While borrowers with fair credit need to do more legwork to find the best deal, strong loan options are out there. Top lenders for fair credit borrowers include: Upstart, Best Egg, Upgrade, Prosper, AmONE, and Achieve.

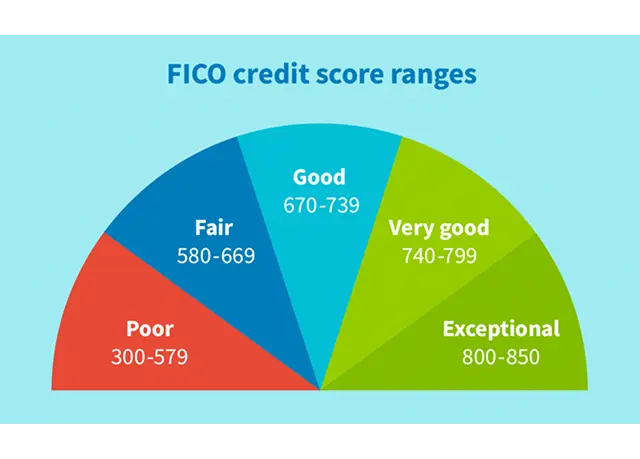

When it comes to personal loans, having fair credit – typically defined as a credit score between 580 and 669 – can sometimes make it challenging to find the best options. While fair credit is neither excellent nor poor, it does require borrowers to consider lenders' minimum credit score requirements and potentially pay higher interest rates.

This article is all about helping fair credit borrowers navigate the lending landscape and get the most out of a personal loan. We will explore what to expect when applying for a loan with fair credit, and identify the top lenders who cater to fair credit borrowers. We also discuss how to evaluate fair credit personal loans, and explore frequently asked questions on this topic.

6 Best Loans for Fair Credit

Fortunately, several lenders specialize in providing personal loans for fair credit borrowers. These lenders understand fair credit, the needs of fair credit borrowers, and are committed to offering fair terms and rates. Let's explore six of the top lenders for fair credit personal loans:

- Upstart

- Best Egg

- Upgrade

- Prosper

- AmONE

- Achieve

Upstart: Ideal for Short Credit History

Upstart is an excellent choice for fair credit borrowers, especially those with a short or thin credit history. While other lenders may focus solely on credit scores, Upstart takes a different approach by using AI and machine learning algorithms to assess creditworthiness. This allows Upstart to consider data points beyond just a credit score, including your alma mater, credit utilization, employment length, and annual income history. This means fair credit borrowers with a limited credit history have a better chance of approval compared to traditional lenders who rely solely on credit scores.

Another advantage of choosing Upstart is their fast funding process. Once approved, fair credit borrowers may receive their loan funds as early as the next business day. This quick turnaround time can be crucial for individuals in need of immediate financial assistance. Whether it's for debt consolidation, home improvements, or any other personal financial need, fair credit borrowers can rely on Upstart for efficient service.

Upstart Fast Facts:

- Loan sizes offered: $1,000 to $50,000

- Minimum credit score requirements: No minimum credit score requirements

- Interest rates/fees: APR is 7.8% to 35.99%. Most borrowers will also pay an origination fee

- Repayment terms: 3 years or 5 years

- Lender reviews: 4.9/5 stars on Trustpilot with over 45,000 customer reviews, and a Better Business Bureau rating of A+

- Standout feature: AI-driven underwriting process considers other datapoints that many lenders don't, helping to improve approval odds for fair credit and thin-credit borrowers

- Watchouts: Make sure the total cost of an Upstart loan (including interest rate and origination fee) is competitive vs. other lending options

Read our full review of Upstart here.

Best Egg: Best for secured & unsecured options

Best Egg is a reputable personal loan lender that offers options for both secured and unsecured loans, making it suitable for fair credit borrowers with varying financial situations. Secured loan options are rarer than unsecured options, and improve approval odds because a borrower offers collateral as a guarantee to repay the loan. For their secured loans, Best Egg accepts two primary types of collateral: a borrower's vehicle and the built-in features of a home, such as cabinets and lighting.

While secured loans are helpful because they improve the odds of a borrower getting approved and getting a better rate, the downside of offering up collateral is that if you default on the loan, the lender has a claim to your property. Particularly if a borrower is considering a secured loan option, it is especially important to review loan terms and ensure that your budget can cover repayments.

Regardless of whether a borrower chooses a secured or unsecured loan from Best Egg, the process with this lender is similar to their competitors in terms of being quick and easy. Borrowers can expect to receive funding as early as one business day after getting their application approved.

