Hearth helps contractors offer financing to their customers and manage the sales and invoicing process end-to-end. Although it comes with an annual fee, its impressive track record and comprehensive toolkit make it worth a serious look.

Here's a fact every contractor should know: nearly 43% of customers turn to a loan or credit card to fund home improvement projects. If you aren't offering your customers flexible monthly payment options, your sales, job sizes, and customer satisfaction may all be suffering. (We've written an entire article about it that's worth a read.)

Hearth Financing is a leader in the contractor customer financing space, making it easy for contractors to provide monthly payment options to their customers. In addition, Hearth's software helps contractors manage their sales and payment process, making it a "one-stop shop" for financing and customer management.

This review covers the range of Hearth's services, from connecting customers to personal loans and 0% APR credit cards to sales, marketing, and invoicing support. We also consider the pros and cons of using Hearth and some alternatives to compare them to.

Read on to see if Hearth is the right partner for your contractor business.

Pros & Cons

Hearth Pros

- Hearth's network of 18 lenders offers flexible financing options for a wide range of needs and credit scores, even bad credit

- Financing APR rates start as low as 4.99% for loans, and 0% introductory APR rates on credit cards

- Easy for contractors to send financing links to their customers via either text or email

- Software creates quotes, contracts, and invoices, and marketing material

- Software connects to Quickbooks and can be used to collect and manage customer payments

- No dealer fees or per-project fees

- Generally excellent customer reviews and testimonials

Hearth Cons

- Charges a one-time setup fee of $99 and an annual fee ranging from $1,499 to $4,999

- Although it integrates with Quickbooks, not all banking software is supported, potentially limiting some functionality

How Hearth Works

Hearth is a technology company founded in 2016 and headquartered in San Francisco and Austin. Today, it has about 20,000 contractors on its platform and has funded over $500 million worth of home improvement jobs. Its core services boil down to two areas:

- Customer financing, including personal loans and 0% APR credit cards

- A software application designed specifically for contractors to manage their sales, invoicing, and payment collection process

How Hearth Powers Customer Financing

Hearth doesn't lend money directly to customers. Instead, they have assembled a network of 18 lenders – including Prosper, Upstart, SoFi, and BHG Money -- that customers can instantly access by filling out a single Hearth financing application.

The financing process is designed to be simple for both the contractor and the customer:

- The contractor emails or texts a financing link to their customer

- The customer fills out a simple application that takes only a few minutes

- Customers review prequalified personal loan offers from different lenders in the Hearth network. Reviewing offers does not involve a hard credit pull, so scores are not impacted

- Once a customer decides on which lender to move forward with, the lender conducts a hard credit pull to finalize the application process

- Upon approval, the loan is funded to the customer's bank account as soon as the next business day

Hearth financing covers a wide range of:

- Loan amounts: from $1,000 to $250,000

- Repayment terms: from two to 12 years

- Credit scores: as low as 550

- Interest rates: starting as low as 4.99%

As with any loan, final amounts, rates, and terms will be dependent on a borrower's creditworthiness. In addition to personal loans, Hearth can also qualify customers with credit scores of 680 or higher for 0% Intro APR credit cards.

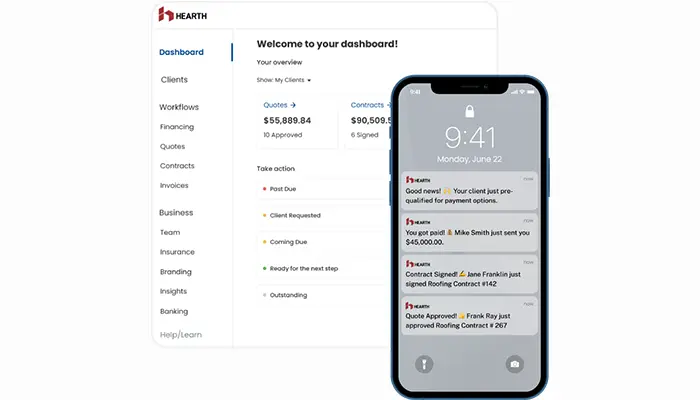

For contractors, the customer financing process is all managed through the Hearth software, which can be viewed both on a desktop and as a mobile app. They can track their customers' progress throughout the loan application process, send reminders, and embed financing links into quotes and invoices to provide customers with payment options at key points in a project.

