Perpay stands out as a unique loan option, as it lets you combine credit building with buy now, pay later.

By now you've probably come across "Buy Now, Pay Later" (BNPL) companies like Affirm, Klarna, and Afterpay. Perpay also falls into the same category, allowing its users to make purchases and pay for them over time.

However, Perpay offers a unique twist: in addition to providing thousands of products to choose from, it reports to the credit bureaus, allowing users to improve their credit scores as they responsibly pay over time.

Read on to understand exactly how Perpay works, what you can buy with it, and how it compares to the alternatives.

Pros & Cons

Like any financial tool, Perpay has its advantages and drawbacks. These can help you decide whether it's the right fit for your financial needs.

Pros

- Credit Building: For users who opt-in, payment history will be reported to the credit bureaus, helping to build your credit score.

- No Interest or Fees: You will never waste money paying interest or fees because payments are pulled directly from a user's payroll direct deposit.

- Automatic Payments: Payments are automatically deducted from your paycheck, making budgeting simpler.

- Legitimate company: Perpay boasts an A+ rating from the Better Business Bureau, which shows that Perpay is not a scam site.

- Wide Selection of Products: The company's marketplace features a wide range of products from over 1,000 retailers that can all be paid for over time.

Cons

- Limited Eligibility: Because a direct deposit paycheck is a requirement to open an account, self-employed individuals and gig-economy workers are not eligible.

- Higher prices for some products: Perpay does not charge interest or late fees, so to make money, it marks up items in its marketplace. You are likely to find similar items for a cheaper price on other sites.

- Potential for Overspending: Automatic deductions could lead to overspending if not managed properly.

- Mixed Customer Service Reviews: Some users have reported issues with customer service and account management.

- Shipping: Customers have reported delays in shipping and delivery.

Understanding Perpay

Perpay is more than just a buy-now, pay-later business. It’s a financial tool designed to help you manage your spending while also building your credit. When you make a purchase through Perpay, the cost is divided into payments that are deducted straight from your direct deposit paycheck, eliminating the need for a bank account if you don't already have one.

One of the unique aspects of Perpay is that it allows you to:

- Report your on-time payment history to the bureaus, thereby enhancing your credit record over time.

- Increase your credit limit, giving you more spending power in their marketplace.

- Sign up for a credit card that is accepted anywhere Mastercard is accepted, which provides a spending limit starting at $500 and a generous 3% rewards to apply towards the platform's marketplace.

Eligibility Criteria

While full-time employment is not required, a stable source of income with a direct deposit paycheck is a prerequisite for utilizing a Perpay account. The minimum annual income required to qualify is $15,000, and individuals must be 18 years of age or older. There is no credit check or minimum credit score required to open an account as long as you fulfill the other criteria.

Getting Started

Getting an account requires nothing more than a steady source of income. Once you sign up and provide your direct deposit information, Perpay will calculate your spending limit based on your estimated net pay. This ensures that your payments are manageable and align with your financial means. The first payment is typically required before an item is shipped, which means that it may take a little while to receive your first purchase. Perpay's distinctive commitment to fostering responsible credit building sets it apart. By dividing purchases into automatic paycheck deductions, the company allows users to make payments in installments without the burden of interest or fees. Payments are spread out over a period of up to six months, making it a flexible and efficient way to manage your spending.

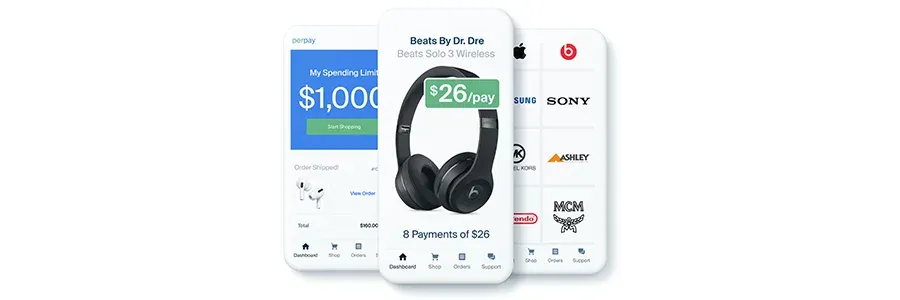

Where To Shop With PerPay

Users shop within the company's own online marketplace, which boasts 1,000 retailers and provides a wide range of products from popular brands at your fingertips. While you cannot use Perpay to purchase items outside the marketplace, the Perpay Credit Card can be used anywhere Mastercard is accepted. However, keep in mind that purchases with the Credit Card outside the marketplace are not eligible for pay-over-time.

