We have good news if you took out student loan debt and are no longer happy with the cost, lender, or repayment terms. Student loan refinance gives you the ability to reset everything from how much you pay per month to how long you’ll be in debt to which lender you work with.

It's great the option to refinance exists, but to feel confident in your decision, it's important to shop around, compare rates, and check lender reviews.

To get started, read our review of Laurel Road to find out if they could be the right bank for your student loan refinance. Refinancing your student loans can lower your monthly payments, reduce your interest rate, and offer more flexible repayment options.

Finding a reputable lender with an easy application process, low rates, and no “extra” fees will help you come out ahead, and Laurel Road may fit the bill.

Laurel Road (formerly Darien Rowayton Bank, or DRB) is a top lender that offers a variety of refinancing options, including refinances of federal, graduate, private, and Parent PLUS loans.

They were acquired by Key Bank in 2019 and also offer mortgages, personal loans, and online banking products like checking and a high-yield savings account as well. Laurel Road is known for its lower interest rates and lack of “hidden” fees, making it a clear choice to consider, particularly for healthcare and business professionals looking to refinance student loans.

In our complete review, we dive into the details of each product offering to show you the good and the bad to help you make the decision that's best for you.

To jump ahead, tap on our Table of Contents below:

Table of Contents

The Basics

You've likely been getting bills from your current lender for years without knowing much about them — but they certainly know a lot about you. That's why we're giving you the basics on Laurel Road. Get to know them before making a decision.

- Laurel Road was established in 2006 and operates out of Connecticut. They have physical bank branches in that state but serve customers across the country with their online banking platform.

- They rebranded in 2017, and were previously called DRB student loan refinancing.

- They've recently been named to Inc.'s prestigious list of Fastest Growing Companies.

- Laurel Road won the “Best Consumer Lending Product” award from FinTech Breakthrough in 2018.

- Laurel Road originally focused on the banking needs of healthcare and business professionals. Today, the company has expanded to include a range of products serving different audiences.

Laurel Road: Products Offered

Laurel Road has been popular for student loan refinancing, but since being acquired by Key Bank in 2019, it has expanded its offerings to include a checking account, mortgages, personal loans, a high yield savings account, and more.

Here's a list of refinancing options and other online banking products that you can get with Laurel Road.

- Private student loan refinancing

- Student loan refinancing for parents with Parent PLUS loans

- Mortgages

- Personal Loans

- Checking Account

- High Yield Savings Account with HYSA rates of 5.00% on your entire balance

- Laurel Road Student Loan Cashback® Card

Student Loan Refinancing

If you’re looking to refinance your student loans, Laurel Road offers low rates and different loan options. Laurel Road has flexible repayment terms, rates as low as 5.24% (at the time of article publishing), and discounts for using AutoPay and using their banking products. Keep reading to learn more about refinancing student loans:

Laurel Road Student Loan Refinancing: Who’s Eligible?

Before you apply to a refinance lender, you should try to see if you meet their requirements. Here's who is eligible to refinance student loans with Laurel Road.

- Be a U.S. citizen or permanent resident

- Typically need a credit score of 660 or higher

- Meet requirements for debt-to-income ratio

- Have graduated with a Bachelor's degree or higher from a Title IV accredited school

- Have a minimum loan balance of $5,000 (Laurel Road doesn't have an upward limit on how much total student loan debt you can refinance – which is useful for healthcare and business professionals with advanced degrees)

The Benefits

- Low fees. Laurel Road does not charge any application fees, loan origination fees, or prepayment penalties. With some student loan refinancing companies charging 7% or more up-front, this is a refreshingly straightforward way to do business. That said, there is a 5% fee for late payments (or $28, whichever is lower), but that’s it.

- Co-signers allowed for a lower rate. Laurel Road allows co-signers on their student loan refinances, making it easier to qualify for a loan and obtain a lower rate. What’s more, they also offer co-signers release, allowing borrowers to remove their co-signers after 36 months of on-time payments.

- Flexible loan terms. Laurel Road loans offer a lot of repayment terms, including 5, 7, 10, 15, and 20 years. This can help you manage your monthly payment better than most other loan providers.