Best Egg Fast Facts:

- Loan sizes offered: $2,000 to $35,000

- Minimum cedit score requirements: 600

- Interest rates/fees: APR is 8.99% to 35.99%, plus an origination fee

- Repayment terms: 3 to 7 years

- Lender reviews: 4.6/5 stars on Trustpilot with over 2,700 reviews, and an A+ rating from the Better Business Bureau

- Standout feature: Greater flexibility and approval odds by offering a secured loan option for borrowers with lower credit

- Watchouts: Does not lend in Iowa, Vermont, West Virginia, and Washington, D.C., and does not allow co-signers

Read our full review of Best Egg here.

Upgrade: Optimal for Rate Discounts

Upgrade is another top lender for fair credit personal loans, particularly for those seeking rate discounts for qualifying actions. This lender offers three ways to save on interest: signing up for autopay reduces your rate by 0.5%; using a "direct creditor pay" option when refinancing or consolidating debt can net another 1%-3% off your rate; and opening an Upgrade checking account can save up to another 20% off the loan rate. These kinds of discounts are rarely seen among lenders serving Fair credit borrowers, making Upgrade potentially one of the best deals through their discounts.

Upgrade offers fair credit borrowers a straightforward online application process, making it convenient and fast. Another benefit of using Upgrade for fair credit borrowers is that their approval process takes into account various financial factors, not just credit score, providing borrowers with better loan options and approval odds. In short, Fair credit borrowers who are looking for loans for debt consolidation, home improvements, or other personal expenses can benefit from Upgrade's loan options.

Upgrade Fast Facts:

- Loan sizes offered: $1,000 to $50,000

- Minimum cedit score requirements: 560

- Interest rates/fees: 8.49% to 35.99%; an origination fee; late/returned payment fees

- Repayment terms: 3, 5, or 7 years

- Lender reviews: 4.4/5 stars on Trustpilot with over 40,000 reviews, and an A+ rating from the Better Business Bureau

- Standout feature: Rate discounts usually reserved for Excellent credit borrowers are available to Fair credit borrowers

- Watchouts: A potentially hefty origination fee (1.85% to 9.99%) could wipe out potential savings from rate discounts, so make sure to carefully review all rates and terms

Prosper: Suitable for Multiple Loans

Prosper is a leading Peer to Peer (P2P) platform, meaning that the lenders on their website are small, individual investors instead of financial institutions. The benefit for borrowers is that these investors will have a range of different criteria and risk appetites, increasing the likelihood of approval and higher loan limits.

Although it is a peer lending platform, Prosper still feels like borrowing from a typical online lender: you submit an application on their website, and they manage the approval and loan repayment process. Prosper is known for offering excellent customer service, with one of their unique benefits being that borrowers can take up to two loans out at the same time on their platform. Just be aware that in order to take out a second loan, a borrower must first have established six months of solid payment history with Prosper.

Prosper personal loans are suitable for debt consolidation, home improvements, or other personal financial needs fair credit borrowers may have. Like other lenders, Prosper can prequalify you for loan options with no impact to your credit score, so you can see your approved loan amounts and rates before applying.

Prosper Fast Facts:

- Loan sizes offered: $2,000 to $50,000

- Minimum cedit score requirements: 600

- Interest rates/fees: 8.99% to 35.99%, plus an origination fee of 1% to 7.99%

- Repayment terms: 2 years to 5 years

- Lender reviews: Over 12,400 customers have reviewed Prosper on Trustpilot, giving them an average score of 4.6/5. The lender also has a Better Business Bureau rating of A+

- Standout feature: Allows borrowers to take up to two loans at once

- Watchouts: Has late fees starting at $29 for the first offense, going up $40 for repeat late payments

Read our full review of Prosper here.

AmONE: Best for easy loan comparison shopping

When looking for personalized loan offers catering to various credit profiles, AmONE stands out as a versatile option. Unlike other lenders on our list, AmONE does not actually offer loans; instead, they act like a matchmaker, connecting borrowers to multiple pre-vetted lenders in their network. The benefit for borrowers is clear: after filling out just one form, they instantly receive multiple offers from different lenders, making comparison shopping for the best rate and terms easier.

AmONE's lending network covers the full range of credit profiles, from poor to excellent credit scores, and offers loan amounts reaching $50,000. The platform is user-friendly and free to use, making the process of finding the right loan hassle-free and efficient. With AmONE, borrowers have access to a diverse range of loan products, making it an excellent choice for those seeking simplicity and convenience in comparing loan options.

AmONE Fast Facts:

- Loan sizes offered: $1,000 to $50,000

- Minimum cedit score requirements: No minimum credit score requirement

- Interest rates/fees: Varies depending on lenders you match with

- Repayment terms: Varies depending on lenders you match with

- Lender reviews: 4.5/5 stars on Trustpilot with over 2,100 reviews, and a score of B+ on Better Business Bureau

- Standout feature: AmONE's loan marketplace automatically connects borrowers to multiple qualified lenders at once

- Watchouts: While AmONE will pre-qualify you for loans, you still need to formally apply with lenders you match with on the platform. Interest rates and fees need to be carefully reviewed on a lender-by-lender basis

Read our full review of AmONE here.