The Perpay Credit Card Explained

The company's sleek black credit card product is another distinct feature that differentiates Perpay. This optional feature is designed to help users build credit through responsible usage. Once the card is approved and shipped, users will receive a tracking number to monitor the delivery of their card. The credit card is accepted at all Mastercard locations, and it offers 3% rewards for use on the Perpay Marketplace. But the real advantage of the credit card lies in its potential to enhance your credit score. Perpay reports your payment history after four months of on-time payments, provided that total payments exceed $200. This can result in an average credit score increase of 39 points.

Building Credit with Perpay

The ability to build credit is a primary benefit of using Perpay. For customers who opt-in, Perpay+ will begin reporting payment history on purchases over $200 to the credit bureaus after four months of payments in good standing. This further enhances the potential for credit score improvement.

Keep in mind that making payments on time is essential. Delayed payments or failure to make payments on time can lead to the reporting of delinquent payments, potentially affecting your credit score negatively. So, if you’re considering using Perpay, be sure to manage your payments responsibly to reap the full benefits of credit building.

Perpay Marketplace: What You Can Buy & When You'll Get It

Whether you’re in the market for a new PlayStation from Sony, fresh furniture for your home, the latest Apple products, or a high-quality vacuum from Dyson, you can purchase it on the marketplace. It features a wide range of product categories from 1,000 partnered retailers, offering a diverse shopping experience to all its users.

The marketplace's return policy varies by product, and not all products are eligible for return. However, those that are eligible enjoy a simple process with an easy print-at-home return label. So, before you click that purchase button, make sure to refer to the Shipping and Return section on the website for specific details. This will help you avoid any potential surprises down the line.

Products and Companies on the PerPay Marketplace

The marketplace is home to a wide range of popular brands. Whether you’re an Apple aficionado or a Samsung supporter, you’re sure to find something that suits your taste. But the shopping options don’t stop there. In addition to renowned brands, the marketplace also boasts a variety of product categories, including:

- Electronics

- Home goods & Furniture

- Apparel

- Beverages

- Appliances

Creating an account on the marketplace is needed to unlock the full array of purchase options. This measure ensures that the complete offerings are accessible only to registered members. So, if you’re interested in exploring the extensive range of products on offer, make sure to sign up and start browsing!

How Long it Takes for PerPay to Ship

The shipping process includes the following steps:

- Make a first payment before any items are shipped out.

- Tracking information is typically sent within 3-5 days after payment.

- An order shipped generally arrives within 3-5 business days from the receipt of the tracking information.

For larger items like furniture and appliances, Perpay offers a freight shipping service with White Glove Delivery. The expected delivery timeframe for these products is 3-4 weeks from the initial payment, so make sure to plan accordingly if you’re ordering a larger item.

Comparing Perpay to Other Buy-Now, Pay-Later

Although Perpay provides a unique and user-friendly platform, it’s not the sole BNPL purchasing option available. Other platforms like Affirm and Afterpay offer similar services, allowing customers to split their payments over time. However, what sets Perpay apart is its commitment to helping users build credit. By reporting on-time payment history to credit bureaus, it offers a unique twist on the traditional buy-now, pay-later business model.

In addition, Perpay’s collaborations with well-known brands expand their product range in the marketplace, offering consumers a diverse selection of products accessible directly through the platform. So, while there are other buy-now, pay-later options out there, Perpay’s unique features and extensive product range make it a contender worth considering.

Customer Experiences: The Good, The Bad, & The Ugly

As for any business, users report a range of experiences with Perpay. Many praise the platform for its convenience, great selection of products, positive impact on credit scores, and excellent customer service. However, some customers have left negative reviews for delayed shipping, especially for items intended as gifts, and have had difficulty getting satisfactory responses from the customer service team. Some users have faced challenges when attempting to cancel their accounts, citing unclear instructions and a lack of proper links to facilitate the process. And finally, some users have noticed that prices on the marketplace can be higher than elsewhere. (Perpay notes that they have to mark-up their products to make money, because they do not charge interest or other fees.)