- Low interest rates. Laurel Road offers some of the lowest rates in the industry, with student loan refinancing starting at 4.49% and going up to 7.65%. You can even earn a discount by setting up direct deposit through a Laurel Road checking account, and another 0.25% discount by setting up AutoPay.

- High loan maximums. Laurel Road offers to cover the entire cost of tuition with no cap on the amount you can borrow. Obviously, you will need to pass underwriting and qualify, but this lets you borrow up to the total cost of college.

- Medical residency flexible repayment. If you are a medical student refinancing your student loans, once you are matched to a residency or fellowship program, Laurel Road offers repayment of as little as $100/month while in the program.

The Drawbacks

- Short forbearance period. While many student loan companies offer 12 months of forbearance at a time, Laurel Road only offers 3 months of forbearance. You can re-apply every 3 months for 12 months over the loan's lifetime, but some competitors offer more.

- Graduation required. To qualify for a student loan refinance from Laurel Road, you must have graduated with at least a bachelor’s degree and be eligible to work. (Unfortunately, an Associate Degree does not qualify.)

- No academic deferment is available. If you decide to go back to school, you cannot continue to defer your payments. You will need to make regular payments while in school.

- No dedicated advisor. Some student loan companies offer a dedicated advisor that you can stay in touch with to ask questions. But Laurel Road only has a general customer service phone number and email that may connect you with a different advisor each time.

- $5,000 minimum. Laurel Road requires a $5,000 loan minimum to refinance your student loans.

Parent Student Loans Refinancing

If you are a parent of a student and have Parent PLUS loans in your name, Laurel Road offers refinancing for Parent PLUS loans. You may also be able to refinance these loans into the student’s name.

The Benefits

- Can ReFi into the graduate’s name. With Parent loan refinancing, Laurel Road lets you refinance into your child’s name, removing you from the loan altogether. The child will need to qualify, but this is a great option for students of graduates that now have the income and credit history to carry the loan.

- Pre-qualification available. You can pre-qualify for student loan refinancing online, and it doesn’t hurt your credit score. You will fill out a short online application, and see if you are approved (plus your potential interest rates and loan options).

- Competitive rates. While the rates will vary for Parent Loans, Laurel Road has some of the best rates available. Just like with their standard student loan refinancing, Laurel Road offers discounts for setting up qualifying direct deposits to their checking account and using AutoPay.

The Drawbacks

- High credit score. Laurel Road typically only accepts applicants with good credit and a decent income. This makes it harder to qualify if you have little or no credit history, or have negative marks on your credit profile.

- Lose Federal Parent PLUS benefits. When you refinance federal student loans, you lose the forgiveness and deferment options available to federal borrowers. This is a major downside to private student loans. For example, The current student loan moratorium paused student loan payments for federal borrowers but not private loans.

- No grace period. Refinancing your student loans might lose you some of your grace period, especially if you just graduated. While many loan companies offer a 6 - 9 month grace period, refinancing your loans will require repayment to start immediately.

Laurel Road Mortgages

In addition to student loan refinancing, Laurel Road is an equal housing lender that offers mortgages and refinancing for clients looking to purchase a home. Key Bank is the mortgage servicer and offers fairly standard loan options and rates.

The Benefits

- Low interest rates. Laurel Road offers competitive rates on mortgages, as long as you have good credit and a solid income. Rates vary by credit profile and other factors, but you can check your rates through their online application.

- Closing cost bonus. Laurel Road offers up to $650 toward closing costs when getting a mortgage. This can help lower your expenses when buying a home.

- Cash out refinancing available. You can refinance your mortgage through Laurel Road, and take cash out in the process . This can help you borrow from your home equity, while refinancing to a (potentially) better rate.

- Low Down Payment Options. In addition to discounts, eligible dentists, physicians, and residents can qualify for low down payment options on physician mortgage loans from Laurel Road.

The Drawbacks

- No FHA, VA, or USDA Loans. Laurel Road only offers conventional mortgages at this time.

- No HELOCs or second mortgages. You can’t get a home equity line of credit (HELOC) or a second mortgage through Laurel Road.

Laurel Road Personal Loans

Laurel Road also offers low APR personal loans, which can be used for anything from credit card consolidation, and home improvement to business funding.

The Benefits

- Pre-qualification available. You can quickly check your rate and approved amount with a 5-minute online application.