Achieve: Perfect for Co-borrower Applicants

Achieve, a leading online lender, is an excellent choice for fair credit borrowers looking to increase their approval odds and access higher loan amounts by applying with a co-signer/co-borrower. Submitting a joint application can be a smart strategy for borrowers with lower credit scores, because the lender uses the combined credit histories and incomes of both parties to assess creditworthiness.

Not only does Achieve accept co-borrowers, but they actively encourage it: Achieve offers a rate discount of up to 6% for those who are approved with a joint application.

An Achieve personal loan can be used for a wide variety of purposes, although most borrowers choose Achieve to refinance and consolidate high-interest credit card debt. This is because Achieve offers further rate discounts (up to 4%) for those who use their loan for debt consolidation/refinancing. No matter what you use the loan funds for, Achieve's application is fully digital and easy to complete, with most borrowers receiving their funds within 1-3 days of starting the process. The lender's simple application process and positive approach to co-borrowers makes it a flexible standout among other lenders.

Achieve Fast Facts:

- Loan sizes offered: $5,000 to $50,000

- Minimum cedit score requirements: 620

- Interest rates/fees: 8.99% to 35.99%. Origination fees ranging from 1.99% to 6.99%

- Repayment terms: 2 to 5 years

- Lender reviews: 4.8/5 stars on Trustpilot with over 10,700 reviews, and an A+ rating from the Better Business Bureau

- Standout feature: Generous rate discounts for co-borrower/co-signer applicants

- Watchouts: Achieve's minimum loan amount of $5,000 may be more than some borrowers are looking for

Read our full review of Achieve here.

Understanding Fair Credit

It is essential to first understand the fair credit category before exploring the best personal loan options for fair credit borrowers. Fair credit signifies a FICO score within a specific range, typically between 580 and 669. Credit scores are a roll-up of several different components of an individual's financial profile, and represents their creditworthiness in one handy number. Lenders use these scores to assess loan eligibility and interest rates, making them a very important factor in determining what kind of loan and interest rate you will be eligible for. While fair credit falls between excellent and bad credit, fair credit borrowers may encounter certain challenges, such as higher interest rates, when seeking personal loans.

How Fair Credit impacts loan eligibility

Fair credit can impact loan eligibility for personal loans, because lenders view fair credit borrowers as slightly higher risk. For that reason, lenders are likely to charge fair credit borrowers with higher interest rates to help compensate for that perceived risk.

With that said, borrowers should not be discouraged, as they can still expect a wide range of options and approval odds with fair credit. The important thing to remember when applying is to:

- Review lenders' minimum credit score requirements in order to find lenders most likely to approve you

- Find lenders who specifically cater to fair credit borrowers or focus on lending to individuals with varied credit profiles. These lenders have a better understanding of fair credit, and their loan products are designed to meet the needs of fair credit borrowers

- Comparison shop different loan options to make sure that you are identifying the best possible rates and fees before committing to a lender

Ultimately, while fair credit borrowers may encounter more limited and costlier options compared to individuals with higher credit scores, there are still many solid options. The key is to build in time to research options, carefully understand lenders' rates and terms, and apply to the lender that best fits your credit profile and needs.

How to Evaluate Your Best Personal Loan Options With Fair Credit

Evaluating fair credit personal loans requires considering various factors such as interest rates, loan options, and repayment terms. It's important for fair credit borrowers to understand the criteria to evaluate personal loans effectively. Let's explore some key aspects fair credit borrowers should consider when evaluating personal loans:

Comparing Interest Rates

Interest rates are a crucial factor for fair credit borrowers when evaluating personal loans. The interest rate determines the cost of borrowing and affects monthly payment amounts. Fair credit borrowers should compare personal loan rates, keeping in mind that lenders may offer different rates depending on the borrower's creditworthiness. The annual percentage rate (APR), which combines the interest rate with any fees or charges, provides a more accurate representation of the loan's total cost.

It's especially important for fair credit borrowers to carefully review, compare, and choose personal loans with competitive interest rates to minimize the overall cost of borrowing. The fair credit loan category has a broad range of interest rates and fees, meaning that especially for this type of borrower, not all loans are created equal.

It's essential to do the legwork and confirm you're finding the best possible rate, because lower interest rates can result in significant savings over the life of the loan.

Importance of Prequalifying

Gauging approval odds for personal loans is crucial for fair credit borrowers, for a couple of key reasons. First, prequalifying helps safeguard fair credit scores by utilizing soft credit checks. Instead of a hard credit pull, which appears on your credit report and can temporarily lower your credit score by a few points, a soft credit check does not "ding" your credit score, but still allows lenders to verify your personal information and give you a good sense of what you are likely to be approved for if you apply. While it is not a guarantee of approval, it is a strong indicator.

