egg has among the highest reviews of any online lending platform out there. For example, they have:

- A Better Business Bureau rating of A+/Excellent, with over 2,700 customers rating it a 4.85/5 stars

- A Trustpilot score of 4.6 out of 5 stars, with over 8,600 customer reviews

What Customer Reviews Say

Customer reviews on sites like BBB, Trustpilot, and Reddit emphasize Best Egg's competitive rates, fast funding, smooth online experience, and helpful customer service. However, like any business, some customers have criticisms.

The minority of customers who reported negative experiences were those who were denied a loan after Credit Karma suggested that they were likely to be approved. Another small group of customers also reported negative experiences after being frustrated by their loan repayment amounts.

This is a good reminder that even if a borrower is pre-qualified, loan approval is never guaranteed until after the formal application process is completed. Additionally, it is important to always review the total and monthly costs of the loan before accepting it in order to avoid surprises once repayments become due.

Comparing Best Egg to Online Lenders

Although Best Egg provides a comprehensive range of financial services, comparing it with other options is a crucial step in making the best possible choice. We’ll compare how Best Egg stacks up against online lenders, including Upstart, Prosper, and Achieve.

Best Egg vs. Upstart

Upstart may be best for: people who want to borrow more. Both Upstart and Best Egg have similarly quick pre-qualification processes, APRs, and funding times. However, Upstart offers an even wider range of loan sizes than Best Egg, from $1,000 up to $50,000. On the other hand, Best Egg has longer repayment term options (up to 7 years) and tends to charge a lower origination fee.

Best Egg vs. Prosper

Prosper may be best for: people with lower credit scores. Prosper is very similar to Best Egg in terms of loan sizes, repayment terms, and origination fees. However, Prosper offers slightly larger maximum loan sizes, up to $50,000, and can work with credit scores closer to 600 -- lower than Best Egg's recommended score of 640.

Best Egg vs. Achieve

Achieve may be best for: people looking for a rate discount. Achieve offers maximum loan sizes, credit requirements, APRs, and repayment terms that are similar to Best Egg. However, Achieve's minimum loan amount is $5,000 -- which may be more than some borrowers are looking for. The unique benefit of Achieve is that they offer rate discounts for qualifying actions, such as signing with a co-borrower or authorizing a direct creditor pay-off -- whereas Best Egg does not.

The Bottom Line

Best Egg emerges as a leading online lending platform for a number of reasons, including its range of loan amounts, fast funding time, competitive APR/fee structure, accessibility for people with less-than-perfect credit, and outstanding customer service and reputation.

Best Egg further stands out from its personal loan competitors with extra products and resources, including a Visa credit card and a Financial Health platform that helps users track and manage their spending.

Although borrowers with excellent credit could likely qualify for loans from others who don't charge an origination fee, for those with Fair or Good credit, Best Egg is an excellent option to consider.

Frequently Asked Questions

Is Best Egg a legitimate company?

Yes, Best Egg is a legitimate company that has been in business since 2014. It has an A+ rating on the Better Business Bureau and an "Excellent" rating of 4.6 out of 5 stars on Trustpilot with over 8,600 customer reviews.

Best Egg is known for providing competitive rates, a wide range of loan amounts, and excellent customer service to borrowers with Fair to Good credit.

Is Best Egg hard to get approved?

Best Egg personal loans are meant for people with fair to good credit. They require a minimum credit score of around 640, but to secure the best rates, a score of 700 or higher is recommended. The approval process typically takes only a few minutes, and funds can be disbursed within one to three business days.

Does Best Egg affect credit score?

Applying for pre-qualification with Best Egg won't affect your credit score, as it uses a soft inquiry. However, when you submit a formal personal loan application, Best Egg will perform a hard credit check, which may cause your credit score to drop a few points temporarily.

How does Best Egg work?

Best Egg is an online lending platform that offers personal loans for a variety of uses. The loan application process is all completed on the Best Egg website:

- Pre-qualification. Borrowers can see what loan amount and APR they are eligible for with no impact on their credit score

- Application. Involves a hard credit check and submitting income and identification verification information

- Loan funding. Typically happens the day after approval, with funds deposited directly into the borrower's checking account

Is Best Egg trustworthy?

Yes. Best Egg has been in business since 2014 and has a rock-solid track record of delivering personal loans at competitive rates. They have an A+ rating on the Better Business Bureau and an "Excellent" rating of 4.6 out of 5 stars on Trustpilot with over 8,600 customer reviews.