Bright Money's unique combination of loans & budgeting tools offers an effective one-two punch of debt reduction and credit building for people looking to improve their financial health.

Bright Money claims to help users bust debt and boost credit scores with AI-driven strategies, but is Bright Money legit?

This clear, concise Bright Money review provides an unbiased look at how it works, its effectiveness, and how it measures up against other financial tools — arming you with the information needed to gauge its potential to reshape your financial well-being.

Pros

- Provides a unique combination of debt refinancing, credit building, and budgeting tools

- Offers a debt consolidation loan ranging from $500 to $8,000

- Offers a low-cost credit-builder loan to boost credit scores

- Leverages cutting-edge AI to develop customized debt repayment and savings plans

- Offers an automated savings account that "rounds up" everyday expenses

- Products can be used individually or in combination

- High ratings from customers

- Products have no origination fees, late fees, or prepayment fees

Cons

- Requires a user to connect their bank and credit card information

- Subscription model has a monthly fee ranging from $7.42 (annual membership) to $9.99 (monthly membership)

About Bright Money: The Basics

Simply put, Bright (or Bright Money) is an app that Bright Capital Inc owns. It connects to a user's bank accounts and credit cards to provide AI-generated financial insights, help pay down debt, and boost savings.

To accomplish this, the platform has four main tools:

- A debt consolidation and refinancing loan ("Bright Credit")

- A credit-builder secured loan ("Bright Builder")

- An automated savings account that "rounds up" everyday charges for effortless saving ("Bright Smart Round-Ups")

- A personalized AI-powered debt payoff and financial planning tool ("Bright Plan")

Let's explore these fundamental components of Bright Money Financial Services to understand the specifics of how each works and the benefits of using them.

(For more information, you can also check the Bright Money faq, which has a great breakdown of information.)

Bright Credit: Debt Consolidation & Credit Card Refinancing

Bright Money's debt consolidation tool is a low-interest credit line specifically designed to pay down high-interest credit card balances. Users select an amount between $500 and $8,000 and, once approved, can use the funds to eliminate existing debt.

How It Works

"Bright Credit" is a revolving line of credit instead of a standard personal loan. A personal loan is delivered as a lump sum payment, which the borrower repays over time to zero out the balance due. In contrast, Bright Money's product is a line of credit, which means that as the borrower repays what they owe, the credit line is restored and can be reused over and over to pay down other debt.

Approval Criteria

While Bright Money does not indicate a minimum credit score or other approval requirements, it is important to note that borrowers must apply through the Bright Money app. Specific loan amounts and interest rates offered will depend on a borrower's financial profile.

Interest Rates and Fees

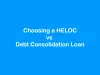

Because Bright Credit can offer lower interest rates (9% to 24.99%), borrowers can save significant amounts on interest rates and fees by refinancing their debt with this loan.

Additionally, the loan has no fees outside the monthly fee users pay to access the Bright Money app. This means no origination fees, late fees, or prepayment fees.

Due to the lower interest rate and lack of fees, a Bright Credit loan becomes a competitive product if you want to refinance debt as part of your strategy to manage your credit card bills.

Comparing Debt Consolidation from Bright Money vs. Upstart

Although some of the unique value of Bright Money is that it offers a powerful combination of debt refinancing, credit building, and budgeting tools, it is still worth comparing its individual products to competitive alternatives. Consider Bright Money vs. Upstart specifically when it comes to their debt refinancing loan:

- Loan sizes offered: While the Bright Credit revolving loan ranges from $500 to $8,000, Upstart's loans are significantly larger, ranging from $1,000 to $50,000

- Interest rates: Bright Credit's interest rates range from 9% to 29.99%, while Upstart's rates are 7.8% to 35.99%. Borrowers with subpar credit are likelier to pay a higher rate with Upstart.

- Repayment terms: Because Bright Credit is a revolving line of credit, there is no fixed repayment deadline. Upstart offers terms of 3 years or 5 years for their unsecured personal loans.

- Credit score requirements: Neither Bright Money nor Upstart have minimum score requirements; both use AI to assess a borrower based on a number of criteria including income, debt load, and employment

- Lender Reviews: Both lenders have an A+ rating from the Better Business Bureau, and similarly high Trustpilot scores: Bright Money has a 4.6/5, while Upstart has a 4.9/5

Read our full review of Upstart here.

Bright Builder: Secured Credit-Builder Loan

While "Bright Builder" is technically a loan, its purpose is to establish strong payment history in the eyes of the major credit bureaus, rather than provide borrowers with access to cash.