Sales & Payment Management Software for Contractors

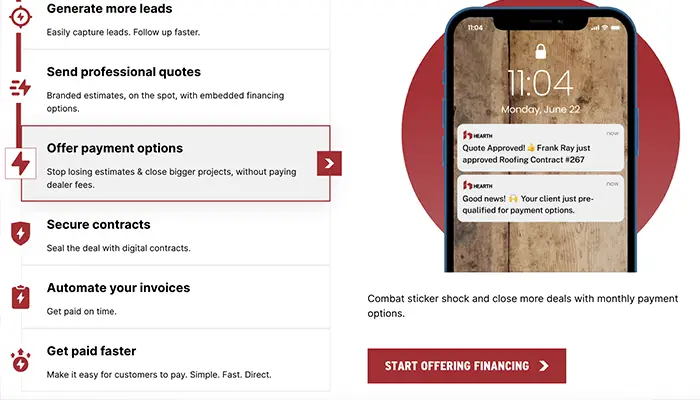

The app and platform are what really sets Hearth apart from other customer financing companies. It connects customer financing to the rest of the sales and customer management process, making contractors' lives easier by automating repetitive tasks (such as reminding customers to approve a quote or pay an invoice) while providing a clear way to track deal flows and enhance the customer experience overall.

Hearth's app provides the following features:

- Quotes: Digitized quote templates can embed customized monthly financing payment estimates in order to reduce customer sticker shock. These can be texted or emailed to customers

- Contracts: Once a quote is approved, the document is automatically converted into a contract that can be e-signed, with a financing link easily accessible to customers if they wish to use it

- Invoices: Hearth invoices connect to Quickbooks to make account management more seamless. Financing links can be added in case customers decide to use them once a project is underway

- Digital Payments: Accepts credit card payments via Stripe, providing customers a preferred way to pay with minimal effort for either party

- Marketing: Provides a financing banner and calculator that can be added to a contractor's website, advertising flexible and monthly payment options for your projects

In total, the app helps both contractors and customers navigate the sales and payment process in a way that is fully digital, seamless, and straightforward.

Hearth's Pricing Model

The benefits of flexible financing options and account management software come with a price. Unlike other customer financing competitors, however, Hearth does not charge dealer fees (which tend to be 3% to 20% per project financed).

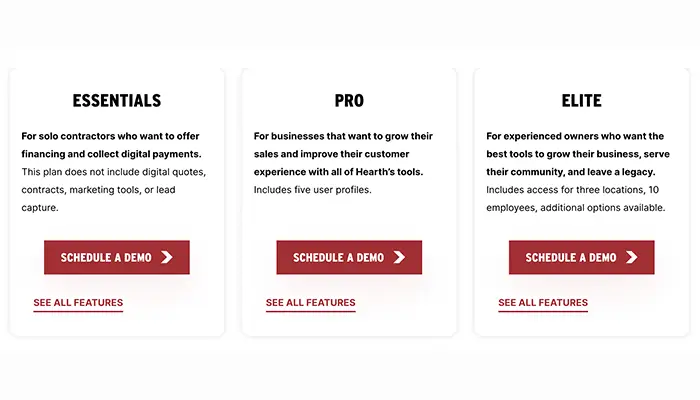

Instead, Hearth charges a one-time setup fee of $99 for all new contractors joining the platform, plus an annual fee that is due on the renewal date, one year after the initial subscription. The cost is based on which tier of service you want access to:

Essentials: $1,499 annually

Best for: Small companies or solo operations looking for a flexible customer financing option

Key features:

- Limited software and mobile app access for one user

- Direct-lending financing marketplace with unlimited loans

- Marketing features including a company-branded payment options page and downloadable marketing flyers

Pro: $1,799 annually

Best for: Small or medium companies looking for a flexible customer financing option plus account management software

Key features:

- Software and mobile app access for up to five team members

- Direct-lending financing marketplace with unlimited loans, with the option to add 0% introductory APR credit cards for $199/year

- Full account management functionality including: Digital invoicing & payment collection, Lead capture, Financing status tracking, and Quickbooks Integration

- Marketing features including: A loan payments calculator for customers, a company-branded payment options page, downloadable marketing flyers, and promotional web banners for your website

Elite: $4,999 annually

Best for: Medium to large companies looking for a flexible customer financing option plus account management software

Key Features:

- Software and mobile app access for up to five team members

- Direct-lending financing marketplace with unlimited loans, with the option to add 0% introductory APR credit cards for $199/year

- Full account management functionality including: Digital invoicing & payment collection, Lead capture, Financing status tracking, and Quickbooks Integration

- Marketing features including: A loan payments calculator for customers, a Company-branded payment options page, downloadable marketing flyers, and promotional web banners for your website

Why Hearth Could Be Right For Contractors

A fair question you might have is whether Hearth is worth the annual fee. According to their statistics, Hearth has an impressive track record when it comes to the value it provides contractors. They report that using their financing program results in:

- 17% close rate improvement

- 30% average job size increase

- 13x return on investment (ROI)

The impressive impacts are the result of Hearth's combination of flexible financing and customer management software. With their support, contractors are able to secure funding for various home improvement jobs while also benefiting from efficient automated processes that save time on paperwork. Having multiple payment choices at hand enables an enhanced customer experience, leading to higher sales figures and repeat business.