- No collateral needed. Laurel Road personal loans do not require collateral, such as a home or vehicle, to qualify.

- Borrow up to $45,000. Loans are available up to $35,000 for most purposes and up to $45,000 for debt consolidation, major purchases, and home improvement.

- Autopay discount. You can save 0.25% when qualifying direct deposits or automatic payments are made from a linked bank account.

The Drawbacks

- $5,000 minimum loan amount. It's a higher requirement than some other online lenders.

- Interest rates. Loan rates range from 8.99% to 23.25% APR depending on your income, credit history, debt-to-income ratio, and other factors.

- Limited repayment terms. Loan lengths only range from three to five years, which is less flexible than some other personal loan companies.

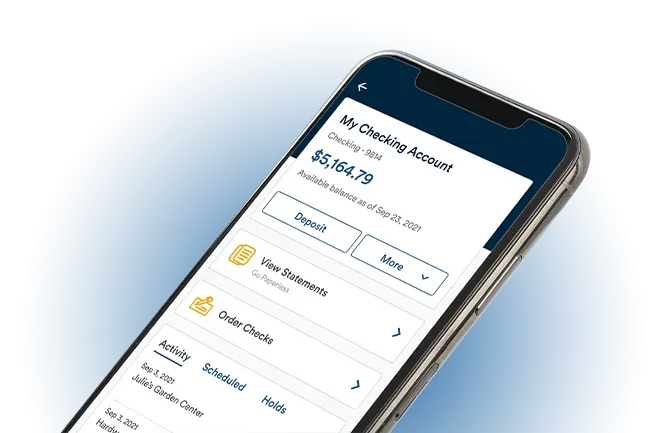

Laurel Road Online Banking

As part of Key Bank, Laurel Road offers online banking services, including a rewards checking account, cash-back credit card, and high yield savings account (HYSA).

The Benefits

- Low monthly fees. The bank offers a checking account and savings account with no minimum requirements for cash deposits or balances, and no monthly maintenance fees.

- High Yield Savings Account. The Laurel Road HYSA pays 5.0% APY on all deposits with no minimum and $0 costs to start.

- Checking Account with Rewards. Laurel Road offers cash back rewards through their checking account and the ability to lower student loan rates. The credit card rewards earn cash back to pay down your loan balances.

- Student Loan Cash Back Credit Card. This uniquely-designed card offers up to 2% cash back on qualifying purchases, and is accepted everywhere MasterCard is.

The Drawbacks

- Limited investment options. Other banks may offer more options to save and invest with products such as certificates of deposit (CDs) or money market accounts. Laurel Road currently focuses on offeirng a high yield savings account (HYSA).

- Credit card rewards limited. The credit card rewards pay 2% cash back, but only if you use the funds to pay down your student loan. Otherwise, you can only earn 1% cash back.

Trustpilot Reviews

Laurel Road has a range of reviews on TrustPilot, with an average rating of 3.3 out of 5 stars. These Laurel Road reviews on Trustpilot highlight some of the customer experiences.

Frequently Asked Questions

What credit score do you need for Laurel Road student loans?

Laurel Road does not share a minimum credit score, but to qualify for the best rates, you generally need a “good” credit score of around 660 or higher.

Will student loans with Laurel Road be forgiven?

Laurel Road student loans are not eligible for federal student loan forgiveness programs (including Biden’s latest proposal). Laurel Road is a private lender, and private lenders do not qualify for any of the federal loan forgiveness programs. The only exception is if you refinanced your federal student loan with Laurel Road during the pandemic, you might be eligible for student loan forgiveness.

Is Laurel Road legitimate?

Laurel Road is a legitimate lender that has been in business since 2013. Originally known as Darien Rowayton Bank (or DRB), the company rebranded to Laurel Road. It was purchased by Key Bank in 2019, and is now available in all 50 states. Laurel Road grew as a bank to offer a cash back credit card, checking, and a high yield savings account.

Does Laurel Road do a hard pull for personal loans?

If you only go through the pre-qualification process to see your rate and loan options, Laurel Road will not do a hard pull on your credit score. But once you complete the application, Laurel Road will do a hard pull on your credit to qualify you for the loan.