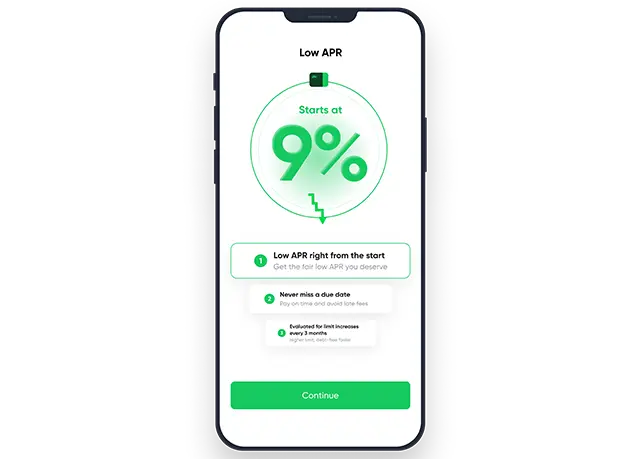

Using the Bright Builder loan increases a borrower's credit score because Bright Money reports each monthly payment to the bureaus. Over time, the borrower's credit profile will show established credit history and on-time payments, two of the most important elements of a strong credit score.

How It Works

Like other credit-builder loans offered by companies such as CreditStrong and Self, Bright Money's loan is a secured loan, meaning that a borrower deposits money into a special savings account as collateral before getting started. Here is how the process works:

- Sign up through the app and deposit as little as $50

- Each month, make a minimum payment of $10

- The payments get reported to TransUnion and Equifax by Bright Money

- Over time, your score increases due to an on-time payment history

- Once you want to stop, your security deposit funds are returned to you

Comparing Credit Builder Loans from Bright Money vs. Self

Although Bright Money is unique in combining debt refinancing, credit building, and budgeting products into one app, comparing individual products to competitive alternatives is still important. Self is a company that focuses exclusively on credit-building, offering a secured credit-building loan:

- Loan sizes: Bright Money's "Bright Builder" loan starts as small as $50, whereas Self's loans are larger, ranging from $600 to $1,800

- Fees: Bright Money doesn't charge an interest rate for this loan, but it does charge a monthly fee of roughly $10. Conversely, Self charges a one-time fee of $9 plus a $25 annual fee

- Monthly Payments: Bright Money requires a minimum monthly payment of $10, while Self has a minimum monthly payment of $25

- Reporting: While Bright Money reports only to only two of the three credit bureaus (it reports to Equifax and Transunion, but not Experian), Self reports to all three credit bureaus

Read our full review of Self here.

Smart Round Ups: Automated Savings

The path to financial freedom is equal parts: reducing debt and boosting savings. While other Bright Money products like the Bright Credit loan are about reducing debt, the "Smart Round Ups" feature is about boosting savings.

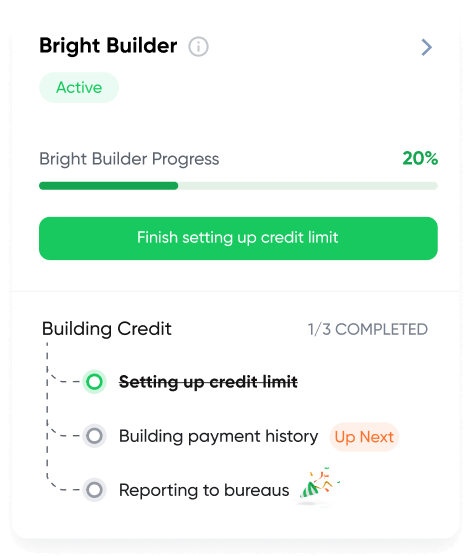

It is an automatic piggy bank that rounds up your everyday purchases to the nearest $.10 and deposits the change into a savings account the company calls a "Bright Stash." Users can control how much money gets rounded up and tucked away and how that money gets split up across different customized savings categories such as "credit card payments," "vacation," or "savings fund."

Either way, it's an effortless way to save with small but steady roundups that really add up over time, optimizing your bank account management.

How It Works

Setting up a Bright account with Smart Round Ups starts in the app. To get going, you:

- Connect your credit and/or debit cards to the app

- Select the rate of round-up savings. (For example, round up to the nearest $.10, the default. Daily savings are capped at $1 unless a borrower chooses to save more)

- As you use your linked credit or debit cards, your expenses round up, and the difference is automatically deposited into the "Bright Stash" savings account

- You can pull the savings out whenever you'd like and apply them toward the savings categories you created in the Bright Stash savings account, such as an extra credit card payment or an upcoming vacation

Overall, the system is designed to be automated and simple, with the Bright Money algorithm adjusting the best amount of money to round up based on income and spending habits. With that said, the user is always in control: you can adjust or pause the Round Ups at any time.