Customer Success

Hearth has three primary ways of contacting customer success:

- Phone: (512) 686-4141

- Email: support@gethearth.com

- In-app: Past the login screen, contractors can send a message directly to Hearth customer support

Evaluating Customer Reviews

Testimonials on sites like Better Business Bureau (BBB) and Trustpilot present mostly excellent experiences, but there are some negative reviews in the mix as well. Hearth's BBB score is 3.77 out of 5, and it has an "Excellent" rating (4.3 out of 5) on Trustpilot with over 300 reviews. By avoiding fake reviews and evaluating what real users are saying, it is possible to get a good sense of Hearth's strengths and weaknesses.

The majority of reviews are from satisfied customers who attest to the company's trustworthy business practices. In particular, Hearth received high marks from users for their customer service team, which overall is described as being responsive and effective at answering questions or resolving issues.

Also, in the positive column, contractors noted the impact Hearth had on their sales close rates and job sizes. This was attributed to Hearth's lender network successfully being used by their customers and the customer management and marketing support through the software platform.

In terms of complaints, users were frustrated that they would not be reimbursed the annual fee if they missed their annual deadline to cancel, and wanted more support from Hearth to understand why their customers weren't using the financing option.

These negative complaints are a good reminder that customers should fully understand all terms and conditions of a partnership before signing up and be realistic and reasonable about lender responsibility. While Hearth does appear to strictly enforce a no-refunds policy, it is also important that the user read the contract carefully and ask questions before moving forward. While Hearth manages the lender network, it cannot control whether a customer will use the network or whether a customer will be approved for a loan.

Alternatives to Hearth Financing

Hearth presents various advantages, but it is always a good exercise to compare and contrast your different customer financing options to ensure you select the right partner for your business.

Consider the following alternative companies:

- Acorn Finance

- HFS Financial

- PowerPay

- Optimus

Comparing Hearth to Other Options

The Bottom Line

Hearth offers a unique suite of benefits that make home improvement projects more accessible and manageable for customers and more profitable for contractors. It stands out with its transparent, contractor-friendly customer management software, simple fee structure, variety of financing options catering to diverse credit profiles, and commitment to customer support.

While there are other financing options available, Hearth differentiates itself with its software tailored for the home improvement industry. The success metrics Hearth provides, as well as the generally excellent testimonials on review sites like Trustpilot, attest to the value Hearth Financing brings to the table.

Although it comes with a fee, it is clear that Hearth's uniquely comprehensive approach to flexible financing and customer management is worth serious consideration from contractors looking to grow their business and increase customer satisfaction.

Frequently Asked Questions

What credit score is needed for Hearth?

Hearth's lender network caters to a range of credit profiles, with financing options for credit scores as low as 550. As with any personal loan, specific loan sizes, interest rates, and terms will be determined based on a borrower's overall credit profile and creditworthiness.

What is a Hearth loan?

Hearth Financing is a reputable financial technology company based in Austin and San Francisco. Their focus is to make it easy for contractors to connect their customers to lenders to finance home improvement projects. Contractors who offer customer financing tend to enjoy higher sales close rates and larger job sizes because customers can break up project costs into more manageable monthly payments.

In addition to offering financing options, Hearth also provides customer management software designed specifically for the contractor/home improvement industry. Contractors can use Hearth's software to generate quotes, contracts, and invoices; track customer financing and payment progress; and generate marketing assets such as financing banners for a contractor's website and flyer templates.

How does Hearth work?

Hearth enables contractors to offer their customers flexible financing through its network of 18 lending partners. Once a contractor joins the Hearth platform, they can generate financing links and send them directly to their customers via text or email. Customers then have the option of applying for a personal loan or 0% introductory APR credit card to finance a home improvement project.

Besides offering contractor customer financing, Hearth also has a customer management software and mobile app that contractors can use to generate quotes, contracts, and invoices; track customer financing and payment progress; and access marketing materials such as financing banners for a contractor's website and flyer templates.

How much is a Hearth subscription?

After a one-time $99 setup fee for new users, the price of a Hearth membership is determined by the type of plan you select. There are three different plans to choose from: the Essentials plan for $1,499 per year, which is good for one user and limited customer management software functionality; the Pro plan for $1,799 per year, which is good for up to five users and offers full customer management software functionality; and the Elite plan for $4,999 per year, which is good for up to 10 users and offers full customer software functionality.

What makes Hearth Financing different from other financial services in the market?

Hearth Financing is a specialist in the home improvement space, offering contractors' customers flexible financing options for their projects. Although there are other companies that also offer contractor customer financing, what really sets Hearth apart is its customer management software designed specifically for contractors. This software allows contractors to manage all aspects of the sales, marketing, financing, and invoicing process. When combined with the ability to offer their customers flexible financing options, the idea is that contractors are able to more efficiently close sales, increase job sizes, and manage their accounts to increase their profitability and customer satisfaction.