The second reason prequalifying is important is because you can see loan sizes, interest rates, and terms you are likely to qualify for before you apply. This means that you can confidently comparison shop between different lenders without having to undergo a hard credit pull each time, which can have a negative impact on your score.

Particularly for fair credit borrowers who might be offered a wide range of loan rates and fees, taking the time to comparison shop is essential to get the best deal. Prequalifying is always the first step in this process.

3 Types of Fees to Consider

When considering personal loans for fair credit, borrowers should take into account the potential for origination fees, late/returned payment fees, and prepayment fees:

1) Origination Fees

An origination fee is a flat fee that a lender will charge you for assessing an application and facilitating the loan funding and repayment process. Pay attention to this fee, as it can sometimes be as high as 15% of the total amount of the loan, and is usually deducted from the loan amount before it is deposited into your bank account. While not all lenders charge an origination fee, most fair credit borrowers can expect to pay this fee.

2) Late & Returned Payment Fees

While it is always a bad idea to fall behind on payments, particularly because of the negative impact it can have on your credit report and credit score, some lenders also charge late and returned payment fees. These fees are usually around $15 per instance, but can go as high as $40 -- which start to add up. To avoid late fees, consider signing up for autopay so you don't accidentally forget to pay. (Another benefit is that some lenders offer a rate discount for using autopay -- a win/win).

Overall, it is always important to review the total cost and monthly costs of a loan, and confirm that your budget can comfortably handle the payments so that you don't start to fall behind.

3) Prepayment Fees

Prepayment fees occur if the borrower is in a position to repay the full loan amount early, and the lender charges a fee to end the loan before the contracted term. While most lenders do not charge a penalty for this, it is important to confirm whether a potential lender may add to the cost of your loan if you choose to end the loan agreement early.

How To Choose

When deciding on the best personal loan option, it's crucial to consider the interest rate and associated fees, and evaluate the minimum credit score requirement for loan approval. Look for flexible repayment terms and loan options that align with your specific needs and financial situation. Additionally, confirming that a lender provides a positive customer service experience is important for ongoing support. Lastly, assessing the availability of loan funds and fast funding options can provide the financial flexibility needed for your goals. By carefully considering these factors, you can make an informed decision that aligns with your financial objectives and sets you up for success.

The Bottom Line

Finding the best personal loans for fair credit can feel like a daunting task, but with the right information and research, you can make an informed decision. Each lender has its own set of criteria and offers different features that cater to individuals with fair credit. It's important to compare interest rates, prequalify, and consider any additional fees before making a decision. Additionally, taking steps to improve your credit score can increase your chances of getting approved for a personal loan. Whether you choose Upstart, Best Egg, Upgrade, Prosper, AmONE, or Achieve, make sure to carefully evaluate your options and select the one that best fits your financial needs.

Frequently Asked Questions

Can I get a loan with a credit score of 640?

Yes, it is possible to obtain a loan with a credit score of 640. However, your options may be more limited and you might be offered higher interest rates. Look for lenders that cater to fair credit scores and consider improving your credit before applying to increase approval chances and secure better rates.

How much do personal loans for fair credit cost?

Personal loans for fair credit come with varying costs depending on the lender. Typically, interest rates are higher compared to good or excellent credit. Some lenders may charge additional fees like origination fees or prepayment penalties. It's important to compare offers from multiple lenders to find the most affordable option.

Can a personal loan improve fair credit?

Taking out and repaying a personal loan can indeed help improve fair credit. Making timely payments on the loan can have a positive impact on your credit score. Before applying, compare interest rates and fees to find the best option. Only borrow what you need and can afford to repay.

How to qualify for fair-credit loans?

To qualify for fair-credit loans, your credit score should be between 580 and 669. Lenders also consider your income, employment history, and debt-to-income ratio. Providing collateral or having a co-signer may increase your chances of approval.

Where to get a personal loan with fair credit?

Looking for personal loans with fair credit? Consider online lenders like Best Egg, Upgrade, Prosper, AmONE, Achieve, or Upstart, which can be great options. Alternatively, credit unions and community banks may offer personalized service and lower interest rates. Don't forget to shop around and compare rates before making a decision.

What's the impact of a personal loan on credit score?

Taking out a personal loan can have both positive and negative effects on your credit score. Timely payments can improve your score, while missed payments can lower it. Applying for multiple loans at once may signal financial instability and negatively impact your credit. Consider the loan terms before applying.

Why is a good credit score important for loan approval?

Having a good credit score is crucial for loan approval. It demonstrates your financial responsibility and helps lenders evaluate the risk of lending to you. A higher credit score can result in better loan terms, including lower interest rates and larger loan amounts. Additionally, a good credit score improves your chances of getting approved for a loan.