Bright Plan: AI Financial Management & Budgeting Tool

One of the biggest benefits of using Bright Money is the advanced AI and algorithm-powered insights it provides when you link your bank account and credit cards. Bright Money calls its technology "MoneyScience AI," and it helps users by:

- Clearly visualizing their cash flow and expenses

- Setting realistic goals

- Tracking progress

- Recommending how to allocate funds towards different goals, including savings and debt repayments, based on income and spending habits

How It Works

"Bright Plan" is extremely simple to get started with. You only need to download the app and link your bank and credit card accounts. From there, Bright Money uses the "MoneyScience AI" to:

- Review income and spending habits

- Assess your debts and goals

- Provide real-time recommendations as to how to maximize your money

- Help manage your bills with payments and reminders

- Provide ongoing budgeting suggestions that adjust in real-time

Customer Experiences & Reviews

In short, Bright Money has excellent reviews from its customers. They have a 4.6 out of 5 stars on Trustpilot with over 4,700 reviews and an A+ rating from the Better Business Bureau.

One of the most common themes in customer feedback was the strength of the customer service team. Users who had issues with their account or a question noted that the customer team was fast, responsive, and helpful.

Customers also frequently praised Bright Money for being effective in its budgeting recommendations and helping pay down high-interest debt.

The minority of negative feedback focused on frustrations regarding Bright Money's billing practices. Some customers were caught off guard that Bright Money would deduct a lump sum for six-month and annual memberships instead of a monthly fee. This is a good reminder to always understand a product's fee structure before signing up.

Tips for Maximizing Your Experience

Adopting certain strategies can enhance your experience and help you fully utilize the potential of Bright Money. From selecting the most suitable membership plan to actively engaging with the app’s features, there are ways to ensure that Bright Money’s capabilities fully align with your financial objectives.

Stay Updated and Proactive

Keeping your accounts connected and up to date is crucial for achieving success with Bright Money, a financial management app that relies on good data to provide good recommendations. Regularly updating your financial information and engaging with the app’s features will keep your financial plan current and effective.

Leverage Educational Resources

Bright Money’s educational resources present a wealth of information that gives you the knowledge to make informed financial decisions. From budgeting tools to personal finance tutorials, these resources are designed to empower you on your financial journey.

Seek Help When Needed

Bright Money’s customer support is always ready to assist you by email (hello@brightmoney.co) and phone during business hours, seven days per week, at 877.274.6494. With a high customer satisfaction score and a team ready to address your concerns, don’t hesitate to reach out to this valuable resource for assistance.

The Bottom Line

With its personalized strategies, AI-powered insights, and lending and saving products, Bright Money positions itself as a "one-stop-shop" for people looking to pay down debt, get smart about budgeting, and boost their credit score. Based on its positive reviews and strong combination of products, Bright Money is well worth considering for people who want to multitask their way to stronger financial health.

Frequently Asked Questions

Is Bright Money a line of credit?

Yes, Bright Money offers a loan product called "Bright Credit," which is a revolving line of credit ranging from $500 to $8,000 that borrowers can use to refinance high-interest debt.

How does Bright Money work?

Bright Money offers a spectrum of financial services, encompassing debt management, credit score improvement, and savings assistance.

It has four different products: A debt consolidation and refinancing loan ("Bright Credit"); a credit-builder secured loan ("Bright Builder"); an automated savings account that "rounds up" everyday charges for effortless saving ("Bright Smart Round Ups"); and a personalized AI-powered debt payoff and financial planning tool ("Bright Plan"). In combination, they help borrowers visualize their finances, pay off high-interest debt, save money, and boost their credit score.

Can you borrow money from Bright Money?

No, Bright Money does not offer personal loans, but they provide a low-interest line of credit to pay off credit card debt quickly and save on high interest charges.

Is Bright Money app legit?

Yes, Bright Money app is considered legit and is ranked as one of the best debt-payoff apps. It has an A+ rating from the Better Business Bureau and uses a combination of AI-based recommendations and a revolving line of credit to help borrowers get out from under high-interest debt.

Is Bright Money suitable for all types of credit card debt?

Yes, Bright Money is suitable for managing and paying off various types of credit card debt through personalized strategies and low-interest credit lines.