Despite these challenges, reviews tend to be more positive than they are negative. It's clear that experiences can vary, and it’s important to take the time to read reviews when considering using the platform.

Transparency and Trustworthiness: Is Perpay Reliable?

Perpay boasts a solid trustworthiness track record for its business practices. The company has held Better Business Bureau accreditation since 2013 and currently maintains an A+ rating from the BBB. This indicates that the company has met the BBB’s stringent standards for transparency and accountability and is not a scam site.

Perpay's Customer Support

Should you encounter any issues while using Perpay, their customer support team is readily reachable via email or phone. You can reach them by emailing hello@perpay.com or by calling (215) 398-1284. While some customers have reported very helpful instructions from customer service, others have expressed dissatisfaction with:

- Extended approval times

- Inadequate email follow-ups

- Difficulties rectifying situations such as an entire paycheck mistakenly sent to Perpay due to an employer’s mistake

Tips for Using Perpay Responsibly

Responsible use is very important to maximize the platform’s benefits. One way to ensure this is by setting a budget. Perpay allows users to specify their estimated spending limit when creating an online profile, and you can use budgeting tools to monitor your spending and effectively manage your budget.

Another important aspect of using the platform responsibly is avoiding overspending. While it might be tempting to splurge on the latest gadgets or fashion items, it’s crucial to stay within your spending limit and only buy what you can afford. By doing so, you can enjoy the convenience of Perpay’s buy-now, pay-later service without the stress of financial instability or unnecessary debt.

Alternatives to Consider

Despite Perpay’s unique and convenient solution for spending management and credit building, it’s not the only available alternative. Other BNPL services like Afterpay and Affirm offer similar services and might be more suitable depending on your specific financial situation and goals.

In addition to buy-now, pay-later services, there are also other financial solutions available if you are looking to borrow money, such as personal loans, peer-to-peer lending, or cash advance products. By exploring these alternatives, you can find a solution that best fits your own financial goals and needs.

The Bottom Line

In conclusion, Perpay offers a unique buy-now, pay-later service that not only provides a convenient way to manage your spending but also helps build your credit. With its wide range of products and partnered retailers, it offers a diverse shopping experience; however, like any financial tool, it’s important to use it responsibly and within your means. While some users have reported issues with customer service and shipping, many others praise the platform for its convenience and credit-building potential. As always, it’s important to do your own research and consider all your options before choosing a financial solution.

Key Takeaways

- Perpay is a buy-now, pay-later financial platform that auto-deducts payments from paychecks, allowing users to manage spending and build credit without having to pay interest.

- Perpay’s marketplace offers a wide selection of products from over 1,000 retailers across a wide range of products including electronics, home goods, furniture, apparel, and more.

- Perpay is known for its credit-building features. If users opt-in, payment history will be reported to the credit bureaus after four months of on-time payments, helping to improve credit scores with responsible use. Perpay also offers a Credit Card with spending limits starting at $500 for qualified users.

- While Perpay is a legitimate business with an A+ BBB rating and good user reviews, some customers have reported issues with shipping times, customer service, and higher prices than could be found elsewhere.

Frequently Asked Questions

Is Perpay a legit site?

Yes, it is a legitimate company that allows you to spread out the cost of a purchase over a series of automatic payments from your paycheck.

Is it hard to get approved for Perpay?

To get approved, you must have a job with a steady direct deposit paycheck that provides a consistent source of income to ensure timely payments and fulfill financial obligations.

Does Perpay really help your credit?

Yes, the platform can help improve your credit by reporting on-time payments to credit bureaus, increasing your credit score within the first 6 months, and building a positive payment history and credit mix over time.

Can I withdraw money from Perpay?

Yes, you can withdraw money from your account by clicking "Withdraw" next to your cash balance amount in the side menu of your Dashboard.

How does Perpay work?

It works by automatically deducting payments from your paycheck to cover your pay-over-time purchases, eliminating the need for a bank account and helping you manage your spending effectively.